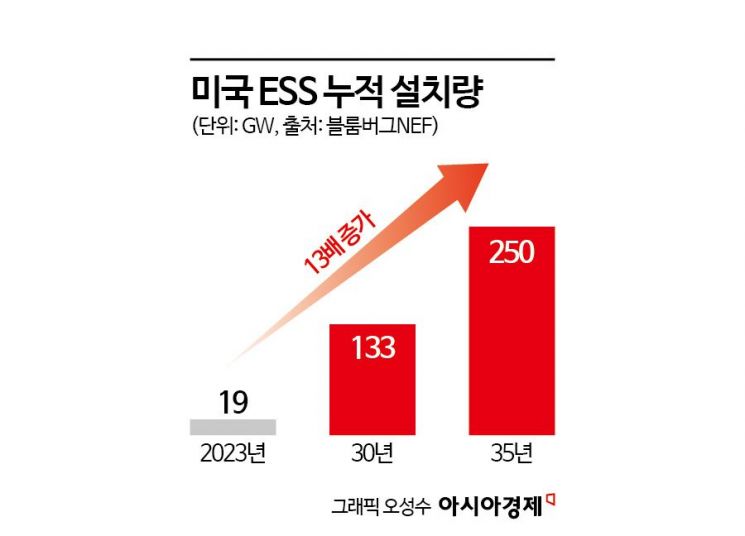

North American ESS Installations Expected to Increase 13-Fold in 12 Years

Korean Materials Companies in High Demand Amid 'De-China' Trend

The three major Korean battery companies are accelerating their moves into the North American energy storage system (ESS) market. Following LG Energy Solution's commencement of mass production of lithium iron phosphate (LFP) batteries in the United States, SK On is also joining the LFP sector in earnest, speeding up its efforts to target the local market.

On July 11, SK On announced that it had signed a memorandum of understanding (MOU) with L&F to supply cathode materials for LFP batteries in the North American region. Under this agreement, the two companies will discuss practical cooperation measures, including the volume and timing of future supplies. Based on this, they also plan to pursue a mid- to long-term supply contract.

The reason SK On has partnered with L&F lies in the rapidly growing North American ESS market. In the United States, demand for ESS is surging across various industries, including artificial intelligence (AI) data centers and eco-friendly energy. According to industry research firm BloombergNEF, the cumulative installed capacity of ESS in the U.S. is expected to soar from 19 gigawatts (GW) in 2023 to 250 GW by 2035.

In this process, demand for LFP batteries is also expected to increase sharply. This is because LFP batteries are more price-competitive and have superior safety compared to nickel-cobalt-manganese (NCM) batteries. According to SNE Research, global LFP cathode material usage from January to April this year surged by 78.2% compared to the same period last year.

Shin Youngki, Head of Procurement at SK On, stated, "This MOU will serve as an important milestone for SK On in securing the LFP battery value chain and entering the North American market." He added, "We will firmly establish a U.S.-made LFP battery production base that meets the requirements of the Advanced Manufacturing Production Credit (AMPC) under the U.S. tax code, thereby securing price competitiveness."

L&F is the fastest among domestic materials companies in advancing its LFP cathode material business. In May, it also signed an MOU with a major Korean battery company and is currently shipping products from its pilot line to customers. On the previous day, the company invested 336.5 billion won to establish a new corporation dedicated to the LFP business and completed its equity acquisition. L&F plans to gradually secure a production capacity of up to 60,000 tons.

Korea is the only country outside of China to have secured a battery supply chain. As countries around the world have recently raised tariffs on Chinese materials, demand for 'de-China' alternatives is shifting to Korean-made LFP materials.

The three major Korean battery companies?SK, LG Energy Solution, and Samsung SDI?have already met AMPC requirements under the U.S. Inflation Reduction Act (IRA) by localizing their North American plants. As a result, they are able to avoid competition with China in the North American market while also securing price competitiveness, achieving a dual benefit.

According to an analysis by Samil PwC Management Research Institute, the market share of Korean battery companies in North America rose from 26.7% in 2021 to 54% in the first quarter of this year. This is the result of Korean battery companies quickly responding to the IRA by localizing production and thereby rapidly securing market leadership as the U.S. began to favor domestic production.

Last month, LG Energy Solution began mass production of ESS-use LFP batteries at its Holland plant in Michigan, United States. Among major global battery manufacturers, LG Energy Solution is the first to establish a large-scale mass production system for LFP batteries in the U.S. In addition, the company is considering various measures, such as converting part of its joint plant with General Motors (GM) in Tennessee into an LFP production line. Samsung SDI is also reportedly in discussions to introduce an LFP battery production line for electric vehicles at its joint plant with GM in Indiana, United States.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)