Exports to the US and China Decline Due to Trump Tariffs

Saudi Arabia, Taiwan, and Others See Over 10% Growth

"Export Shift Toward Third Countries Expected to Continue"

The "Trump-triggered" tariff policy is reshaping the export landscape for domestic small and medium-sized enterprises (SMEs). While trade volumes with the United States and China?previously the main export destinations?have declined, countries such as Saudi Arabia, Taiwan, and Poland are emerging as new export markets. Experts predict that this trend will likely continue for some time, as the trade war initiated by the US and China is restructuring global supply chains.

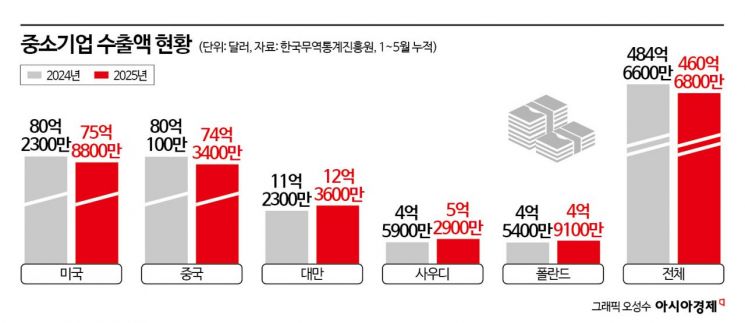

According to trade statistics from the Korea Trade Statistics Promotion Institute as of July 2, domestic SMEs exported $7.588 billion to the United States between January and May this year, down 5.42% from $8.023 billion during the same period last year. Since April, the Trump administration has imposed high tariffs on automobiles, steel, and aluminum, which has directly impacted domestic SMEs that export parts and intermediate goods to the US.

The decline in exports to China was even more pronounced. During the same period, exports to China fell by more than 7%, dropping from $8.001 billion to $7.434 billion. An industry insider explained, "The situation in China is much more complicated due to a combination of weakened consumer sentiment and high US tariffs," adding, "This has resulted in a contraction of trade for domestic SMEs that used to export parts, materials, and intermediate goods to China as a way to indirectly export to the US."

Notably, countries that previously accounted for a small share of exports are gradually emerging as new export markets. During the same period, exports to Saudi Arabia rose 15.25% year-on-year to $529 million, while exports to Taiwan increased 10.06% from $1.123 billion to $1.236 billion. Exports to Poland (up 8.14%) and Cambodia (up 5.0%) also saw significant increases compared to previous years. As a result, despite sluggish trade with key export destinations, the total export value of SMEs only declined by 4.94%, from 48.5 billion won to 46.1 billion won.

Experts attribute this to the proactive export diversification strategies adopted by domestic SMEs amid an uncertain trade environment. Not only have advanced industries such as artificial intelligence (AI) and bio-health expanded into new markets, but traditional mainstays like semiconductors, steel, and cosmetics have also been partially redirected. Yang Ji-won, senior researcher at the International Trade and Commerce Institute, stated, "Semiconductor exports to Taiwan have increased as cooperation between domestic companies such as SK Hynix and Taiwan's TSMC has strengthened, while demand for defense products in Poland has risen due to the Russia-Ukraine war. Demand for cosmetics, which had been concentrated in China and the US, has also become more diversified." He added, "Given that global trade uncertainty based on protectionism is expected to persist, the trend of exports shifting toward third countries is likely to intensify for the foreseeable future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)