It has been found that companies in the European Union (EU) are utilizing ESG (Environmental, Social, and Governance) disclosures not just to comply with regulations, but as a core foundation for decision-making aimed at sustainable management.

On July 1, Samil PwC's report "2025 Status of EU Companies' Corporate Sustainability Reporting Directive (CSRD) Reporting" stated, "As EU companies begin to fully implement sustainability disclosures, they are providing strategic implications for Korean companies."

This report is based on an analysis by PricewaterhouseCoopers (PwC), a global accounting and consulting group, which used artificial intelligence (AI)-based analytical tools and internal expert reviews to examine the reports of 250 EU companies. More than 70% of the analyzed companies are located in five European countries, including Germany, Spain, and the Netherlands. Among them, some companies voluntarily published reports even though CSRD has not yet been transposed into domestic law in their respective countries.

Previously, the EU finalized the CSRD in 2023 and began full-scale implementation this year. The report evaluated that "sustainability reporting has become established as a strategic decision-making tool for companies, going beyond mere regulatory compliance." However, it pointed out that there are clear differences in reporting levels among companies in the early stages of the system's introduction, and that many companies are currently in a transitional period as they adapt to the new reporting framework.

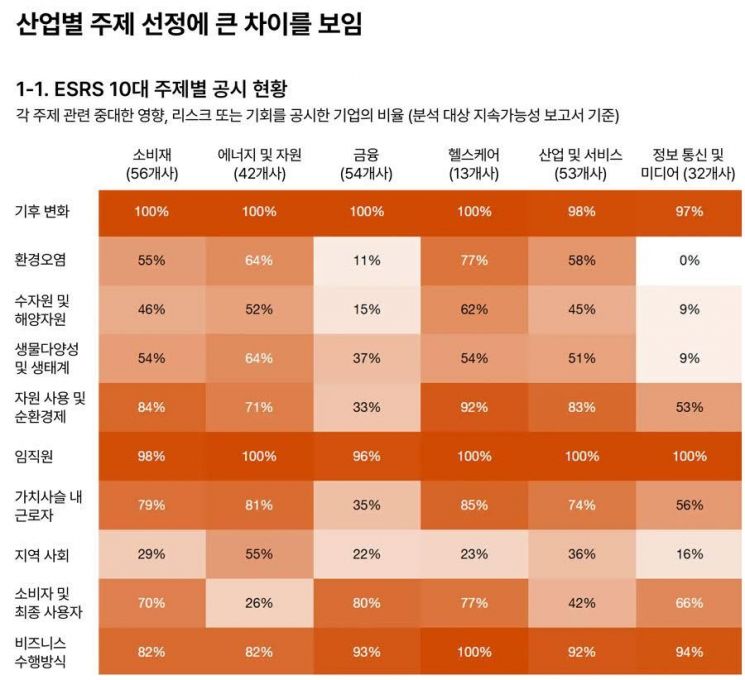

While there were clear differences in disclosure topics by industry, climate change, employees, and business operations were identified as core topics commonly addressed by most companies. In particular, only 2 out of the 250 companies analyzed had no disclosures related to climate change at all.

Most companies disclosed the impact of sustainability issues on financial performance from a risk-centered perspective, in accordance with CSRD standards. This tendency was especially pronounced in areas related to climate change and energy transition. On the other hand, some companies identified and disclosed new opportunities arising from climate action, shifts in social perceptions, and the adoption of new technologies. However, there were also cases among large companies where opportunities were not mentioned at all.

Companies reported negative impacts on people and the environment across the value chain more frequently than positive impacts, with the financial industry being the only sector where positive impact disclosures were more prevalent. Many companies did not clearly link these social and environmental impacts to financial performance. The report advised, "Companies need to move beyond simple identification of impacts and clearly define how these issues function as financial risks or opportunities, in order to reduce the dual reporting burden under CSRD."

Korean companies are expected to benefit practically by referencing the highly developed ESG disclosure cases of EU companies to enhance their own ESG strategies and disclosure standards. The report presented three key tasks for Korean companies to address: proactive preparation for disclosure, strategic utilization of sustainability reports, and the establishment of customized disclosure systems that reflect industry characteristics and strategies.

The report emphasized, "Sustainability reports should be leveraged as strategic assets, not merely as disclosure tools," and added, "Reporting data can be utilized for a variety of decision-making purposes, including product development, energy efficiency, supply chain restructuring, and tax strategy. Such strategic use is expected to expand even further in the future."

Steven Kang, Sustainability Platform Leader at Samil PwC, stated, "The EU is strategically adjusting existing regulations to encourage companies to focus on sustainability based on core values," and added, "Now is the time to focus on the direction rather than the speed of regulation. Companies should seize this as an opportunity to establish sustainable business models."

He further noted, "EU companies are already integrating sustainability into their management strategies," and emphasized, "Korean companies should also refer to these practices to develop strategies tailored to their own circumstances."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)