Seoul Apartment Transactions Down 78% Year-on-Year in Two Weeks After Regulations

Nowon, Seongbuk, Gangseo Lead in Volume; Sharp Drop in Gangnam 3 Districts, Only 4 Deals in Seocho

In Two Weeks, Transactions for Units Priced Under 900 Million Won Account for 60%

Seoul Price Growth Rate Declines for Second Week... "Upward Trend Under Watch"

In the two weeks following the implementation of loan regulations, the proportion of apartment transactions in Seoul priced at 600 million won or less doubled compared to the previous year. In contrast, the share of transactions for apartments priced between 1.2 billion and 1.5 billion won dropped significantly. By region, transaction volume increased in Nowon District, while it decreased in Seocho District. Experts analyzed that demand is concentrating on mid- to low-priced apartments due to the loan restrictions. However, they also noted that, given the relatively low transaction volume, it is unlikely that this phenomenon will become a long-term trend.

According to an analysis of the Ministry of Land, Infrastructure and Transport's actual transaction price system on July 14, the number of apartment transactions in Seoul from June 28 to July 10 was tallied at 881. This represents a 77.9% decrease compared to the same period last year, when there were 3,894 transactions. Since actual transaction reports can be filed within 60 days of the transaction, the figures may still change.

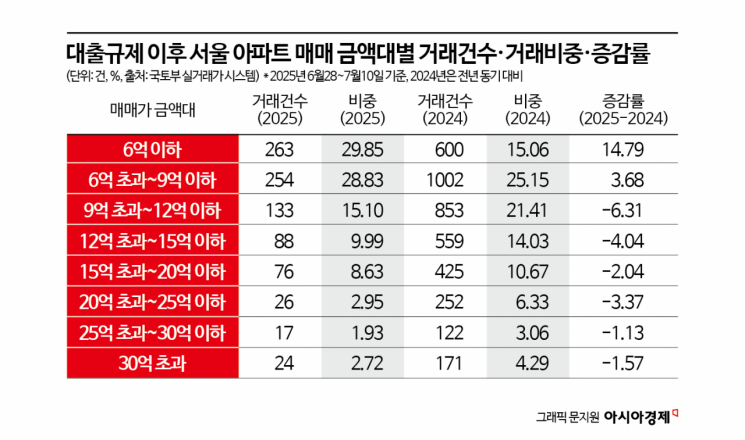

Transaction Share Drops Sharply Where Loan Regulations Have Strong Impact

Overall transaction volume declined after the Financial Services Commission announced new loan regulations on June 27. Notably, there was a marked shift in transaction shares by apartment price range. The share of transactions for apartments priced above 1.2 billion won, the average price of apartments in Seoul, dropped sharply. From June 28, the mortgage loan limit in the Seoul metropolitan area and regulated areas was capped at 600 million won, residency requirements were imposed, and even jeonse loans prior to transfer of ownership were blocked. This is seen as having tied the hands of buyers who had hoped to move up to higher-priced neighborhoods through 'gap investment.'

