Trends and Case Studies in AI Credit Assessment Services

Lee Geunju, Chairman of the Fintech Association: "Collaboration with the National Assembly, Authorities, and Industry"

As artificial intelligence (AI)-driven digital finance continues to expand, the financial sector has suggested the need for standardized guidelines on alternative credit assessment.

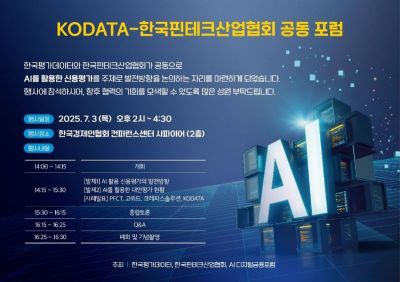

Yoo Jushin, Chairman of the AI Digital Finance Forum, made this statement at the "AI-Driven Credit Assessment" forum, which was held by the Korea Fintech Industry Association and Korea Evaluation Data (KODATA) on July 3, 2025, at the Korea Employers Federation Conference Center in Yeouido, Seoul.

Chairman Yoo pointed out several issues with current alternative credit assessment methods, including concerns about personal data and privacy violations, lack of explainability, data bias, and insufficient legal and institutional frameworks.

He stated, "It is necessary to grant the right to access information usage records, introduce explainable AI (XAI) technologies, and ensure data diversity," emphasizing, "In particular, there is a need to establish dedicated guidelines for alternative credit assessment."

Kim Youngdo, Senior Research Fellow at the Korea Institute of Finance, delivered a keynote presentation on the topic of "Development Directions for AI-Based Credit Assessment."

Senior Research Fellow Kim said, "AI-based credit assessment faces multiple challenges, including fairness issues stemming from algorithmic bias, the opacity of complex AI models, and limitations of evaluation metrics." He added, "It is necessary to establish a flexible regulatory framework tailored to the characteristics of AI, as well as technical standardization and measures to address information asymmetry."

Additionally, Senior Research Fellow Kim advised that companies should establish AI governance systems to manage the potential risks of AI.

Institutions participating in the forum, including PFCT, Gowid, Crepassolution, and Korea Evaluation Data, each presented case studies on AI-driven credit assessment and alternative information services.

Lee Suhwan, CEO of PFCT, introduced a case study on building a credit assessment model using optimal combinations of AI-based algorithms.

Wi Junghwan, Head of Gowid, explained a real-time data-based risk measurement model.

Kim Sangbin, Head of Crepassolution, presented an alternative credit assessment service that applies scores developed by patterning data with AI.

Na Eunjung, Head of the Data Science Center at Korea Evaluation Data, introduced the database (DB)-based real estate information service "Realtop" and an alternative information service developed in collaboration with the Korea Financial Telecommunications and Clearings Institute.

During the general discussion, Lee Hodong, former CEO of Korea Evaluation Data, served as the moderator. Panelists included Lee Hyojin, CEO of 8Percent, Lee Sungbok, Doctor at the Capital Market Institute, Woo Chisu, Head of the Credit Data Industry Division at Toss, and Seo Seungbeom, Head of the Corporate Data Department at Korea Credit Information Services.

Lee Geunju, Chairman of the Korea Fintech Industry Association, said, "I hope this forum will serve as an opportunity to address both the technical and institutional challenges of AI credit assessment and enhance the international competitiveness of digital finance infrastructure." He added, "The association will work closely with the National Assembly, financial authorities, and the industry to ensure the stable institutionalization of digital financial innovations, including AI credit assessment."

Hong Doseon, CEO of Korea Evaluation Data, said, "As the financial industry undergoes rapid transformation with the advent of AI, I hope this forum will serve as a venue to explore the future direction and concrete alternatives for credit assessment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.