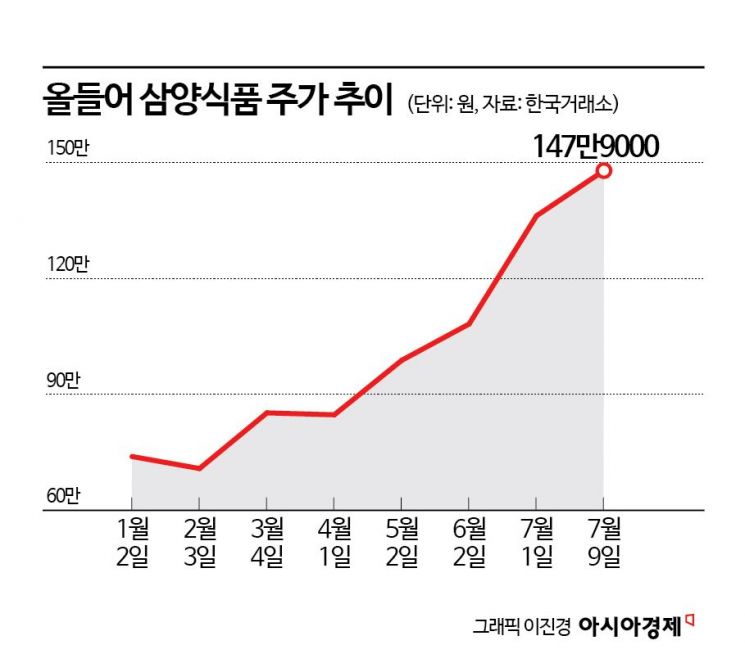

Intraday High Reaches 1,485,000 Won, Setting Another All-Time Record

Stock Price Doubles Since Start of Year... Second Quarter Momentum Fueled by Expectations for Miryang No. 2 Factory

Brokerages Raise Target Price to as High as 1.8 Million Won

Samyang Foods, which became a blue-chip stock in May, is now on the verge of surpassing 1.5 million won within just two months. The full-scale operation of the Miryang No. 2 Factory is expected to expand supply, leading to further earnings growth, and securities firms are once again raising their target prices in response.

According to the Korea Exchange on July 10, Samyang Foods closed at 1,479,000 won the previous day, up 2.99%. During the session, the stock price climbed to 1,485,000 won, setting a new all-time high. The share price has surged sharply for three consecutive days, quickly reaching the upper 1.4 million won range. Compared to the beginning of the year, Samyang Foods’ stock price has approximately doubled.

The main driver behind this recent rally appears to be the full-scale commencement of operations at the Miryang No. 2 Factory this month. Kang Eunji, a researcher at Korea Investment & Securities, stated, “Buldak Bokkeum Myeon produced at the Miryang No. 2 Factory will be exported to the United States, Europe, and other regions starting in the third quarter, driving earnings growth. In particular, as sales growth was limited in the first quarter due to supply shortages in some US channels and in Europe, rapid growth is expected going forward.”

Ryu Eunae, a researcher at KB Securities, also commented, “The additional production capacity amounts to 830 million servings annually, which is 20% higher than the previously expected 690 million servings. This increase is due to the extension of daily operating hours from 20 to 22 hours. With this expansion in production capacity, we anticipate an increase in supply to major distributors such as Costco in the United States, as well as improved profit margins resulting from a better product mix.”

There are also forecasts that Samyang Foods will maintain strong earnings momentum in the second quarter of this year. Joo Younghoon, a researcher at NH Investment & Securities, said, “For the second quarter, Samyang Foods’ consolidated revenue is expected to reach 544.4 billion won, up 28% year-on-year, and operating profit is projected at 132.5 billion won, up 48%, meeting the consensus (the average of securities firms’ forecasts). Given that export statistics for ramen continue to confirm high global demand for Buldak Bokkeum Myeon, the company is likely to sustain the strongest earnings momentum in the industry.” He added, “Although the won-dollar exchange rate declined and marketing expenses increased compared to the previous quarter, which is expected to lower the operating margin by about 1.0 percentage point to 24.3%, there is no need for concern as the margin remains robust.”

Securities firms have also been raising their target prices this month. Korea Investment & Securities raised its target price for Samyang Foods from 1.43 million won to 1.8 million won. KB Securities increased its target from 1.25 million won to 1.5 million won. Kyobo Securities raised its target from 1.33 million won to 1.57 million won, and NH Investment & Securities increased its target from 1.3 million won to 1.65 million won. Kwon Woojeong, a researcher at Kyobo Securities, explained, “We applied a target price-to-earnings ratio (PER) of 20 times for Samyang Foods based on 2026 projections, but there is ample room to raise the valuation further to 25 times. This is not an excessive valuation, considering Samyang Foods’ overwhelming overseas growth rate and share compared to competitors, as well as the fact that Japan’s Toyo Suisan was valued at up to 27 times PER during its overseas expansion. Given Samyang Foods’ significantly increased global recognition, further upward adjustments to its valuation are entirely possible.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)