Second Quarter Results Amount to Near "Earnings Shock"

Smartphone Sales, Which Boosted Q1, Slump in Off-Season

Home Appliances Hit by Tariffs... Semiconductors Remain Weak

DS Operating Profit Estimated at Late 1 Trillion to Early 2 Trillion Won

Attention on Second-Half Rebound... DRAM Price Hikes a Positive Sign

HBM Also Finds Breakthrough with "1c Process-Based DRAM" Development

Last Month's Launch of "Exynos 2500" Draws Interest

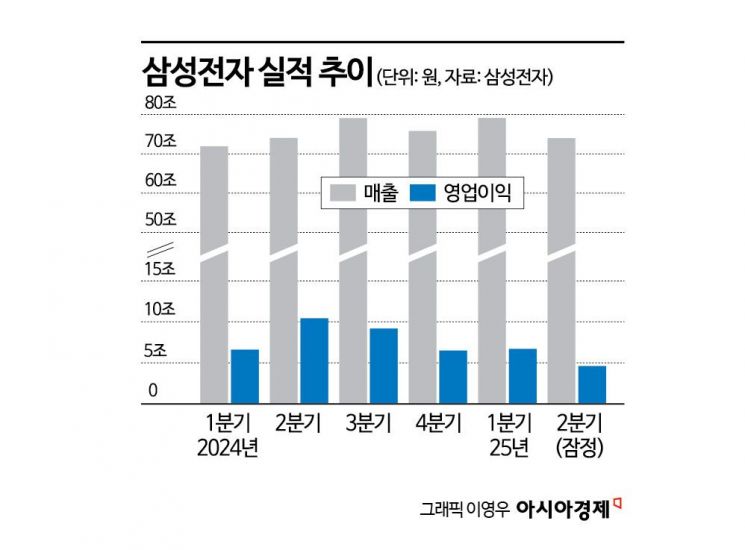

Samsung Electronics' near "earnings shock" performance in the second quarter was largely due to a decline in mobile phone sales, which had driven results in the first quarter but fell during the seasonal off-peak period, while the foundry (semiconductor contract manufacturing) business continued to underperform. However, Samsung Electronics noted that it had set aside significant semiconductor inventory provisions, viewing the second quarter as the bottom and expecting a clear rebound in the third quarter.

In its provisional announcement on July 8, Samsung did not disclose detailed figures, but it is expected that most business divisions posted unsatisfactory results. Smartphones, which had driven strong performance in the first quarter, entered the off-season, and home appliances likely saw expenditures outpace profits as the impact of U.S. tariffs began in earnest. The Device Solutions (DS) division, responsible for semiconductors, also appears not to have rebounded. According to securities analysts, DS’s operating profit for this quarter is estimated to be in the high 1 trillion won to low 2 trillion won range. While this is weak compared to the 6.45 trillion won recorded in the second quarter of last year, it is somewhat higher than the 1.1 trillion won of the first quarter of this year. Most analysts attribute this to a recovery in demand and price increases for general-purpose (legacy) DRAM, rather than any remarkable achievement.

Samsung Electronics plans to move past all negative factors in the second quarter and focus on the second half of the year. The company’s decision to set aside high provisions for semiconductor inventory assets in the second quarter is seen as an effort to clear out all underperforming elements in the first half.

Fortunately, memory semiconductor prices have recently shown signs of recovery. According to market research firm DRAMeXchange, the average fixed transaction price for general-purpose PC DRAM (DDR4 8Gb 1Gx8) last month surged by 23.81% from the previous month to $2.60. This follows increases of 22.22% in April and 27.27% in May, marking three consecutive months of price jumps exceeding 20%.

Even in high-bandwidth memory (HBM), where Samsung Electronics has lagged behind SK Hynix, the company has made some technological progress. Samsung recently developed "1c design process-based DRAM," which is considered the foundation for producing the sixth-generation HBM, HBM4. The company has also completed internal procedures to verify mass production capability. The 1c process is the most advanced among existing DRAM memory process technologies. At the 10nm-class level (1nm = one hundred-millionth of a meter), it is the most refined among the six stages of 10nm-class processes (1x, 1y, 1z, 1a, 1b, 1c).

Samsung reportedly plans to apply the 1c process to its semiconductor production lines and begin manufacturing the latest DRAM. Based on this, the company also plans to develop and launch HBM4 in the market. Last month, Samsung reportedly agreed to supply HBM3E, the previous generation to HBM4, to AMD and Broadcom. A Samsung representative stated, "Improved HBM products are being evaluated and shipped to customers."

The non-memory business, which had struggled due to the negative impact of U.S. sanctions on advanced artificial intelligence (AI) chips and lower line utilization rates, may also show signs of recovery in the second half of the year. In particular, the foundry business is gaining momentum. Last month, Samsung Electronics unveiled its smartphone application processor (AP), the Exynos 2500, on its website. Notably, the product was labeled as being in "mass production," indicating that yields have improved to the point where large-scale manufacturing is possible. Samsung plans to equip its latest Galaxy smartphones with the Exynos 2500. The company will begin this strategy with the foldable phone "Galaxy Z Flip 7" series, which will be unveiled on July 9. The Flip 7 is also expected to serve as a test bed to confirm the potential of the Exynos 2500.

However, the impact of U.S. tariffs is expected to remain a variable for Samsung Electronics' performance in the second half of the year. On July 7 (local time), U.S. President Donald Trump sent a letter to President Lee Jaemyung, stating that if no progress is made in negotiations, a 25% reciprocal tariff will be imposed after August 1. Smartphones and home appliances are expected to fall within the scope of these tariffs.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)