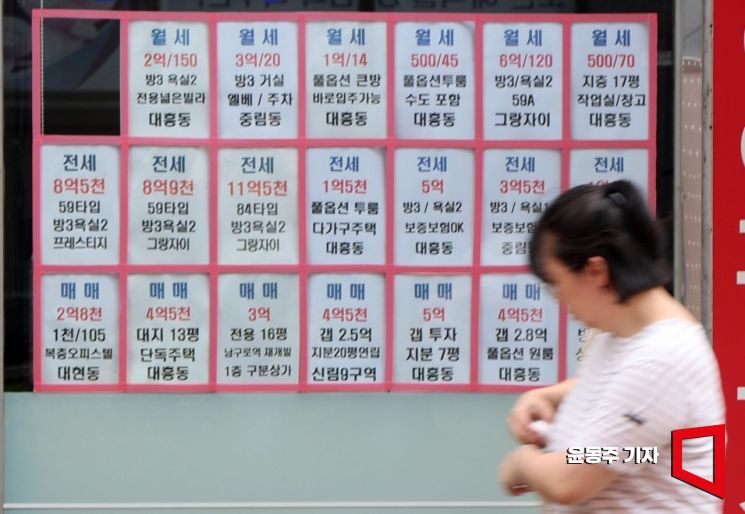

On the 27th, apartment prices in Mapo and Seongdong districts of Seoul rose at the largest rate since related statistics began to be published in 2013. It is expected that the upward trend in Seoul apartment prices will continue for the time being due to the expectation that prices will rise further. The photo shows a real transaction notice at a real estate agency in Mapo, Seoul. 2025.06.27 Photo by Dongju Yoon

On the 27th, apartment prices in Mapo and Seongdong districts of Seoul rose at the largest rate since related statistics began to be published in 2013. It is expected that the upward trend in Seoul apartment prices will continue for the time being due to the expectation that prices will rise further. The photo shows a real transaction notice at a real estate agency in Mapo, Seoul. 2025.06.27 Photo by Dongju Yoon

In the past two weeks, the transaction share for apartments priced over 900 million won and up to 1.2 billion won was 15.1%, a decrease of 6.3 percentage points from last year's 21.4%. For apartments priced over 2 billion won and up to 2.5 billion won, the share fell by 3.4 percentage points (from 6.33% to 2.95%). The share for apartments between 1.5 billion and 2 billion won shrank by 2.04 percentage points (from 10.7% to 8.6%). Transactions for apartments priced above 3 billion won also decreased by 1.57 percentage points (from 4.29% to 2.72%).

On the other hand, the share of mid- to low-priced transactions increased significantly. In the past two weeks, transactions for apartments priced at 600 million won or less accounted for 29.9% of the total, about twice as high as last year's 15%. The share for apartments priced over 600 million won and under 900 million won was 28.8%, up 3.68 percentage points from last year. Since the loan regulations, apartments priced at 900 million won or less now account for 58.7% of all transactions, or about six out of ten deals.

