Exports decline after four months...

Semiconductor growth offsets "sluggish automobiles and steel"

May holidays widen travel account deficit...

Primary income account swings to surplus as dividend seasonality fades

In the second half, greater tariff impact on automobiles and steel...

Attention on additional tariff items and reciprocal tariff negotiations

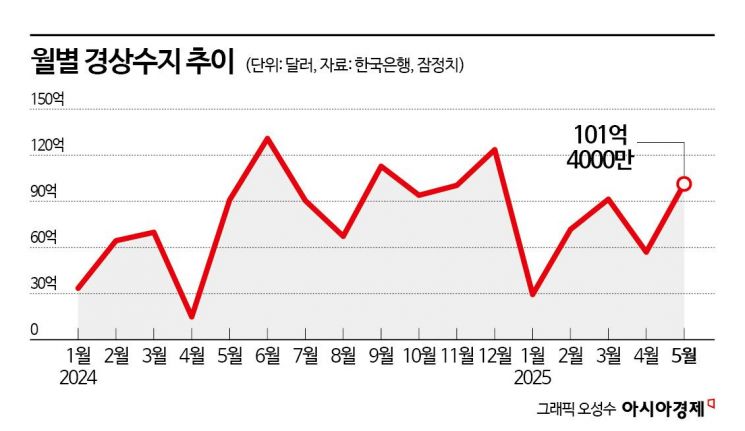

In May, South Korea's current account posted a surplus of $10.14 billion. This marks the 25th consecutive month of surplus and is the third largest May surplus on record. Although exports turned to a decline for the first time in four months due to sluggish performance in automobiles and steel, the drop in imports?driven by falling oil prices?was even greater, resulting in a wider goods surplus. The primary income account also swung to a surplus as seasonal factors such as foreign dividend payments disappeared.

Exports decline after four months...Semiconductor growth offsets 'sluggish automobiles and steel'

According to the "May 2025 Balance of Payments (Provisional)" released by the Bank of Korea on the 4th, South Korea's current account in May recorded a surplus of $10.14 billion. The current account has been in surplus for 25 consecutive months since May 2023. The surplus widened compared to the previous month ($5.7 billion) and the same month last year ($9.09 billion). For the month of May, this is the third largest surplus on record, following 2021 ($11.31 billion) and 2016 ($10.49 billion).

The goods account, which constitutes a significant portion of the current account, posted a surplus of $10.66 billion. The surplus widened compared to the previous month ($8.99 billion) and the same month last year ($8.82 billion). Both exports and imports decreased year-on-year, but the sharper drop in imports contributed to the wider surplus.

On the 4th, at the Bank of Korea in Jung-gu, Seoul, during the press briefing for the "May 2025 Balance of Payments (Provisional)," (from left) Junyoung Kim, Manager of the International Balance of Payments Team at the Bank of Korea, Jaechang Song, Head of the Financial Statistics Department, Sungjun Kim, Head of the International Balance of Payments Team, and Suhan Kwon, Manager of the International Balance of Payments Team, are answering questions. Bank of Korea

On the 4th, at the Bank of Korea in Jung-gu, Seoul, during the press briefing for the "May 2025 Balance of Payments (Provisional)," (from left) Junyoung Kim, Manager of the International Balance of Payments Team at the Bank of Korea, Jaechang Song, Head of the Financial Statistics Department, Sungjun Kim, Head of the International Balance of Payments Team, and Suhan Kwon, Manager of the International Balance of Payments Team, are answering questions. Bank of Korea

Exports totaled $56.93 billion, down 2.9% from a year earlier. Non-IT items such as automobiles, steel, and petroleum products declined, leading to the first decrease in four months. However, the continued growth in semiconductor exports partially offset the overall decline. In May, customs-cleared semiconductor exports reached $13.93 billion, up 20.6%. In contrast, petroleum products fell to $3.64 billion, a 20% decrease. Exports of steel products and passenger cars also dropped by 9.6% and 5.6%, respectively.

