Greenhouse Gas Emissions from Six Major Insurers Reach 157,357 Tons Last Year, Down 0.25% from Previous Year

Samsung Life, Samsung Fire & Marine, Hyundai Marine & Fire Actively Expand ESG Investments

Need for Improvement in Inconsistent Data Reporting Among Financial Institutions

Major insurance companies in South Korea are making significant efforts to reduce greenhouse gas emissions, which accelerate climate change. Because the insurance industry is directly exposed to large-scale losses from disasters such as fires and heavy rainfall caused by climate change, these companies are also increasing investments related to Environmental, Social, and Governance (ESG) initiatives.

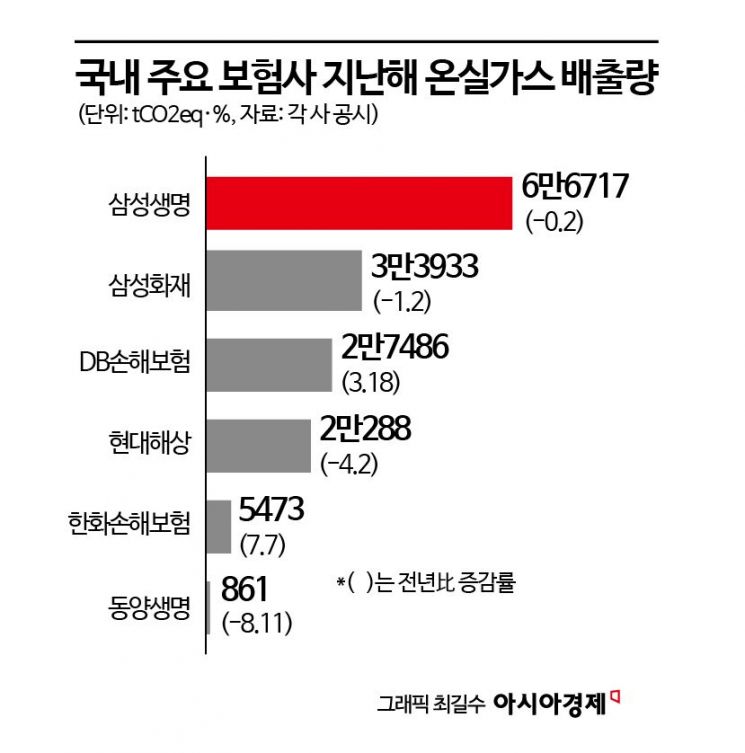

According to the recently published sustainability management reports from six major domestic insurers?Samsung Life, Samsung Fire & Marine, DB Insurance, Hyundai Marine & Fire, Hanwha General Insurance, and Tongyang Life?their total greenhouse gas emissions last year amounted to 157,357 tCO2eq (tons of carbon dioxide equivalent, hereafter t), representing a 0.25% decrease compared to the previous year. Greenhouse gas emissions are categorized as direct emissions (Scope 1), indirect emissions (Scope 2), and others (Scope 3). However, since each insurer uses different reporting standards, only direct and indirect emissions were aggregated.

Samsung Life's greenhouse gas emissions last year were 66,717 t, a 0.2% decrease from the previous year. This figure includes six subsidiaries such as Samsung Card and Samsung Asset Management. For Samsung Life alone, the emissions were 60,113 t, a 0.15% increase from the previous year. However, when considering the "market-based emissions," which include the offset achieved by purchasing electricity generated from renewable energy, the figure was 57,372 t, a 4.42% reduction compared to the previous year. Samsung Life's financial emissions last year were 27.71 million t, a 0.36% decrease. Financial emissions refer to the amount of carbon emissions indirectly caused by the insurer's financial activities, such as investments and loans. Samsung Life's ESG investment last year totaled 10.6484 trillion won, a 9% increase from the previous year. Hong Wonhak, CEO of Samsung Life, stated in the report, "We will expand the scale of ESG investments to over 20 trillion won by 2030 and systematically manage and reduce carbon emissions."

Samsung Fire & Marine's greenhouse gas emissions last year were 33,933 t, a 1.2% decrease from the previous year. This figure combines Samsung Fire & Marine and nine domestic and overseas subsidiaries. The company aims to reduce greenhouse gas emissions to 16,967 t by 2030 and achieve net zero emissions by 2050. Samsung Fire & Marine's financial emissions were 8.557 million t, a 9.7% reduction from the previous year. The company's renewable energy consumption last year was 5,031 MWh, a sharp increase of 82.2% from the previous year, while general (non-renewable) energy consumption was 95,368 MWh, a 2.28% decrease. Samsung Fire & Marine is actively working to reduce greenhouse gases, for example by more than doubling the proportion of "Green Premium" electricity purchased compared to the previous year. Lee Munhwa, CEO of Samsung Fire & Marine, announced, "We will raise our cumulative ESG investment target by 2030 from the previous 10.5 trillion won to 12 trillion won."

Hyundai Marine & Fire's greenhouse gas emissions last year were 22,887 t, a 4.2% reduction from the previous year. The company aims to reduce emissions to 22,200 t this year. ESG investments totaled 1.6051 trillion won, a 29% increase from the previous year. Hyundai Marine & Fire expects that natural disasters caused by climate change will increase insurance payouts and investment loss risks. In response, the company plans to continue expanding ESG investments and reducing greenhouse gas emissions.

Some insurers saw an increase in greenhouse gas emissions. DB Insurance's emissions last year were 27,486 t, a 3.18% increase from the previous year. Financial emissions also rose by 3.5% to 3.7 million t. DB Insurance aims to reduce annual emissions by 1% each year compared to the previous year until 2030. Hanwha General Insurance's emissions last year were 5,473 t, a 7.7% increase. Since last year, Hanwha General Insurance expanded its calculation scope from 10 owned buildings, including its headquarters, to all operational real estate, including the newly acquired Hannam building.

Although the mandatory publication of sustainability management reports has been postponed until after 2026, major domestic insurers are voluntarily releasing reports and focusing on reducing greenhouse gas emissions. However, the lack of unified reporting standards makes it difficult to compare figures across financial institutions. Some insurers disclosed detailed figures for all affiliates, while others only published aggregate data or selectively released figures favorable to themselves, resulting in significant disparities.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.