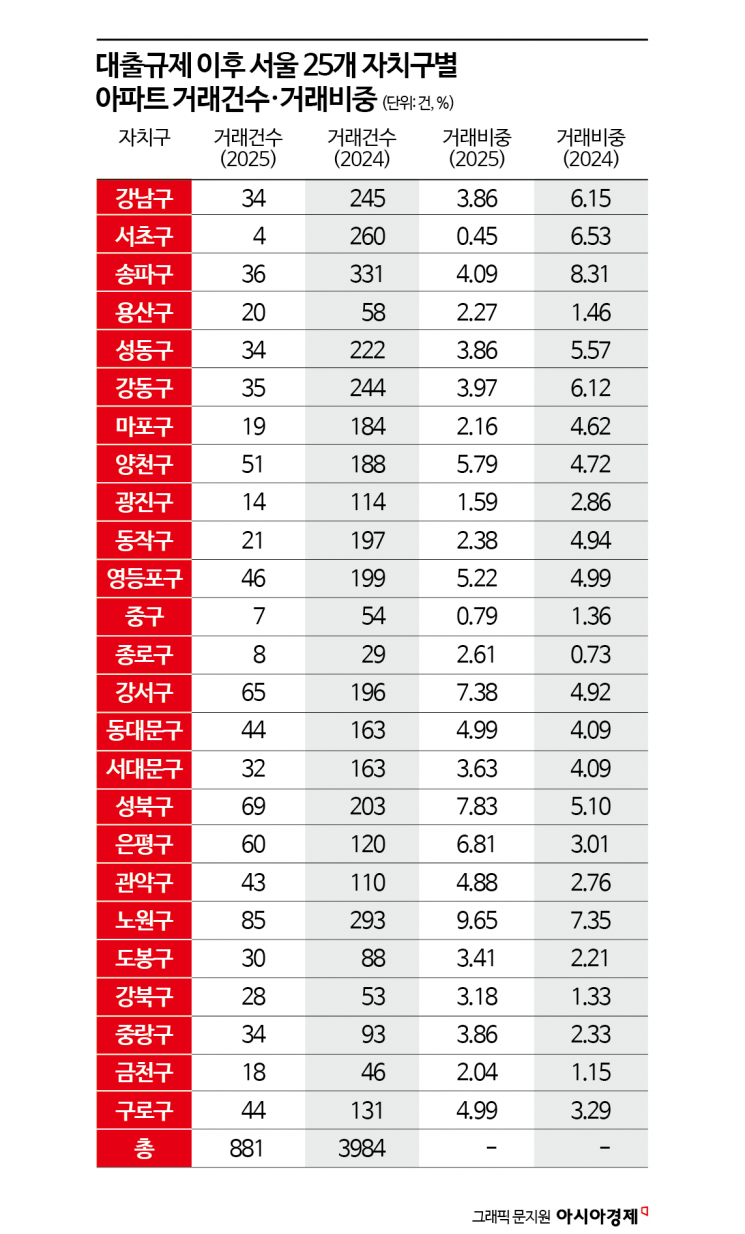

Seoul Transaction Volume by District Over Two Weeks: Nowon, Seongbuk, Gangseo in That Order

By region, transaction volume (share) was highest in Nowon District, which has many mid- to low-priced apartments, with 85 transactions (9.65%), followed by Seongbuk District with 69 transactions (7.83%), and Gangseo District with 65 transactions (7.38%). During the same period, Seocho District recorded 4 transactions (0.45%), Yongsan District 20 (2.27%), Gangnam District 34 (3.86%), and Songpa District 36 (4.09%). In areas designated as land transaction permit zones, such as the three Gangnam districts and Yongsan District, loan regulations are exempted only for properties for which land transaction permit applications were filed before the June 27 regulations. Transaction volume may decrease further next month.

The rate of increase in Seoul apartment prices also slowed after the loan regulations. According to KB Real Estate, the week of July 1 (as of July 7) saw Seoul apartment prices rise by 0.28%, marking the 24th consecutive week of increase. However, the rate of increase has declined for two consecutive weeks, falling from 0.44% before the loan regulations (June 23) to 0.31% last week.

Seoul's Buyer Sentiment Index also dropped to 60.6, down 15.8 points from 76.4 the previous week. Compared to June 23, before the announcement of the loan regulations (99.3), the decrease is even steeper. In particular, the Buyer Sentiment Index for the 11 Gangnam districts fell by 18.6 points from the previous week to 63.7. The 11 Gangnam districts had exceeded 100 in the fourth and fifth weeks of June before the regulations, but sentiment cooled sharply after the measures took effect.

High-Priced Apartments Take a Direct Hit... 'Gap Narrowing' for Mid- to Low-Priced Units Remains to Be Seen

Experts believe that the likelihood of the price gap narrowing between mid- to low-priced and high-priced apartments due to the new loan regulations is low. For apartments priced under 900 million won, where the loan burden is relatively small, prices have not risen much this year, and the increase in transactions may reflect renewed expectations for price growth.

Ham Youngjin, head of the Real Estate Research Lab at Woori Bank, analyzed, "Due to the regulations, transaction shares have increased in areas such as Nodogang and Gumgwan districts, where many homes are clustered in the 600 million to 800 million won range and prices have not risen much." However, he added, "In the short term, the total number of transactions remains low, so it remains to be seen whether the increase in transactions and the upward trend will continue."

Kim Hyosun, Chief Real Estate Specialist at NH Nonghyup Bank, explained, "This year, demand for apartments priced between 1.5 billion and 2 billion won stood out due to polarization and the desire to move up to better locations. However, with the new loan regulations, transactions will decrease immediately, and if this trend continues, prices will certainly face downward pressure."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.