All Industry Production Down 1.1% for Second Consecutive Month

Mining and Manufacturing (-2.9%) and Construction (-3.9%) Drive Decline

Facility Investment and Construction Performance Continue to Worsen

Consumption Remains Flat... Positive Sentiment Factors for June

Government Expects "Rapid Impact from Second Supplementary Budget"

Full Efforts to Address Trade Risks Including U.S. Tariffs

Sluggish domestic demand has impacted overall industrial activity, resulting in declines in both total industrial production and investment last month. Retail sales, which reflect consumption, remained flat but continued to show signs of weakness. The Composite Index of Business Indicators, which provides insight into current economic conditions and future outlook, also turned to a decline for both the coincident and leading indices for the first time in four months. The government has announced plans to focus on revitalizing domestic demand and supporting livelihoods through the swift execution of an additional supplementary budget.

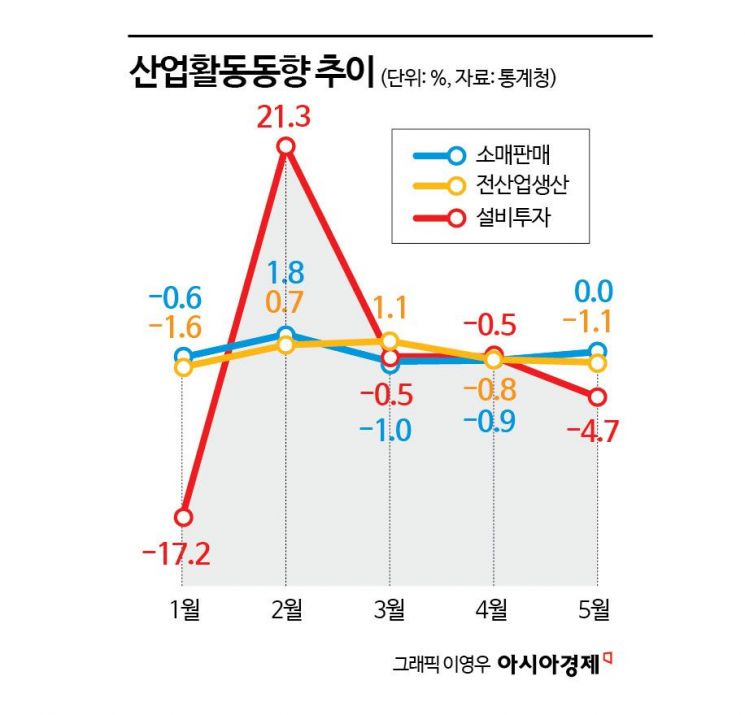

According to the "May 2025 Industrial Activity Trends" released by Statistics Korea on the 30th, total industrial production last month fell by 1.1% compared to the previous month. After a decline in January (-1.6%), there had been signs of improvement in February (0.7%) and March (1.1%), but from April (-0.8%) the sector has now recorded two consecutive months of negative growth. This marks the longest period of decline since the three-month streak from May to July last year. Compared to the same month last year, total industrial production in May also decreased by 0.8%.

While production in public administration increased by 0.8%, declines in mining and manufacturing (-2.9%), as well as construction (-3.9%) and services (-0.1%), contributed to the overall decrease. In particular, the mining and manufacturing sector posted a second consecutive monthly decline, mainly due to adjustments in pharmaceuticals (-10.4%) and semiconductors (-2.0%), both of which had seen significant increases in production the previous month. Weakness in upstream industries such as automobiles and construction also led to a sharp drop in metal processing (-6.9%).

The government explained that, although the impact of U.S. tariffs is an underlying factor, it is still difficult to confirm any clear effects in the data. It also assessed that sluggish domestic demand likely played a larger role in the disappointing industrial activity indicators. Cho Seongjung, Director of Economic Analysis at the Ministry of Economy and Finance, stated, "The main contributors to the negative growth in total industrial production were mining and manufacturing, and construction. The decline in construction was due to weak domestic demand, and the reduction in mining and manufacturing output was also largely attributable to sluggish domestic demand."

Investment indicators continued to worsen. Facility investment fell by 4.7% last month, marking a third consecutive month of decline. The drop was steeper than in March and April (-0.5%). Although investment in transportation equipment increased by 0.1%, investment in machinery, including semiconductor manufacturing equipment, declined sharply by 6.9%. Construction completed decreased by 3.9%, as both building construction (-4.6%) and civil engineering (-2.0%) saw reduced performance. This was a larger drop than the previous month (-1.4%).

Retail sales, which provide insight into consumption trends, remained flat (0.0%). While this was an improvement over March (-1.0%) and April (-0.9%), it still indicates that weak domestic demand persists. Sales of durable goods (1.2%) and semi-durable goods (0.7%) increased, but sales of non-durable goods such as cosmetics, which have a shorter consumption period, declined by 0.7%. Compared to the same month last year, retail sales continued to decrease for a second consecutive month, following a 0.1% drop in April and a 0.2% decrease in May.

The current economic trend and outlook also remain unfavorable. The cyclical component of the coincident composite index declined by 0.4 points to 98.5 last month. After falling in January (-0.4 points), the index had risen for three consecutive months starting in February (0.1 points), but dropped again after four months. Although there had been signs of economic recovery recently, growing domestic and external uncertainties have taken a toll. The cyclical component of the leading composite index also fell by 0.1 points to 100.9, marking its first decline in four months since January (-0.4 points).

There are some positive factors, such as the Consumer Sentiment Index (CSI) for this month, which stood at 108.7, remaining above 100 for a second consecutive month after 101.8 in the previous month, and exports for the period from the 1st to the 20th of this month, which increased by 8.3% compared to the previous month, an improvement over May's -1.3%. Director Cho commented, "Although the industrial activity indicators for May were not favorable, these factors could help improve conditions in June."

Going forward, the government plans to swiftly implement a second supplementary budget of 30.5 trillion won to boost domestic demand and stabilize livelihoods, while also making every effort to address trade risks such as U.S. tariff negotiations. Director Cho explained, "The first supplementary budget was focused on wildfire damage and responding to tariffs imposed by U.S. President Donald Trump, so its effects are not immediately visible." However, he predicted, "If the large-scale consumption coupons provided under the second supplementary budget are distributed, the effects will appear quickly and help improve the indicators."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)