6.27 Loan Regulation and Phase 3 DSR Reflected in First Effective Statistics

"Mayongseong" and Three Major Gangnam Districts Among 21 of 25 Seoul Districts See Slower Price Growth

Gwacheon and Bundang, Targeted by Ministry of Land's Joint Inspections, Also Lose Momentum

Following the implementation of loan regulations, the upward trend in apartment prices in Seoul and the greater metropolitan area has slowed. In particular, 21 out of Seoul's 25 districts, which had been at the epicenter of the price surge, saw their rate of increase shrink. The 6·27 loan regulation and the third phase of the Debt Service Ratio (DSR) regulation, which took effect this month, appear to have impacted buyer sentiment.

According to the "Weekly Apartment Price Trends Nationwide for the First Week of July 2025 (as of July 7)" released by the Korea Real Estate Board on July 10, apartment sale prices nationwide rose by 0.04% compared to the previous week, a slower pace than the previous week's 0.07%. In the greater metropolitan area, prices increased by 0.11%, down from 0.17% the previous week, while Seoul saw a 0.29% rise, compared to 0.40% the week before.

In 21 out of Seoul's 25 districts, the rate of increase slowed. The slowdown was particularly pronounced in the "Hangang Belt," which had previously led the market. Districts such as Seongdong (0.89%→0.70%), Mapo (0.85%→0.60%), and Yongsan (0.58%→0.37%)?collectively known as "Mayongseong"?as well as the three major Gangnam districts?Gangnam (0.73%→0.34%), Seocho (0.65%→0.48%), and Songpa (0.75%→0.38%)?all showed a clear cooling in buying activity.

This week's statistics are the first to effectively reflect the market response after the 6·27 loan regulation, which capped the limit for housing mortgage loans in the metropolitan area at 600 million won. The third phase of the DSR regulation also took effect on July 1. The Korea Real Estate Board explained, "While some preferred complexes, such as newly built or redevelopment sites, continue to see increases, overall buying inquiries in Seoul have declined due to growing wait-and-see sentiment among market participants, resulting in a reduced rate of price increase across the city."

In Gyeonggi Province, Gwacheon saw its rate of increase drop sharply from 0.98% to 0.47%, while Bundang in Seongnam fell from 1.17% to 0.46%. Gwacheon and Bundang are areas where the Ministry of Land, Infrastructure and Transport, together with related agencies including the Korea Real Estate Board, has recently intensified joint on-site inspections.

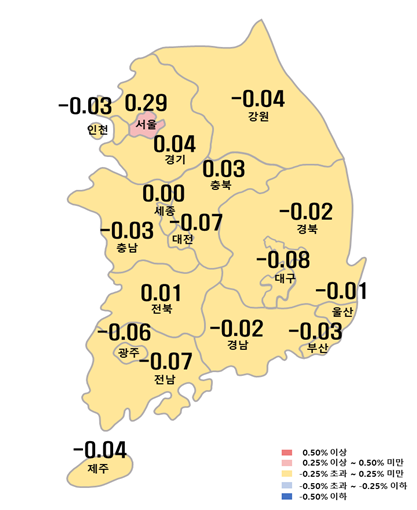

In regional areas, the five major metropolitan cities saw prices fall by 0.05%, a larger decline than the previous week's -0.04%. Daegu continued its decline for the 85th consecutive week at -0.08%. Sejong remained flat at 0.00%, while the eight provincial areas maintained a decline of -0.02%.

Weekly Apartment Price Trends in Metropolitan Local Governments by Korea Real Estate Board. Korea Real Estate Board.

Weekly Apartment Price Trends in Metropolitan Local Governments by Korea Real Estate Board. Korea Real Estate Board.

Jeonse (long-term lease) prices nationwide rose by 0.01%, a slower pace than the previous week's 0.02%. In Seoul, the rate of increase was 0.08%, slightly higher than the previous week's 0.07%. The greater metropolitan area as a whole saw a 0.03% increase, while regional areas showed no change at -0.01%.

Market experts interpret this trend not as a mere pause but as the beginning of a short-term "price adjustment." Park Wongap, chief real estate expert at KB Real Estate, said, "While prices are not falling sharply, buyers are starting to change their minds. In high-priced areas such as Gangnam, the adjustment phase could last three to six months, while in mid- to low-priced areas, it could continue for one to two months." He added, "With only asking prices remaining and actual transactions decreasing, the market is becoming confused, and concerns about additional regulations are also weighing on the market."

Yang Jiyoung, senior expert at Shinhan Premier Pathfinder, explained, "This slowdown in prices is a direct result of the third phase of the DSR and the loan regulations. Areas with a high reliance on loans are being hit the hardest." He added, "While the regulations will induce a short-term adjustment, in the long run, interest rates and supply will be the key variables. Depending on the government's additional policy directions, the timing of a rebound could vary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)