Petrochemical and Oil Downturn Spurs New Business Entry

Controversy Over 320 Billion Won Raised Through Exchangeable Bonds

Speculation Grows Over Possible Return of Former Chairman Lee Hojin

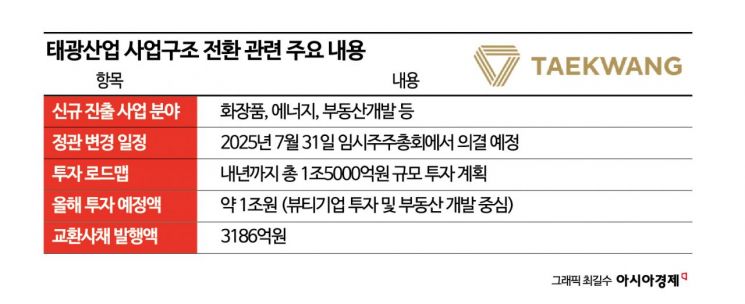

Taekwang Industrial has prepared a proposal to amend its articles of incorporation to include new business areas such as cosmetics manufacturing and sales, energy-related businesses, real estate development, hotel and resort development and operation, investment in REITs and project finance vehicles (PFVs), and blockchain-based financial industries. The company plans to put this proposal to a vote at an extraordinary shareholders' meeting on the 31st. A company representative explained, "This decision stems from a sense of crisis that survival will be difficult without a comprehensive overhaul, given the structural stagnation of our existing core businesses in petrochemicals and textiles."

Taekwang Industrial plans to execute about 1 trillion won of the total 1.5 trillion won investment this year. The main investment areas include beauty, renewable energy, and real estate development. In the beauty sector, it is reported that a subsidiary has already submitted a letter of intent (LOI) to acquire Aekyung Industrial and is currently included on the shortlist of final bidders.

Most of the investment funds are expected to come from external sources. While Taekwang holds about 1.9 trillion won in cash-equivalent assets, more than 500 billion won in investment is needed for its existing petrochemical and textile divisions. The company also needs to maintain 560 billion won in reserve operating funds, equivalent to 3.5 months of expenses, to prepare for further market deterioration. With the shutdown of its second petrochemical plant and low-melting fiber (LMF) plant, significant funds will also be required for facility dismantling and workforce redeployment. As a result, the actual surplus funds available for new businesses are estimated to be less than 1 trillion won.

To cover the shortfall in investment funds, Taekwang Industrial held a board meeting late last month and resolved to issue exchangeable bonds worth about 320 billion won. The exchangeable bonds will be backed by 271,769 treasury shares, representing 24.4% of the total shares. The company plans to issue the exchangeable bonds next month and use the proceeds for business restructuring.

However, some in the market have criticized the issuance of exchangeable bonds as an attempt to avoid canceling treasury shares. A company official stated, "While it is important to reflect the current government's policy by canceling treasury shares and thereby increasing stock value, now is the time to secure survival through active investment and business restructuring," adding, "Securing investment funds through the issuance of exchangeable bonds is an essential measure to ensure the company's existence and job stability for employees."

Some observers cautiously suggest that this round of fundraising and business transformation may be linked to the potential return of former chairman Lee Ho-jin, the largest shareholder, to management. Lee currently holds about 30% of Taekwang Industrial's shares. However, the company stated, "Mr. Lee currently serves only as an advisor in an unregistered executive capacity and has not directly instructed or led the issuance of exchangeable bonds or the business strategy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)