Bank Household Loans Reach 1,161.5 Trillion Won in June... Up by 6.2 Trillion Won

Housing Transactions Surge in May and June, Impact to Continue Through July and August

Effectiveness of June 27 Measures Key... This Month's Housing Transactions to Influence September Loans

Last month, bank household loans surged by 6.2 trillion won. This sharp increase was influenced by a rise in housing transactions following the lifting of land transaction permit zones in Seoul, which affected household loans with a time lag. Additionally, demand for loans intensified ahead of the implementation of the third phase of the Debt Service Ratio (DSR) regulation. Housing transactions, which spiked in May and June, are expected to further accelerate the growth of household loans through July and August. The trend in household loans after September is anticipated to depend on the trajectory of housing transactions this month.

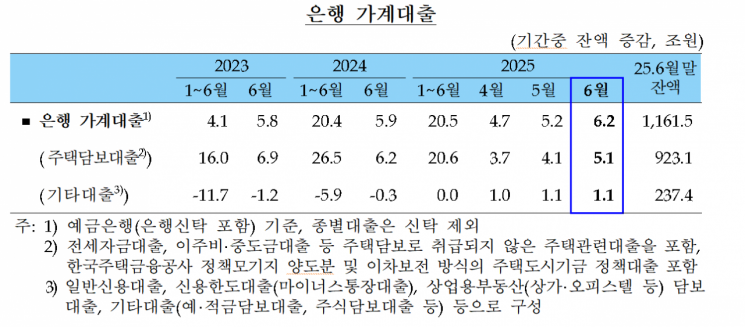

According to the "Financial Market Trends in June 2025" released by the Bank of Korea on July 9, the outstanding balance of bank household loans at the end of last month stood at 1,161.5 trillion won, an increase of 6.2 trillion won from the previous month. This is the largest monthly increase in 10 months, since August last year, when the real estate market was overheated (9.2 trillion won). However, the Bank of Korea's reported increase (6.2 trillion won) is smaller than the 6.7 trillion won rise estimated for the five major banks over the same period. This is due to factors such as the inclusion of transfers to the Korea Housing Finance Corporation (minus 500 billion won in June).

The primary driver behind the surge in bank household loans was mortgage loans. Last month, mortgage loans increased by 5.1 trillion won, reaching 923.1 trillion won. This marks the largest monthly growth since September last year (6.1 trillion won). The increase was amplified as the rise in housing transactions over the past few months began to impact loan demand with a time lag. According to the Ministry of Land, Infrastructure and Transport, the number of apartment sales in Seoul dropped briefly from 9,500 in March to 5,000 in April, but rebounded to 7,300 in May.

Park Mincheol, head of the Market Supervision Team at the Bank of Korea’s Financial Markets Department, stated, "In June, household loans across the entire financial sector, including banks, continued to increase by over 6 trillion won (6.5 trillion won), mainly driven by housing-related loans." He added, "We expect the growth in household loans to expand through July and August due to the surge in housing transactions in May and June." He also noted that the trend in household loans after September should be assessed based on housing transaction trends this month. Park said, "It is still too early to assess the impact of the government's June 27 measures, as only about two weeks have passed since their announcement. However, experts consider the 600 million won limit on mortgage loans and the requirement to report a change of residence within six months when using a mortgage to be quite strong measures. If these measures work as intended, we expect them to help cool down the overheated housing market and significantly slow the growth of household debt."

Jeonse deposit loans, which are included in mortgage loans, increased by 300 billion won from the previous month. Other loans, including general credit loans, credit line loans (overdraft loans), commercial real estate-backed loans, savings and installment deposit-backed loans, and stock-backed loans, increased by 1.1 trillion won. Typically, the sale and write-off of non-performing loans at the end of the half-year act as a factor reducing loan balances. However, last month, demand for stock investment and living expenses offset this effect, resulting in a similar increase to the previous month.

Corporate loans turned to a decline. At the end of last month, the outstanding balance of bank corporate loans was 1,343 trillion won, down 3.6 trillion won from the previous month. After large increases in April (14.4 trillion won) and May (8 trillion won), corporate loans decreased last month. Loans to large corporations fell by 3.7 trillion won, largely due to temporary repayments for end-of-half financial ratio management and the repayment of credit line loans by some major companies. Loans to small and medium-sized enterprises increased by 100 billion won, with the modest growth attributed to continued credit risk management by banks and the sale and write-off of non-performing loans at the end of the half-year. Park explained, "In May, some large companies diversified their funding sources by securing working capital through foreign currency sales of export proceeds instead of credit line loans, but in June, all of these loans were repaid, resulting in a larger decline." He added that, excluding these special circumstances for some large companies, the overall decrease was only slight.

Bank deposits surged by 27.3 trillion won from the previous month in June, mainly due to an increase in demand deposits. Demand deposits rose sharply by 38.4 trillion won, driven by inflows of corporate funds for end-of-half financial ratio management. Time deposits decreased by 7.1 trillion won as banks' incentives to attract deposits diminished due to previous deposit expansion.

Assets under management at asset management companies decreased by 2.5 trillion won. Money market funds (MMFs) dropped by 20.5 trillion won, mainly due to significant outflows of corporate and government funds for end-of-half financial ratio management and semi-annual settlements. Equity funds and other funds increased by 7 trillion won and 9.5 trillion won, respectively, expanding the scale of inflows.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)