Global Auto Industry on Edge as China Sorts Out Its EV Sector

Signal of Market Restructuring in China’s EV Industry

Fewer Than 10 Out of 100 Chinese EV Firms Likely to Survive

Leading Players: BYD, Huawei, Xiaomi Take Center Stage

Surviving Chinese EV Giants Poised to Dominate Overseas Markets

Global EV Industry Braces for Fiercer Cost Competition

In China, the government is in the midst of a large-scale effort to distinguish between competitive and non-competitive electric vehicle (EV) companies. The goal is to ensure that only the most competitive companies survive, thereby strengthening the overall competitiveness of the EV sector. As a result, there is a prevailing view that once the restructuring of the EV market is complete, BYD, the market leader in terms of share, will see its global competitiveness further enhanced. If the domestic market is effectively reorganized into a winner-takes-all structure, BYD is expected to accelerate its overseas expansion, backed by concentrated support from the Chinese government. This could also lead to an aggressive expansion in the Korean market, which the company entered this year. This is why global automakers, including Hyundai Motor and Kia, are closely monitoring the changes taking place in the Chinese market.

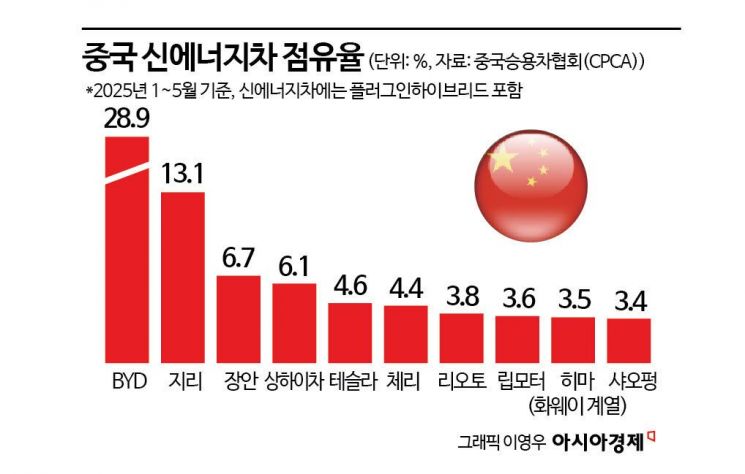

According to industry sources on July 3, there are currently around 100 Chinese EV companies that are actually continuing to produce and sell vehicles in China. This number has already been reduced from about 500 in 2018 after one round of restructuring. Among these, only three companies?BYD, Li Auto, and Seres?are operating profitably. The top 10 companies control 80% of the Chinese EV market share, while the remaining 90 or so companies are barely surviving thanks to support from local governments.

The industry believes that the restructuring of the Chinese EV market has begun in line with the typical industrial policy cycle of the Chinese government. China has implemented similar policy strategies in most industries, such as solar power, LCDs, and batteries. In the early stages of a market, the government lowers entry barriers through national subsidies and policy support, encourages excessive competition, and then ensures that only a handful of dominant companies survive. Thereafter, the government provides concentrated support to these select companies, helping them expand into global markets.

Top 3 Chinese EV Companies with High Survival Potential

Among these, BYD, Huawei, and Xiaomi are considered the companies most likely to survive the ongoing industrial restructuring. As the market leader, BYD boasts unrivaled cost competitiveness and advanced EV technology. With annual sales exceeding 4 million units in China alone, BYD has achieved economies of scale, enabling it to lower component costs. The company also maintains a high degree of in-house production for key parts, resulting in a stable supply chain. In addition, BYD enjoys strong brand trust in China, thanks to its leading battery technology?an essential element for EV platforms.

Huawei and Xiaomi are also seen as strong contenders for future market leadership. Leveraging their ICT capabilities, both companies are building operating systems (OS) that connect smartphones, tablets, home appliances, and vehicles, enabling the creation of new ecosystems. As the transition to software-defined vehicles (SDVs) accelerates, EVs are becoming "smartphones on wheels." In this context, ICT technological capabilities that seamlessly link users' daily lives across devices become increasingly important. Huawei supplies autonomous driving platforms and in-vehicle OS to various manufacturers, while Xiaomi has launched complete vehicles integrated with its own smartphones.

Surviving Chinese EV Giants Set to Dominate Overseas Markets

Once the selection process for competitive EV companies is complete, global automakers such as Hyundai Motor are expected to face a crisis. This is because they will have to compete with a select group of highly competitive Chinese companies that have survived fierce competition in the domestic market. Chinese companies are already leveraging their price competitiveness to aggressively expand their market share in Europe, South America, ASEAN, and other global markets.

