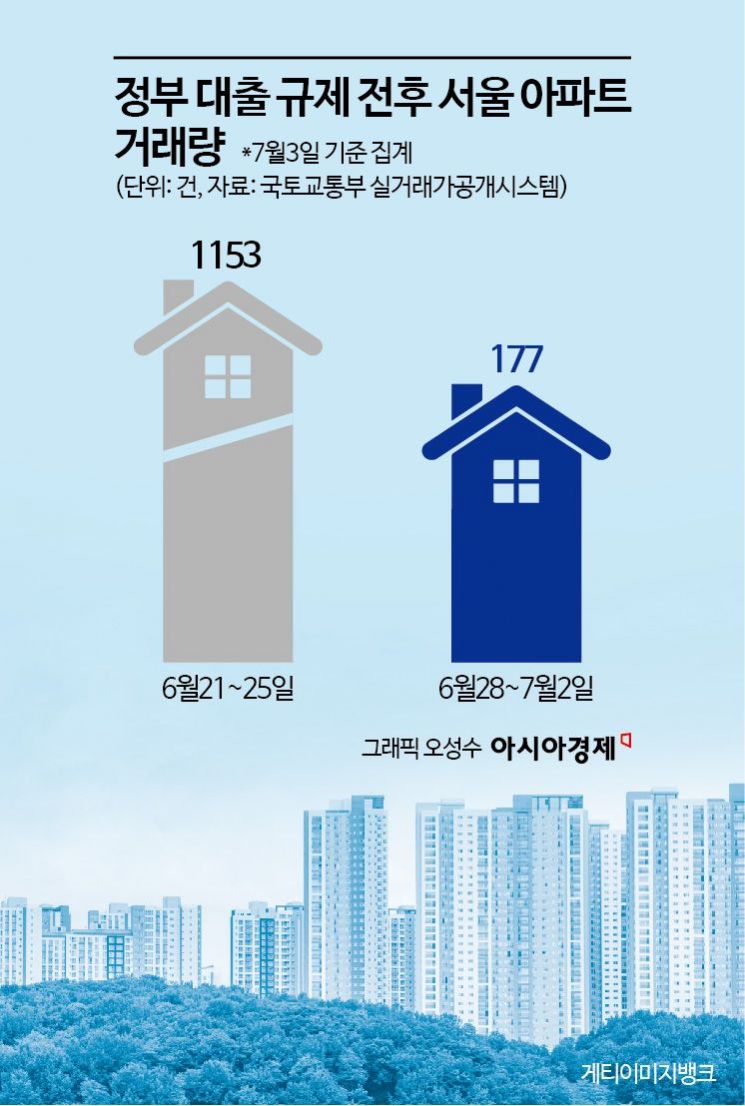

177 Apartment Transactions in Seoul in 5 Days After Regulations

Down 85% Compared to Same Period Last Week

30-Day Reporting Deadline Means More Deals Yet to Be Counted

"With Funding Cut Off, Transaction Volume Is Bound to Decrease"

"Since the lending regulations were implemented, apartment transactions have come to a complete halt. There are people who want to sell, but there are almost no inquiries from buyers." (Representative of Real Estate Agency A in Sangwangsimni-dong, Seongdong-gu)

"The maximum loan amount is only 600 million won, and gap investment has effectively been blocked, so it's practically a standstill. All we get are calls to check prices." (Representative of Real Estate Agency B in Godeok-dong, Gangdong-gu)

Since the announcement of lending regulations on June 27, there are signs that apartment transaction volumes in Seoul are sharply declining. Although precise statistics have not yet been compiled, transactions have clearly decreased compared to before. The upward trend in apartment prices in Seoul has also eased slightly. Experts analyze that these changes are due to the strong lending regulations, but they also predict that without an increase in housing supply, this stabilization will only be temporary.

According to the Ministry of Land, Infrastructure and Transport's Actual Transaction Price Disclosure System on July 4, the number of apartment transactions in Seoul between June 28, when the lending regulations took effect, and July 2 was tallied at 177. This represents an 85% decrease compared to the 1,153 transactions recorded during the same period and days of the previous week (June 21 to 25). Since transaction reports can be filed within 30 days after a contract, it is expected that there are still many transactions from June 28 to July 2 yet to be counted. However, experts point out that, although monthly figures before and after the regulations should be compared once the data is fully compiled, the scale of the decline is so significant that the downward trend is already clear.

The government has capped the maximum amount of mortgage loans in the Seoul metropolitan area at 600 million won or less. Loans for owners of multiple homes and for gap investors have also been blocked. Yoon Sumin, real estate expert at NH Nonghyup Bank, said, "With the flow of funds cut off, it is inevitable that transaction volumes in Seoul would decrease. I believe this has been effective in calming the market atmosphere for now."

Looking at apartment transactions by district from June 28 to July 2, Nowon-gu recorded the highest number with 22 transactions, followed by Seongbuk-gu with 16, Guro-gu with 13, and Gwanak-gu, Yangcheon-gu, and Eunpyeong-gu with 11 each. The so-called "balloon effect" is partially materializing in outer districts such as Nodogang (Nowon-gu, Dobong-gu, Gangbuk-gu) and Geumgwan-gu (Geumcheon-gu, Gwanak-gu, Guro-gu), where transactions are still possible with loans not exceeding 600 million won.

In contrast, in the premium districts designated as Land Transaction Permission Zones (Toheoguyeok) such as the three Gangnam districts and Yongsan-gu, transaction volumes were much lower. Yongsan-gu recorded 5 transactions, Gangnam-gu 4, and both Seocho-gu and Songpa-gu had 0. By price range, the majority of transactions (76 cases, 42.9%) were between 500 million and 1 billion won. Transactions under 500 million won accounted for 43 cases (24.3%), and those between 1 billion and 1.5 billion won made up 29 cases (16.4%).

The upward trend in prices has also eased. According to weekly apartment price trends for the fifth week of June (as of June 30) released by the Korea Real Estate Board, Seoul apartment sale prices rose by 0.40% compared to the previous week. This is lower than the previous week's increase of 0.43%. Although it is too early to conclude that this is due to the regulations, the slowdown in buyer inquiries and transactions appears to have somewhat softened the upward curve.

Ham Youngjin, head of the Real Estate Research Lab at Woori Bank, said, "In Seoul, the majority of apartment sales have traditionally been for properties priced over 600 million won. The recent transactions seem to be concentrated in outer districts or small-scale apartments that are not affected by the 600 million won loan cap."

Experts expect that the new lending regulations will have only a short-term effect. They emphasize that additional housing supply is necessary for long-term market stability. Yoon Sumin said, "Demand suppression measures are inherently time-limited. As interest rates fall and the supply of housing in Seoul also decreases, upward pressure on prices continues." He added, "Ultimately, supply policies are crucial, and the key issue will be how much long-term supply the market desires can actually be met."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)