Sharp Rise in Industrial Electricity Rates Increases Corporate Burden

Seven Rounds of Industrial Rate Hikes Drive Up Costs

Companies Struggle to Apply Alternatives in Practice

Calls for Power System Reform, Including Expansion of Renewable Energy

Over the past three years, while electricity consumption by major domestic companies has increased by 13%, their electricity bill burden has surged by 70%. This is the result of raising industrial electricity rates, while keeping household rates relatively unchanged, in order to resolve Korea Electric Power Corporation (KEPCO)'s deficit. Energy-intensive companies in sectors such as steel and chemicals, which already struggle to secure profits, are now finding it difficult even to pay their electricity bills.

With the expansion of high-power industries such as semiconductors and artificial intelligence (AI), electricity demand is expected to increase even more rapidly. However, it is becoming increasingly difficult to handle this demand solely through the traditional method of purchasing electricity from KEPCO. Although the government is urging companies to improve energy efficiency and transition to new industries, there are criticisms that, in reality, companies have little room to respond due to rising rates and regulatory constraints.

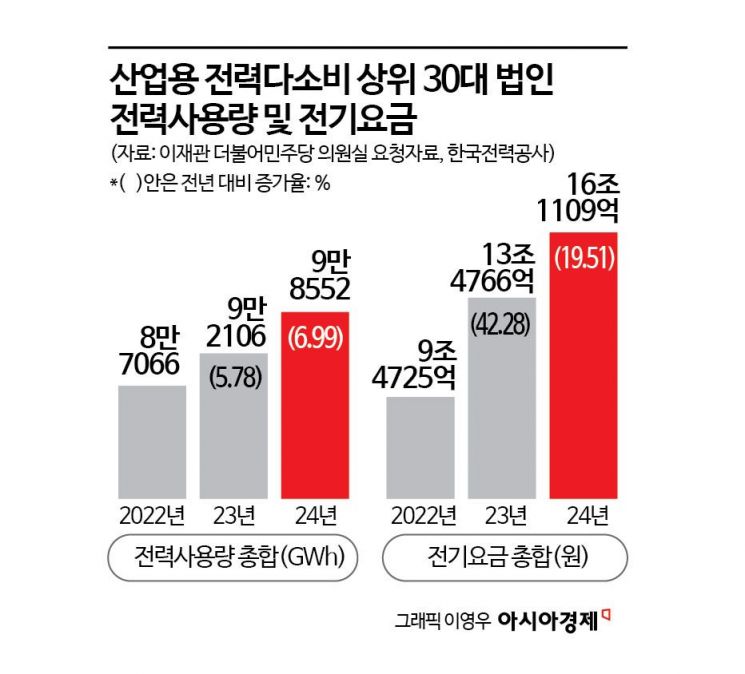

According to data submitted by the office of Lee Jaegwan, a lawmaker from the Democratic Party of Korea, based on KEPCO’s “Status of Electricity Rate Burden from 2022 to 2024,” the total electricity bill for the top 30 corporations by electricity usage jumped by about 70%, from 9.4725 trillion won in 2022 to 16.1109 trillion won this year. During the same period, their total electricity consumption increased by only 13.2%, from 87,066 GWh to 98,552 GWh.

