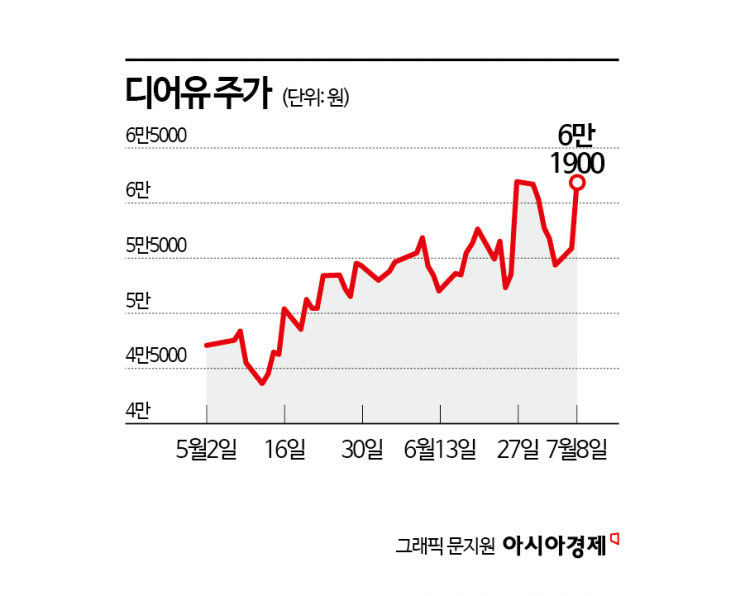

Stock Price Up 70% This Year... Market Cap Rebounds to 1.4 Trillion KRW

'QQ Music Bubble' Launched on June 30 in Partnership with Tencent Music Entertainment

Foreign Investors Net Purchase 55.3 Billion KRW in Past Three Months

According to the financial investment industry on July 9, the share price of DearU has risen by 71.7% so far this year. Even considering that the KOSDAQ index has increased by 15.6% during the same period, DearU's market outperformance amounts to 56.1 percentage points.

Over the past three months, foreign investors have purchased DearU shares worth 57.4 billion KRW. Institutional investors have also recorded a cumulative net purchase of 12.3 billion KRW.

The 'DearU Bubble' service offers a subscription-based platform where users can receive messages from artists in a one-on-one chat room and reply to them. The company collaborates with leading domestic entertainment agencies. As of the end of March this year, overseas users accounted for 74% of the total user base. Since launching the service in 2020, DearU has focused on securing K-pop artist IP. Since then, sports stars and actors have also joined the platform. As of the first quarter of this year, DearU has secured IP from more than 160 agencies and over 600 stars. The average number of subscriptions in the first quarter of this year reached 1.88 million.

DearU signed a strategic partnership with Tencent Music Entertainment Group (TME), China's largest music platform company, and launched the China Bubble service at the end of June. With more artists joining the platform, the company expects revenue to grow rapidly starting in the second half of this year. Through collaboration with Tencent Music Entertainment, the service was launched as a tab within QQ Music. Starting with SM Entertainment, artists from JYP Entertainment and Cube Entertainment have also begun using the Bubble service. In addition to many artists already active in Korea, local Chinese artists are also expected to join. DearU recognizes revenue from the China Bubble service by collecting approximately 10% of sales as royalties. As the number of local subscriptions increases and revenue grows, this is expected to help improve profit margins.

Choi Minha, a researcher at Samsung Securities, analyzed, "We expect the China Bubble service to quickly establish itself in the local market. Given the strong commitment of our partner Tencent Music Entertainment and the fact that the service has ranked high among real-time trending searches on Weibo, there is significant interest in China."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)