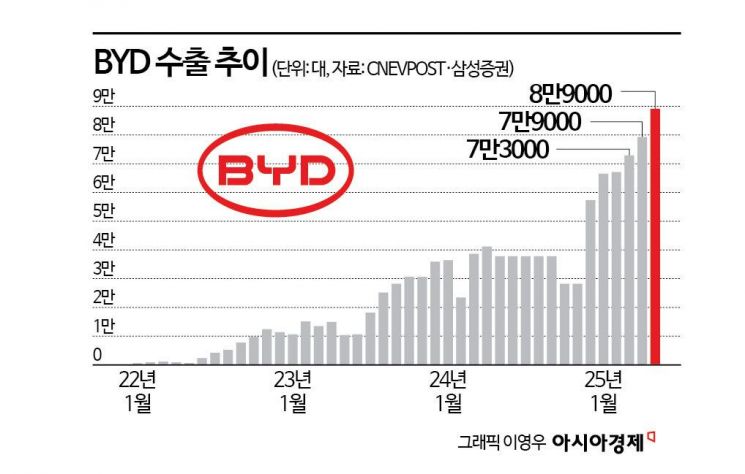

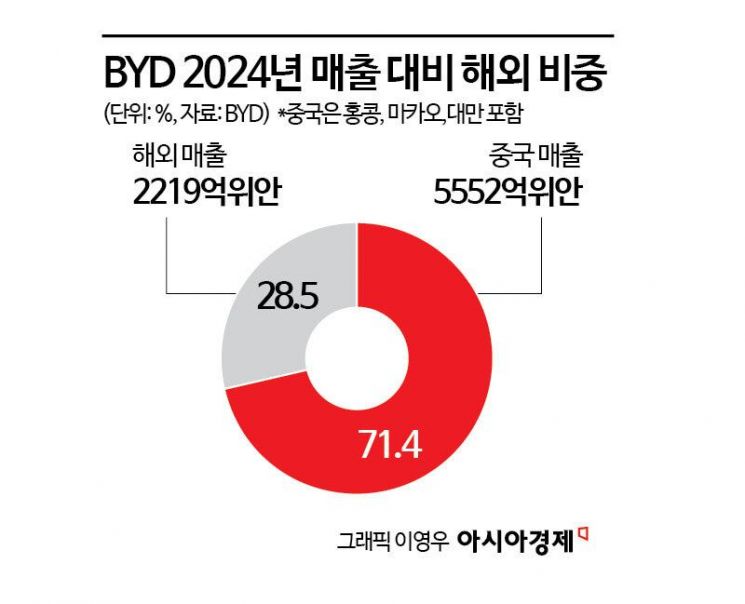

From January to May this year, BYD set a record with exports of 350,000 units, reaching 85% of last year's record export volume of 410,000 units in just five months. BYD is either building or considering factories in more than eight countries worldwide, including Europe (Hungary, Turkey, and other candidate countries), Southeast Asia (Thailand, Indonesia), South America (Brazil), Central Asia (Uzbekistan), and South Asia (Pakistan). Dongdong Yun, BYD's Brand Strategy Manager for the Asia-Pacific region, stated, "Local production will allow us to secure profitability by reducing tariffs and transportation costs," adding, "We will actively integrate into local industrial ecosystems through collaboration with local companies and job creation."

As of February this year, Chinese companies had expanded their share of the European EV market to 16.8%. Despite the European Union imposing countervailing duties of up to 45.3% on Chinese EVs since November last year, Chinese companies have continued to increase their market share in Europe. The growth of Chinese EVs in South America and ASEAN markets is also remarkable. According to the Brazilian Electric Vehicle Association (ABVE), BYD held a 43% share of Brazil's eco-friendly vehicle market (including EVs and hybrids) last year, ranking first. In contrast, Hyundai Motor and Kia's combined market share during the same period was around 1%.

Emerging markets that still lack sufficient EV charging infrastructure currently have a negligible share of EVs in terms of scale. However, considering their population size and growth potential, industry experts agree that companies that secure an early foothold in these markets will enjoy significant benefits as the transition to eco-friendly vehicles accelerates. An official from a global automaker emphasized, "The emergence of 'Chinese EV giants' with price and technological competitiveness, driven by government-led restructuring, is the scenario our industry fears the most," adding, "To compete with them in emerging markets, Korean companies must make every effort to develop cost-reduction strategies through innovative technologies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.