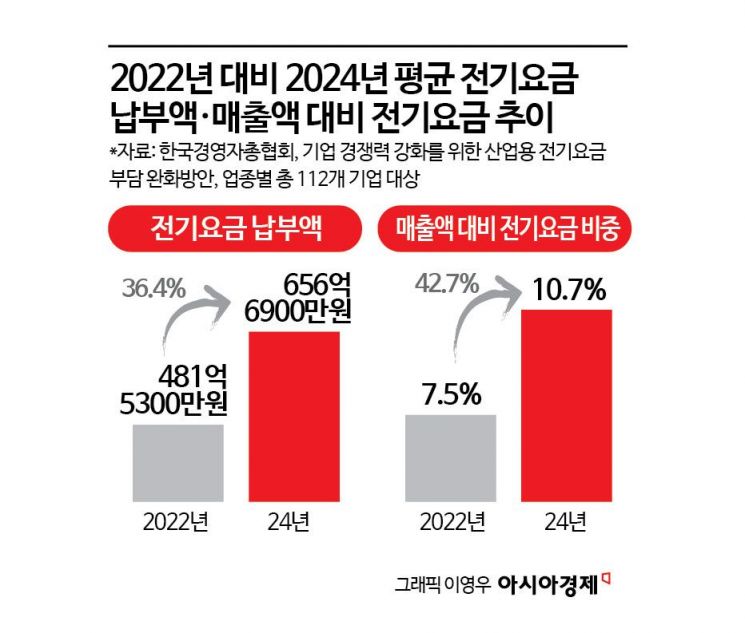

The sharp rise in industrial electricity bills is largely due to seven rate hikes over the past three years. In contrast, the rate of increase for household and general electricity rates was only about half that of industrial rates. According to data compiled by the Korea Employers Federation, the average electricity bill for large companies rose by 40.7%, from 166.6 billion won in 2021 to 233.4 billion won this year.

By company, LG Chem will have to pay 65.3 billion won more in electricity bills this year compared to 2023. S-Oil is also facing an additional annual payment of 64.2 billion won.

Choi Kyujong, head of the Green Energy Support Center at the Korea Chamber of Commerce and Industry, said, "Even at the current level, electricity rates are already a significant burden for companies. The pressure is felt even more acutely because production cost burdens keep piling up and there are no effective countermeasures."

'Renewable Energy Transition' Alternatives Difficult to Apply in Reality

In an effort to move away from the traditional model of purchasing electricity from KEPCO, the industry is exploring various alternatives such as power purchase agreements (PPAs) and self-generation. Last year, Samsung Electronics introduced a solar PPA at its domestic sites for the first time, and SK Hynix also signed PPA contracts with SK Ecoplant and Korea Water Resources Corporation.

However, there are concerns that these alternatives are insufficient to substantially reduce companies' electricity burden. While the total electricity transaction amount for 37 companies with their own power generators increased from 241.1 billion won in 2023 to 352.3 billion won this year, this still accounts for only about 2% of the total electricity bills paid by the top 30 corporations. Even when using private electricity trading methods, additional costs such as separate grid usage fees arise, making it difficult to achieve the expected cost savings.

In a survey conducted by the Korea Chamber of Commerce and Industry last March of 300 domestic manufacturing companies, only 11.7% responded that they were "considering alternative procurement methods" in response to rising industrial electricity rates, and just 27.7% said they would consider adopting such methods if rates increased further. The vast majority of companies have been unable to develop clear countermeasures due to a combination of issues such as costs, regulations, and insufficient infrastructure.

An industry official said, "Companies are making consistent efforts to achieve RE100 (100% renewable energy usage), but the reality is challenging. In the case of PPAs, there is a significant shortage of suppliers in Korea, and operating their own power plants is a major financial burden for companies."

In particular, the semiconductor industry is facing electricity supply issues that have become a matter of survival during the creation of ultra-large clusters. Large-scale AI semiconductor plants consume dozens of times more electricity per unit area than ordinary factories. If the construction of power supply networks is delayed, it is highly likely to lead to production disruptions, which could directly undermine the industry's competitiveness.

The business community points out the need to moderate the pace of electricity rate hikes and to remove institutional barriers that hinder the adoption of alternative measures. A representative from an economic organization said, "Even if companies want to adopt private electricity trading methods due to KEPCO's rate hikes, it is difficult to do so in practice because of additional costs such as grid usage fees. We are asking the government at least to moderate the rate increases."

Major economic organizations are continuously proposing policy alternatives. Last month, the Korea Chamber of Commerce and Industry recommended a transition to a distributed energy system, including the introduction of power generation facilities tailored to local demand and diversification of electricity sales. The Korea Employers Federation called for a revision of the rate system by season and time of day, as well as the introduction of special rates for industries with stable load factors. The Korea Economic Association proposed a plan to reduce electricity rates in industrial crisis areas using government funds.

Lawmaker Lee said, "The burden on companies is increasing due to electricity rate hikes. The government must do its utmost to prepare fundamental countermeasures, such as expanding renewable energy and diversifying supply, in response to rising electricity demand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)