Domestic and international credit rating agencies have warned that the gloomy atmosphere of the first half of this year, marked by a series of corporate credit rating downgrades, is likely to persist into the second half. The negative outlook is concentrated in sectors such as petrochemicals, construction, and savings banks.

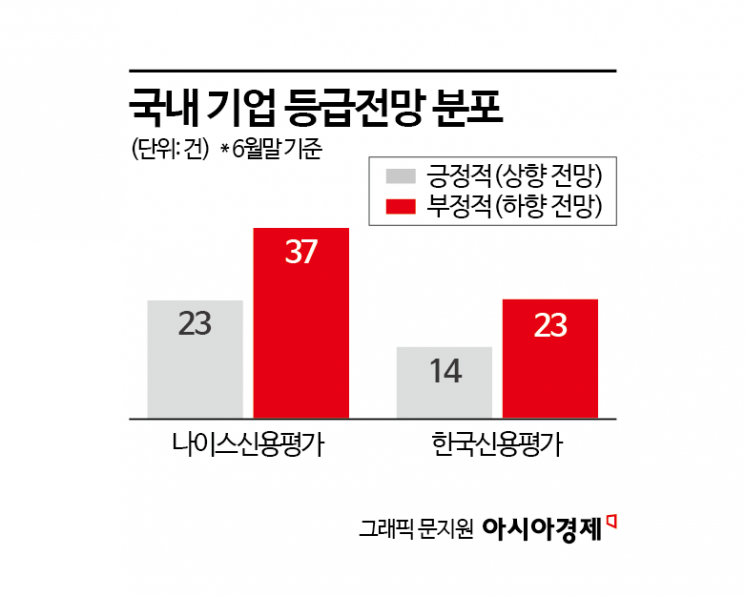

According to NICE Investors Service, as of the end of June, there were 37 cases of 'negative' outlooks (including watchlists) for domestic companies, indicating expectations of future downgrades. This figure far exceeds the 23 cases of 'positive' outlooks, which suggest the possibility of upgrades. In the first half of the year, there were also more cases of credit rating downgrades (28) than upgrades (22) among Korean companies.

A similar trend was observed in the outlooks released by Korea Ratings. As of the end of June, there were 23 cases of negative outlooks or watchlist downgrades, while positive outlooks numbered only 14. Jung Seungjae, a research fellow at Korea Ratings, stated, "The dominance of negative trends continues," adding, "Although the number of negative outlooks has decreased compared to the end of last year due to a large number of downgrades (32 cases in the first half), the situation has worsened in the financial sector."

International credit rating agency S&P Global Ratings also pointed out at a briefing the previous day that the credit outlook for major Korean companies has deteriorated compared to the previous year. Among the 39 domestic companies rated by S&P, the proportion of 'negative' outlooks reached 15%, nearly double the previous year's 8%. In contrast, the proportion of 'positive' outlooks, which stood at 5% a year ago, dropped to 0% this year. This indicates that none of the major companies are expected to see their credit ratings upgraded.

Much of this concern among rating agencies stems from an unfavorable macroeconomic environment. Lee Youngkyu, a senior researcher at NICE Investors Service, warned, "The impact of tariff hikes by the Donald Trump administration in the United States is expected to become more pronounced in the second half," and added, "Global oversupply due to shrinking domestic demand in China is also continuing." While some companies are expected to attempt to restore financial stability through self-rescue efforts, these efforts are also expected to remain limited.

There was also a warning that Korean companies are facing four major structural changes: tariffs imposed by the United States, slowing demand for electric vehicle transitions, oversupply from China, and rapid growth in artificial intelligence (AI). Park Junhong, a managing director at S&P Global Ratings, said these structural changes are weighing on the credit outlook of domestic companies and predicted that many sectors will face profitability pressures over the next one to two years.

By sector, downward rating pressure is expected to continue in the second half, especially for petrochemicals and secondary batteries, which were hit hard in the first half. Domestic rating agencies have already downgraded the credit ratings of major petrochemical and secondary battery companies such as Lotte Chemical and LG Chem. The construction industry is also a concern, as the unfavorable business environment continues to pose risks related to refinancing and materialization of contingent liabilities from project financing (PF).

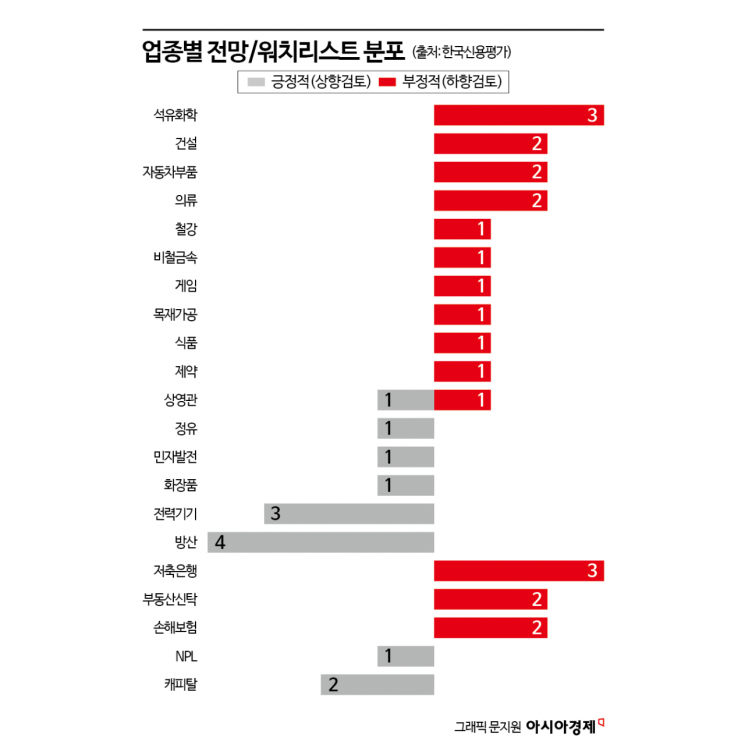

According to NICE Investors Service, as of the end of June, seven petrochemical companies, four construction companies, and three secondary battery companies were on the negative outlook list. Korea Ratings also identified negative outlooks for petrochemicals (3 cases), construction (2 cases), savings banks (3 cases), and real estate trusts (2 cases). These companies are candidates for potential downgrades within a few months if their current financial structures do not improve amid sluggish business conditions.

On the other hand, shipbuilding, electric power equipment, and the defense industry are expected to benefit from favorable external conditions. In the defense sector, where strong demand for defense equipment is anticipated, five companies received positive or upgrade review outlooks from NICE Investors Service, and four from Korea Ratings. Korea Investors Service also gave a positive outlook for shipbuilding and defense in its sectoral outlook treemap for the second half, while maintaining a negative view on construction, petrochemicals, and secondary batteries.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)