The industry expects as early as July, while supervisory authorities plan to announce in the second half of the year

One year since the TMep incident... National Assembly bill pending, discussions underway to fill administrative gaps

Grace period being coordinated after administrative guidance... Industry says "at least six months are needed"

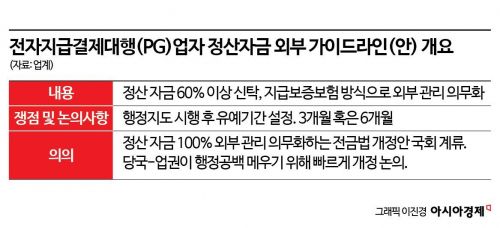

Financial supervisory authorities and the payment gateway (PG) industry are accelerating final discussions ahead of the introduction of new regulations on the outsourcing of settlement funds. The supervisory authorities are preparing a system that will require PG operators to entrust at least 60% of their settlement funds to external institutions, such as through trusts or payment guarantee insurance. This system is expected to be announced no later than the second half of the year. Taking into account the time needed for PG operators to expand their settlement fund management systems, the authorities are coordinating with the industry on whether to set a grace period of three months or six months after the administrative guidance is implemented.

According to the supervisory authorities and the PG industry on July 3, the Financial Supervisory Service is coordinating the grace period to be applied after the implementation of administrative guidance for the "PG Settlement Fund External Management Guidelines." The core of the guidelines is to require PG operators to have at least 60% of their settlement funds managed by external institutions. According to the "2024 Electronic Financial Business Performance" report released by the Financial Supervisory Service at the end of May, the PG industry’s outstanding settlement funds amount to 9.9 trillion won, of which 60% (5.94 trillion won) must be entrusted to external institutions.

Settlement funds are customer money temporarily held by PG companies. When a customer makes a purchase and payment online, the PG company holds the funds for at least two days before deducting fees and transferring the money to the merchant. PG companies are required to transfer the funds to merchants within the settlement period, but if they fail to secure sufficient funds in the interim, the risk of settlement defaults increases.

Kang Min-guk, a member of the National Assembly’s Political Affairs Committee from the People Power Party, has proposed an amendment to the Electronic Financial Transactions Act that would require 100% of PG settlement funds to be managed separately by external institutions. However, this amendment has been pending for nearly a year. As it has now been a year since the large-scale settlement default incident involving TMON and Wemakeprice?known as the "TMep incident"?both the authorities and the industry agree that regulations to strengthen internal controls should be established as soon as possible. In particular, PG operators have reportedly requested the authorities to issue regulations even in the form of administrative guidance to reduce business uncertainty.

PG operators expect that the supervisory authorities may issue administrative guidance to the industry as early as mid-July. However, the authorities are more cautious than the industry. They have stated that the announcement will be made no later than the second half of the year. The main point of contention is the length of the grace period after the administrative guidance is issued. To smoothly entrust PG operators’ funds to external management, settlement systems at the level of those used by banks are required. It is essential to build related systems to verify daily settlement balances and calculate the required ratio for the next business day.

It has been reported that the authorities have proposed a three-month grace period to the industry, starting immediately after the implementation of administrative guidance. If, as the industry expects, the administrative guidance is issued in mid-July, PG operators would need to complete the expansion of their settlement systems and sign contracts with external institutions such as trust companies or insurance companies by mid-October.

The industry argues that three months is too short and has requested the authorities to extend the grace period to six months. An industry official stated, "I understand that the Financial Supervisory Service has almost completed guidelines that reflect much of the industry’s feedback, and that the guidelines will soon be submitted to the Administrative Guidance Review Committee for approval before being distributed to the industry. Given the large scale of settlement balances, guarantee insurance companies are also burdened, and there are limits to trust products, so the authorities should provide at least a six-month grace period."

An official from the Financial Supervisory Service said, "No decision has been made yet on whether the grace period will be three months or six months." The official added, "Considering that it took three years for the legislative amendment to pass after the large-scale settlement default incident known as the 'Merge Point incident,' which occurred before the TMep incident, both the authorities and the industry agree that follow-up measures after the TMep incident must be implemented more quickly. That is why discussions are being accelerated."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)