Imports amounted to $46.27 billion, a 7.2% decrease from the previous year. While capital goods imports continued to rise, a larger drop in raw materials?driven by lower energy prices?led to an overall decline. In May, customs-cleared raw material imports stood at $23.3 billion, down 13.7%. Coal (-31.6%), petroleum products (-30%), crude oil (-14%), and chemical products (-8.4%) all decreased. Capital goods imports increased by 4.9% to $18.34 billion. Imports of semiconductor manufacturing equipment (26.1%), transportation equipment (46.8%), and information and communication devices (16.5%) rose, while semiconductor imports fell by 3.5%. Consumer goods imports also increased by 0.4% to $8.68 billion. Passenger car imports rose by 16.8%, while grain imports dropped by 16.4%.

However, it is still difficult to classify the current situation as a "recessionary surplus," where the surplus is driven more by a decline in imports than by exports. Song Jaechang, Director of the Financial Statistics Department at the Bank of Korea, explained, "A recessionary surplus refers to a situation where exports decrease and, due to sluggish domestic demand, imports fall even more. Currently, the declines in exports and imports are rather the result of external factors, such as changes in the trade environment and falling oil prices," he said. "If we exclude the effect of falling energy prices, the trend of increasing imports remains unchanged. While there were monthly fluctuations, the increase in capital goods imports continued from January to May, and consumer goods imports also showed a slight increase," he noted.

May holidays widen travel account deficit...Primary income account swings to surplus as dividend seasonality fades

The services account, which includes the travel account, posted a deficit of $2.28 billion, narrowing from the previous month’s deficit of $2.83 billion. The travel account deficit widened to $950 million in May as more people traveled abroad during the holidays. In contrast, the intellectual property rights account posted a deficit of $340 million, with the deficit narrowing as domestic companies received royalties from overseas subsidiaries. The other business services account also recorded a deficit of $1.07 billion, with the deficit shrinking due to a base effect from a temporary increase in R&D service payments the previous month.

The primary income account, led by dividend income, recorded a surplus of $2.15 billion. As the seasonal factor of dividend payments faded, the account swung to a surplus within just one month.

Net external assets, calculated as assets minus liabilities in the financial account, increased by $6.71 billion. Direct investment saw outbound investment by residents rise by $4.13 billion, while inbound investment by foreigners increased by $320 million. In portfolio investment, outbound investment by residents?mainly in bonds?increased by $10.09 billion, and inbound investment by foreigners?also mainly in bonds?increased by $12.77 billion. Derivatives decreased by $880 million. Other investments saw assets rise by $8.01 billion, mainly in loans, and liabilities increase by $970 million, mainly in other liabilities. Reserve assets decreased by $570 million.

In the second half, greater tariff impact on automobiles and steel...Attention on additional tariff items and reciprocal tariff negotiations

The impact of U.S. tariffs is expected to expand further in the second half of the year, especially for items such as automobiles and steel. Key variables will include whether additional tariffs are imposed on items like semiconductors, the intensity of such tariffs, and the progress of reciprocal tariff negotiations.

Based on customs data for the first half of the year (January to June), the impact of U.S. tariffs is already being seen, particularly on automobiles and steel, which are subject to tariffs. In the first half, automobile exports fell by 2.1% year-on-year, while steel exports decreased by 3.2%. Notably, exports of automobiles to the U.S. plummeted by 16.4% during this period, and steel exports to the U.S. also dropped by 4.3%. Song noted, "The impact of U.S. tariffs is already evident in the first half. Depending on the progress of reciprocal tariff negotiations, there is still uncertainty, but if the current tariff effects persist, the impact will become even more pronounced for tariffed items in the second half," he said. For automobiles, there is a possibility that some of the increased tariffs in the second half will be passed on to sales prices, and increased local production may reduce the volume of exports from domestic production.

The temporary rise in oil prices due to the Middle East situation is expected to have a limited impact. Song said, "As the Middle East situation continued for about two weeks, Dubai crude oil prices in June rose to $69 per barrel, up from $64 the previous month. However, since oil prices affect import prices with about a one-month lag, we need to watch the trend in July, but the overall impact is expected to be limited," he said.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)