Statement Submitted to USTR

Nine Countries Including South Korea, Australia, and Canada

Designated as Unfair Trading Partners, Corrective Action Demanded

"South Korea's Complex and Stringent Evaluation Procedures

and Intentional Price Suppression Practices

Result in the Lowest Budget Allocation for New Drugs Among OECD Countries," Industry Claims

The U.S. pharmaceutical industry has urged the Donald Trump administration to use trade negotiations with South Korea as leverage to demand improvements in drug pricing policies. The industry claims that the Korean government has artificially lowered the prices of U.S. pharmaceuticals, thereby "free-riding" on the innovation and development of new drugs by American pharmaceutical companies.

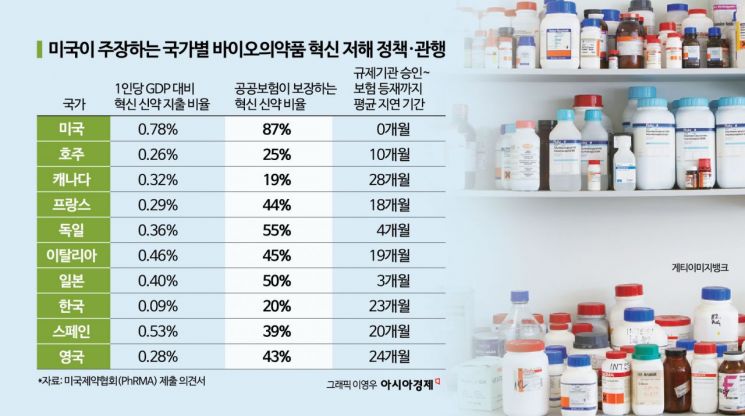

On June 27 (local time), the Pharmaceutical Research and Manufacturers of America (PhRMA) submitted a statement to the United States Trade Representative (USTR), designating nine countries?including South Korea, Australia, Canada, France, Germany, Italy, Japan, Spain, the United Kingdom, and the European Union (EU)?as unfair trading partners due to their high spending on innovative new drugs, and called for corrective measures.

Kevin Henninger, Vice President of PhRMA, highlighted in the statement that the main issues are ▲ the way each country regulates public drug prices and ▲ delays in applying public insurance. He emphasized that "these countries are enjoying the benefits of U.S. biopharmaceutical innovation without bearing the corresponding costs."

Regarding South Korea, he pointed out that "due to the complex and stringent evaluation procedures of the Health Insurance Review and Assessment Service (HIRA) and the National Health Insurance Service (NHIS), pharmaceutical companies experience significant delays before patients can access new drugs." He further stated, "The monetary threshold for one year of life extension was set in 2007 based on Korea's per capita GDP at the time, but despite GDP having more than doubled since then, it has not been updated." He argued that such intentional price suppression practices have resulted in South Korea having the lowest budget allocation for new drugs among high-income OECD countries.

The reason the pharmaceutical industry has spoken out publicly is due to the Trump administration's dual policy. While cracking down on the notoriously high drug prices in the U.S., the administration has also offered a "carrot" by pressuring foreign governments to lower their unfair drug pricing policies.

In fact, President Trump has previously argued that "U.S. pharmaceutical companies bear enormous R&D costs in the development of new drugs, but since these drugs are sold cheaply abroad, the U.S. ends up subsidizing other countries' drug prices." On June 12, he issued an executive order directing the USTR and the Department of Commerce to prevent foreign governments from artificially setting domestic drug prices below market value, which blocks drug price increases in the U.S.

This latest statement is also part of the USTR's investigation into unfair foreign drug pricing policies. As of June 30, a total of 58 statements had been submitted on the USTR website. AbbVie, which owns various innovative new drugs such as the autoimmune disease treatment Humira and psoriasis treatments, specifically identified South Korea as a problem country in its own statement. The company argued that "the non-transparent methods for determining drug prices and reimbursement undermine the value of innovation," and separately urged the USTR to require the Korean government to improve its pharmaceutical value assessment system by the end of 2026. AbbVie also claimed that the way South Korea operates its patent term extension system for biosimilars and other drugs does not align with the intent of the Korea-U.S. Free Trade Agreement (FTA) signed in 2012.

The U.S. Chamber of Commerce, the largest business organization in the country, criticized South Korea for setting drug prices excessively low compared to other developed countries, stating that this prevents U.S. pharmaceutical and biotech companies from receiving fair compensation for new drugs. The National Association of Manufacturers (NAM) argued that ongoing trade negotiations should be used as leverage to ensure that foreign countries protect the intellectual property rights of U.S. companies and adopt fair policies. The Biotechnology Innovation Organization (BIO) also criticized South Korea's drug pricing system for undermining the competitiveness and sustainability of U.S. manufacturers.

However, from South Korea's perspective, there are aspects that may seem unfair. In the domestic drug pricing process, if a foreign pharmaceutical product is to be covered by health insurance, the process involves: the pharmaceutical company's application for new drug reimbursement, review by the Drug Reimbursement Evaluation Committee of the Health Insurance Review and Assessment Service, and, if approved, price negotiations between the National Health Insurance Service and the pharmaceutical company. The final decision is made by the Health Insurance Policy Deliberation Committee, the highest decision-making body for health insurance policy. In reality, there is only one round of price negotiation.

Meanwhile, PhRMA has clearly expressed its opposition to the introduction of the "Most Favored Nation (MFN) pricing system," which would apply the lowest foreign price to U.S. drugs in order to reduce domestic drug costs. The organization warned that such a policy could discourage investment and the development of new drugs.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)