Over 90% of Total Loans at Top Three Internet Banks Are Household Loans

Seeking New Opportunities Through Individual Business Owner Loans and Non-Interest Income

Inevitable Weakening of Internet Banks' Growth Momentum in 2025

The announcement of the June 27 household loan management reinforcement plan, considered one of the most stringent lending regulations, has raised concerns about the profitability of internet-only banks. With over 90% of their total loans consisting of mortgage loans, these banks are now compelled to revise their growth strategies for the second half of the year. Although internet banks are considering expanding into loans for individual business owners as a new avenue, effective management of delinquency rates remains a major challenge, making even this strategy appear uncertain.

According to the financial sector on July 4, the three major internet banks?Kakao Bank, K Bank, and Toss Bank?have recently begun reassessing their management strategies for the second half of the year. This move comes as the June 27 household loan management reinforcement plan has put the brakes on their growth potential. On June 27, the Financial Services Commission and other financial authorities held an emergency meeting to review household debt and announced new measures. These measures include reducing the total household loan growth target for the financial sector by 50% compared to the beginning of the year and capping the maximum mortgage loan amount at 600 million won, regardless of the borrower's repayment ability. In addition, the limit for unsecured loans has been restricted to within 100% of the borrower's annual income.

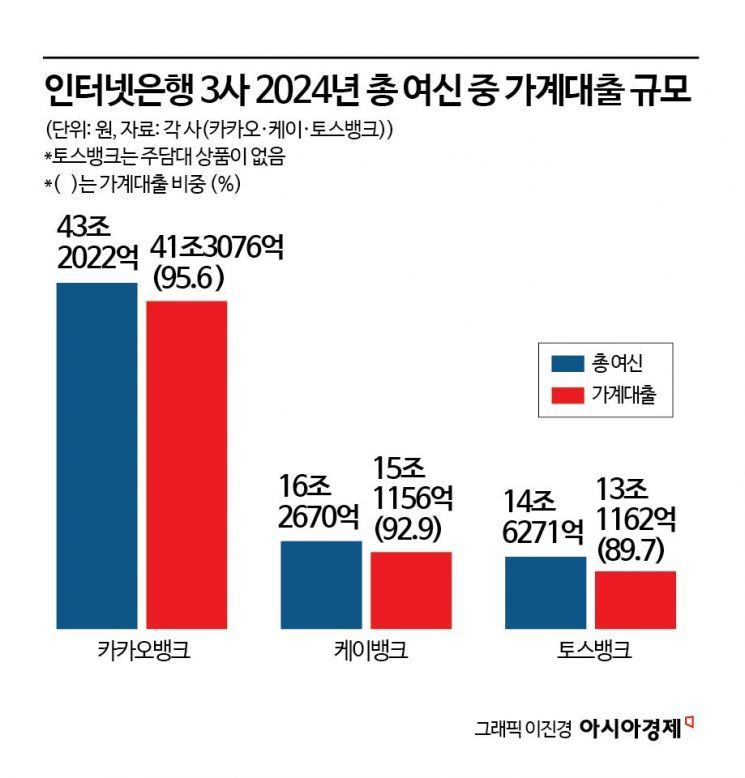

Most analysts believe that this regulation will have a more direct impact on internet-only banks than on traditional banks, as household loans account for the vast majority of their total lending. As of the end of 2024, Kakao Bank’s total loans stood at 43.2022 trillion won, with household loans?including mortgage loans?accounting for 41.3076 trillion won, or 95.6%. For K Bank, household loans made up 15.1156 trillion won, or 92.9% of its total loans of 16.267 trillion won as of the end of 2024. Although Toss Bank does not yet offer mortgage loan products, household loans?including unsecured loans and loans for jeonse and monthly rent deposits?accounted for 13.1162 trillion won, or 89.67% of its total loans of 14.6271 trillion won in 2024.

Internet banks are seeking to diversify their portfolios by expanding corporate loans such as those for individual business owners and by increasing non-interest income. K Bank plans to expand its presence in the individual business owner loan market, which was outlined as a growth strategy in its New Year’s address. Kakao Bank also plans to launch non-face-to-face collateralized loans for individual business owners in the second half of the year and to diversify its portfolio through non-interest income generated via its platform. As of the first quarter of this year, Kakao Bank’s non-interest income had increased by about 33% compared to the previous year.

An internet bank official stated, "With the limit on unsecured loans now restricted to within the borrower’s annual income, it may become difficult to provide funding to financially vulnerable groups such as mid- and low-credit borrowers or small business owners. Unless there is regulatory relaxation or incentives provided for this, it will not be easy to achieve the mission of expanding loan balances while maintaining the required proportion of mid- and low-credit loans."

However, in the case of loans to individual business owners, the high delinquency rates due to sluggish domestic demand pose a significant burden in terms of risk management, which is a major concern for internet banks.

Another internet bank official commented, "Since we must comply with household loan targets while growing our loan portfolios, there is no alternative but to increase the proportion of individual business owner loans. However, given the inherent challenges in managing delinquency rates and asset quality for these loans, it is also difficult to aggressively expand the scale of individual business owner lending."

Kang Seunggeon, a researcher at KB Securities, analyzed, "For internet banks, household loans?which are subject to the new regulations?make up a relatively high proportion of their portfolios, so the government’s enhanced household loan management measures will inevitably weaken their growth momentum in 2025."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)