Annual Electricity Costs Soar 62%

Operating Profits Plummet Amid Multiple Variables

Production Cuts, Night Shifts, and Overseas Relocation

Petrochemical Industry Struggles to Avoid the Blow

Rising AI Demand Adds Pressure on IT Sector

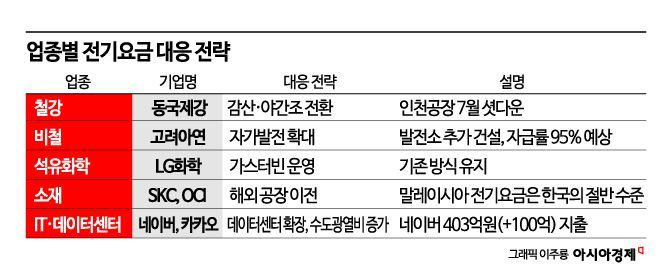

The aftermath of last October's industrial electricity rate hike has been hitting energy-intensive sectors such as heavy chemical and electronics industries hard. Since the beginning of this year, external factors such as oversupply from China and increased U.S. tariffs have dealt a direct blow to the steel and petrochemical industries. On top of this, these industries have had no choice but to shoulder the additional burden of higher electricity costs. As electricity expenses have surged, some companies have responded by cutting production or shifting to night shifts, and more are building new in-house power generation facilities. The IT industry, which operates data centers, is also under comprehensive pressure due to a sharp increase in utility costs.

According to industry sources on July 7, Dongkuk Steel saw its annual electricity bill soar by 62.5%, from 184.5 billion won in 2023 to 299.8 billion won last year. Taking into account the additional rate hike last year, this year's electricity bill is expected to rise by another 10% compared to last year. In contrast, operating profit in the first quarter of this year plummeted by more than 90% year-on-year to 4.3 billion won. Assuming annual profit is around 120 billion won, the company would not even earn enough in a year to cover its electricity bill.

Young Poong, a zinc smelting company, spent 238.4 billion won on electricity in 2023 alone, a 33% increase from the previous year (178.9 billion won). Last year, the electricity cost burden decreased to 205.1 billion won, mainly due to the suspension of some facilities. Young Poong recorded a loss last year.

As electricity demand from the artificial intelligence (AI) industry surges, platform companies are also not free from the burden of higher rates. Naver, for example, saw its utility costs jump by more than 10 billion won year-on-year after the Sejong data center began operations. An IT industry official said, "The annual electricity bill for a single data center can range from several billion won to tens of billions of won," adding, "As demand for AI grows, these costs will inevitably continue to rise."

Companies facing poor market conditions are struggling to find ways to avoid the electricity cost shock. Dongkuk Steel is responding by reducing daytime operations and expanding night shifts at its Incheon plant. To ease the electricity cost burden, Young Poong is building in-house power generation and storage facilities. A representative example is the use of a steam turbine generator (STG) facility powered by waste heat from the smelting process, which enables the company to self-supply about 64 GWh annually (5.3% of total usage). This is estimated to have saved about 9.5 billion won in electricity costs. In addition, by operating a 50 MWh energy storage system (ESS), the company reduced power use during peak hours and saved approximately 1.75 billion won per year.

However, some in the steel industry point out that further investment in energy efficiency facilities is no longer easy. A Hyundai Steel official said, "The energy efficiency of Korea's steel industry is already among the highest in the world, so there are limited means to reduce electricity costs in the short term." According to energy efficiency comparisons by country from the Research Institute of Innovative Technology for the Earth (RITE) in Japan, Korea ranked second in the world with a score of 102 compared to Japan's 100 for blast and converter furnaces, and also second with a score of 101 for electric furnaces, just behind Japan's 100. This means there is virtually no room for further savings given the already high efficiency.

Lotte Chemical, a petrochemical company, also supplies part of its power through an in-house gas turbine power plant, but other responses are limited.

There has also been an increase in cases where companies have relocated production bases overseas to avoid the burden of electricity costs. SKC, OCI Holdings, and SK Nexilis, for example, have moved their production hubs to Southeast Asia, where electricity rates are relatively lower. An industry official said, "While domestic production is maintained for high value-added products, processes that require large amounts of electricity inevitably have to be moved overseas," adding, "Rising electricity costs are accelerating the hollowing out of the domestic manufacturing ecosystem."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.