Construction Starts and Sales Plummet in First Half, Building Materials Industry Faces Profitability Decline

Lee Jaemyung Administration Lacks Supply Measures in First Real Estate Policy

"Exports Have Limits... Waiting Only for Domestic Market Recovery"

As housing supply indicators show little sign of recovery, the outlook for downstream construction industries is becoming increasingly bleak. Building materials companies are struggling to defend their earnings in hopes of a construction market rebound, but their performance forecasts have darkened. Given the industry's structural difficulty in finding new opportunities through exports, the market is closely watching for government responses such as policy-driven orders or an expansion of supply.

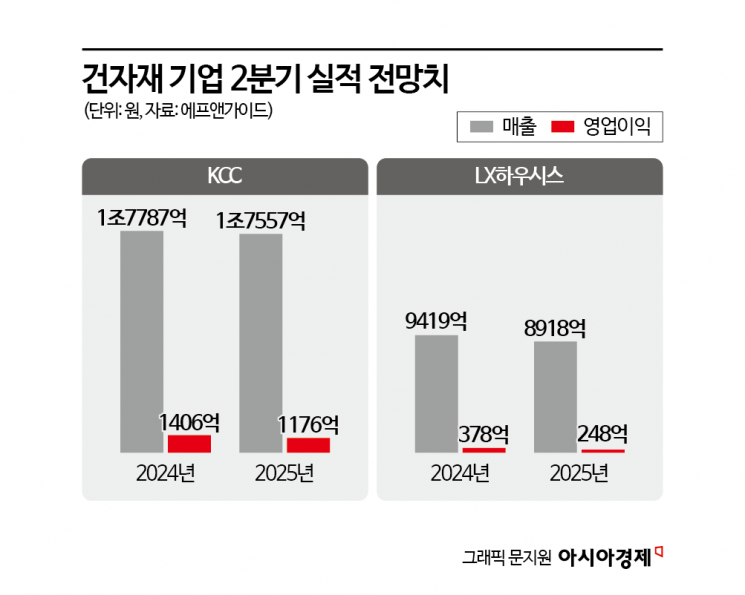

According to FnGuide on July 1, consensus forecasts for the second-quarter earnings of major domestic building materials companies have worsened compared to the same period last year. KCC's second-quarter sales are projected to reach 1.7557 trillion won, down 1.29% year-on-year, while LX Hausys is expected to record sales of 891.8 billion won, a 5.32% decrease. Both companies are also expected to see a decline in profitability, with operating profit anticipated to fall by 16.4% and 34.4%, respectively.

The root cause of the poor performance is the prolonged slump in the construction market. According to housing statistics for May recently released by the Ministry of Land, Infrastructure and Transport, the number of nationwide housing permits issued from January to May this year was 110,438 units, a 12.3% decrease compared to the same period last year. The number of housing starts dropped by 30.3% to 74,276 units, while the number of units offered for sale fell by 41.7% to 52,982 units. In particular, products such as windows, glass, and flooring are mainly supplied at the final stages of construction, so the contraction in these supply indicators is bound to have a delayed negative impact on future performance.

An industry insider commented, "The construction downturn won't last forever, but for now, the consensus in the industry is that we have to endure this difficult period. Since building materials are supplied after construction starts, the period of endurance could be prolonged."

Some companies are seeking breakthroughs by expanding into new businesses or increasing exports. KCC is focusing on its silicone and industrial paint businesses, LX Hausys on industrial films, and Dongwha Enterprise on electrolyte solutions for secondary batteries. However, the proportion of construction materials remains high, and due to the nature of these products, high transportation costs limit export competitiveness. As a result, there are growing calls that a recovery in domestic demand is the only viable solution.

The industry's attention is focused on the government's real estate supply policy. The government is currently concentrating on curbing demand, such as by completely banning mortgage loans for homes priced over 600 million won, but concrete measures to expand supply remain absent. President Lee Jaemyung has emphasized the need to increase supply to stabilize housing prices since before the presidential election, but even the appointment of the Minister of Land, Infrastructure and Transport, the key control tower, has been delayed. With no clear measures in place, the industry is pinning its hopes more on the policy direction and market trends in the second half of the year than on immediate results.

Another industry insider said, "There are no clear positive factors in the second half, but as projects that were suspended in the first half resume, there is a possibility that the situation could improve. Even if the indicators do not rebound immediately, the industry sentiment is expected to be better than in the first half."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)