No Surprises in Rate Freeze at 2.50%...

Focus Shifts to Soaring Household Debt and Financial Stability

August Rate Cut Uncertain...

Effectiveness of Loan Regulations, Supplementary Budget, and U.S. Rate Decisions Are Key Variables

On July 10, the Monetary Policy Board of the Bank of Korea decided to keep the base interest rate unchanged at 2.50% per annum. At this meeting, the focus was placed more on curbing the recent sharp rise in household debt than on easing downward pressure on the economy caused by concerns over near-zero growth this year. The Bank of Korea intends to maintain the current rate this month, taking a breather to assess the impact of the strengthened household loan management measures announced on June 27, and to prioritize financial stability. There are mixed outlooks regarding a possible rate cut in August. Some observers believe the Bank of Korea will adjust the pace of rate cuts, closely monitoring both the government's supplementary budget execution and the U.S. policy rate decisions.

Lee Changyong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Direction Decision Meeting held at the Bank of Korea headquarters in Jung-gu, Seoul on the 10th. Photo by Joint Press Corps

Lee Changyong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Direction Decision Meeting held at the Bank of Korea headquarters in Jung-gu, Seoul on the 10th. Photo by Joint Press Corps

No Surprises in Rate Freeze... Focus Shifts to Soaring Household Debt and Financial Stability

The Monetary Policy Board announced at its meeting held at the Bank of Korea headquarters in Jung-gu, Seoul, that it would maintain the base rate at 2.50% per annum. This outcome was in line with market expectations. In a previous survey conducted by Asia Economy, all 16 expert respondents predicted that the rate would remain unchanged this month.

The main reason for this month’s rate freeze is household debt. In the first half of this year, the total outstanding household loans in the financial sector increased by 21.7 trillion won. Household loans surged, especially in the Seoul metropolitan area, as the overheated real estate market led to a rise in apartment transactions, driving up mortgage loans in particular. The increase in household loans has been growing steadily: 5.3 trillion won in April, 5.9 trillion won in May, and 6.5 trillion won in June. The rise in housing transactions following the lifting of Seoul’s land transaction permit zone in February, as well as a rush in loan demand ahead of the implementation of the third-stage stress-based debt service ratio (DSR), both contributed to this trend. The Monetary Policy Board stated, "The upward trend in housing prices in the Seoul metropolitan area and the sharp increase in household debt have both expanded significantly, and given the need to monitor the effects of the recently strengthened household debt measures, we judged that maintaining the current base rate is appropriate."

In Korea, where real estate assets are heavily concentrated, the surge in household debt due to a real estate market frenzy poses a major constraint on monetary policy. The Board determined that further rate cuts following the reduction in May could stimulate expectations among those waiting to buy real estate, thereby fueling both housing prices and household loans in Seoul and surrounding areas. The Bank of Korea expects that the sharp increase in housing transactions in May and June will continue to drive household loan growth through July and August. Yoon Yeosam, a researcher at Meritz Securities, pointed out, "The recent volatility in real estate prices in the Seoul metropolitan area has heightened concerns over financial stability, such as the increase in household debt, strengthening the case for caution regarding further rate cuts."

August Rate Cut Uncertain... Effectiveness of Loan Regulations, Supplementary Budget, and U.S. Rate Decisions Are Key Variables

Concerns about economic growth persist. However, this month, there is room to pause and observe the progress of the government’s fiscal expansion policies. Previously, Bank of Korea Governor Lee Changyong stated that this year’s supplementary budget could raise the growth rate by 0.2 percentage points. Park Jungwoo, an economist at Nomura Securities, noted, "With the new government’s supplementary budget and other factors offsetting downward pressure on the economy, the Bank of Korea is now in a position to focus more on financial stability, such as the Seoul real estate market and household debt, rather than on economic growth."

In fact, while construction investment continued to decline, the domestic economy saw some alleviation of sluggish growth as consumption improved?helped by the resolution of domestic political uncertainties?and exports continued to rise. Employment also improved, with the total number of employed people increasing, although major sectors such as manufacturing continued to see declines. Nevertheless, caution regarding uncertainty remains high. The Monetary Policy Board stated, "Consumption is expected to gradually recover due to improved economic sentiment and the supplementary budget," but also diagnosed, "There is still significant uncertainty regarding the future growth path, particularly related to the progress of Korea-U.S. trade negotiations and the pace of domestic demand recovery."

Lee Changyong, Governor of the Bank of Korea, is presiding over the Monetary Policy Direction Decision Meeting held at the Bank of Korea headquarters in Jung-gu, Seoul on the 10th. Photo by Joint Press Corps

Lee Changyong, Governor of the Bank of Korea, is presiding over the Monetary Policy Direction Decision Meeting held at the Bank of Korea headquarters in Jung-gu, Seoul on the 10th. Photo by Joint Press Corps

The historically wide Korea-U.S. interest rate gap has also become a burden. Following the rate cut in May, the gap between Korea’s base rate and the upper end of the U.S. policy rate widened to 2.00 percentage points. Experts believe that, with the U.S. Federal Reserve likely to keep rates unchanged at the July Federal Open Market Committee (FOMC) meeting, it would have been difficult for the Bank of Korea to proceed with an additional rate cut. Kim Jinil, a professor of economics at Korea University, said, "The U.S. must consider both the possibility of growth slowdown due to tariff policies and the risk of inflation," adding, "The Bank of Korea is also expected to make its decision based on economic conditions and the Federal Reserve’s policy through the end of the year."

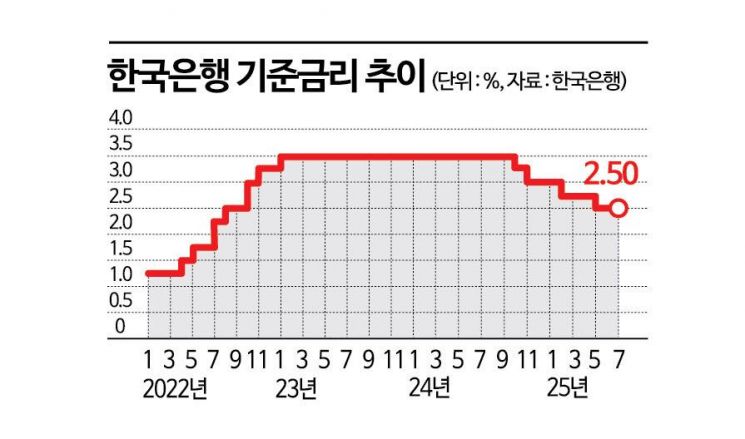

The Bank of Korea is expected to adjust the pace of rate cuts while monitoring the effects of the June 27 measures and the third-stage stress-based DSR regulations. The Monetary Policy Board shifted to a rate-cutting cycle in October last year, lowering rates for the first time in three years and two months, and has since cut rates a total of four times: in November last year, and in February and May this year. In the market, the consensus is that the final rate for this year will be 2.25% per annum. This would be achieved with one additional cut of 0.25 percentage points (25 basis points) from the current rate.

Lee Changyong, Governor of the Bank of Korea, is striking the gavel to declare the opening of the Monetary Policy Direction Decision Meeting held at the Bank of Korea headquarters in Jung-gu, Seoul, on the 10th. Photo by Joint Press Corps

Lee Changyong, Governor of the Bank of Korea, is striking the gavel to declare the opening of the Monetary Policy Direction Decision Meeting held at the Bank of Korea headquarters in Jung-gu, Seoul, on the 10th. Photo by Joint Press Corps

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)