Kia to Hold Overseas Regional Headquarters Chiefs Meeting on the 23rd

Discussing Strategies for Responding to Unpredictable Tariff Variables

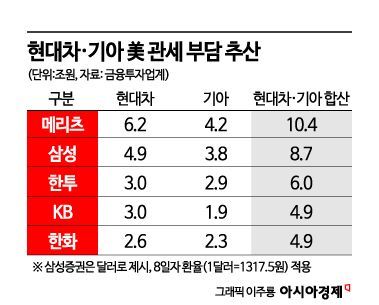

Securities Firms: "Hyundai and Kia Face Tariff Burdens of 5 to 10 Trillion Won"

Automotive Industry Closely Watching Korea-U.S. Tariff Negotiations

Expectations: "Tariff Terms Should Be More Favorable Than Japan, a Competing Country"

Hyundai Motor Company and Kia have each convened their global regional headquarters chiefs for the second half of the year. As the impact of U.S. automobile and parts tariffs is materializing in the form of declining sales for Hyundai and Kia, there is growing speculation that the companies may need to revise their strategies for the latter half of the year. Despite achieving record-breaking results in the first half, sales growth has slowed, and their ranking in electric vehicle sales has also dropped. There are also concerns that tariffs could result in losses exceeding 10 trillion won.

According to the industry on July 9, Kia will hold a meeting of overseas regional headquarters chiefs on July 23, presided over by Kia President Song Ho Sung. Key regional heads, including Yoon Seung Kyu, Executive Vice President and Head of North America Regional Headquarters; Kim Kyung Hyun, Executive Vice President and Head of Kia China; Jung Won Jung, Executive Vice President and Head of Domestic Business Headquarters; An Ki Seok, Head of Asia-Pacific Regional Headquarters; and Jang Su Hang, Head of Asia-Middle East Regional Headquarters, will attend the meeting.

Hyundai Motor Company, which has been holding regular monthly meetings since the appointment of President Jose Munoz this year, will also convene a regional headquarters chiefs meeting around the same time.

Hyundai Motor Group Meta Plant America (HMGMA) located in Georgia, USA. Provided by Hyundai Motor Group

Hyundai Motor Group Meta Plant America (HMGMA) located in Georgia, USA. Provided by Hyundai Motor Group

The core agenda of this meeting for Hyundai and Kia is expected to be strategies for responding to the U.S. market, which is the world's largest automobile market. Since April, the United States has imposed a 25% tariff on imported cars and auto parts. As demand surged before price increases due to the tariffs, Hyundai and Kia recorded their highest-ever U.S. sales in the first half of the year, reaching 893,152 units.

However, there has been a clear decline in monthly sales in recent months. Looking at Hyundai's monthly sales growth rates: except for February (4.1%), the company posted double-digit growth in January (14.6%), March (13.7%), and April (18.5%), but only single-digit growth in May (8.1%) and June (4.5%). In addition, Hyundai and Kia's combined market share in the U.S. electric vehicle market for the first half was 7.6%, ranking third after Tesla (42.5%) and General Motors (13.3%). This represents a 3.4 percentage point decline from 11.0% in the first half of last year. With the U.S. planning to end electric vehicle tax credits in September, sluggish eco-friendly vehicle sales may worsen further.

Accordingly, there is increasing likelihood that the upcoming meeting will discuss strategies to expand U.S. production. Park Kwang Rye, a research analyst at Shinhan Investment Corp., commented, "Kia's future performance will be determined by how efficiently it responds to the global SUV trend and the transition to eco-friendly vehicles."

The finished vehicle industry has conveyed to the government its position that it must secure more favorable negotiating terms compared to Japan, a direct competitor. On July 8 (local time), Yeo Han Koo, Deputy Minister for Trade Negotiations at the Ministry of Trade, Industry and Energy, met with the U.S. Secretary of Commerce to request more favorable treatment for Korea's key export items, such as automobiles and steel, in comparison to competing countries. An industry official stated, "As Korea is an FTA partner with the United States, we can argue for more advantageous trade conditions."

However, the market expects that the Korea-U.S. negotiations will not be able to lower the tariffs. According to FnGuide, Hyundai Motor's second-quarter operating profit consensus is 5.3964 trillion won, down 16% from the previous year, while Kia's is 3.03 trillion won, down 17%. KB Securities and Hanwha Investment & Securities estimate tariff-related losses in annual results to be in the 5 trillion won range.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)