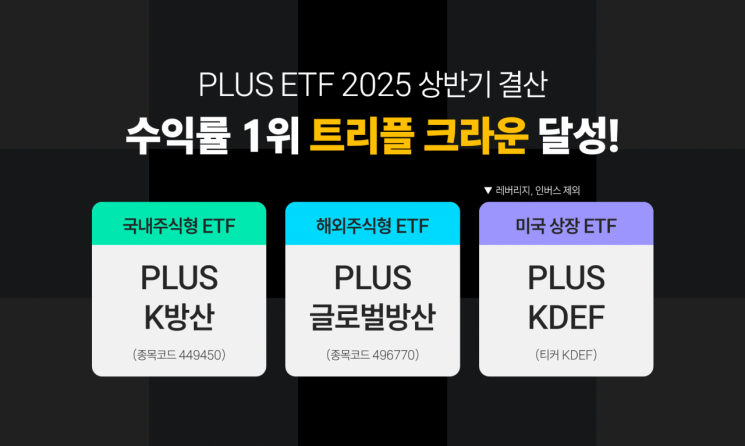

Hanwha Asset Management announced on July 7 that its PLUS ETF ranked first in returns among both domestic and overseas equity ETFs, as well as among U.S.-listed ETFs, in the first half of the year. The total net asset value (AUM) of PLUS ETF increased by approximately 70%.

According to financial information provider FnGuide, the 'PLUS K-Defense' ETF recorded a return of 163.31% in the first half of the year, ranking first among all domestic equity ETFs, including leveraged products. In addition, the ▲PLUS Hanwha Group ETF ▲PLUS Solar & ESS ETF ▲PLUS Aerospace & UAM ETF posted returns of 123.82%, 82.67%, and 81.47%, respectively. Among overseas equity ETFs, the PLUS Global Defense ETF achieved a 61.64% return, securing the top spot.

PLUS ETF also ranked first in returns among U.S.-listed ETFs (excluding leveraged and inverse products) in the first half of the year. According to Bloomberg, the 'PLUS Korea Defense Industry Index (KDEF)' ETF, which was listed on the New York Stock Exchange in the U.S. in February this year, delivered a 94.73% return in about five months.

The total net asset value (AUM) increased rapidly as well. According to the Korea Financial Investment Association, as of the end of June, the AUM of PLUS ETF stood at 5.6744 trillion won, up 69.70% from 3.3437 trillion won at the end of last year. This is the highest growth rate among the top 10 ETF providers.

Hanwha Asset Management cited its ability to offer products suitable for market conditions in a timely manner, delivering positive results for investors, as the background for this growth. The aforementioned ETFs all invest in sectors expected to benefit from international dynamics such as the U.S.-China power struggle and the restructuring of global supply chains.

Choi Youngjin, Head of Marketing at Hanwha Asset Management, commented, "By focusing on shifts in the forces that move the world, we were able to provide investors with products for long-term investment and actively communicate their stories, which proved effective."

He added, "In particular, at a time when the rise and fall of nations is clearly distinguished due to the reorganization of global relationships, our ability to sharply identify these trends and proactively present investment logic was key." He also stated, "Going forward, we will continue to identify and commercialize attractive investment opportunities, not only based on industry outlooks, but also within the broader context of international affairs and the restructuring of global supply chains."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)