Uncertainty in Export Conditions Expected to Continue in Q3

EBSI Remains Below Baseline for Third Consecutive Quarter

Uncertainty stemming from the trade policies of the Trump administration in the United States, combined with a global economic slowdown, is expected to slightly dampen business sentiment among Korean export companies in the third quarter of this year.

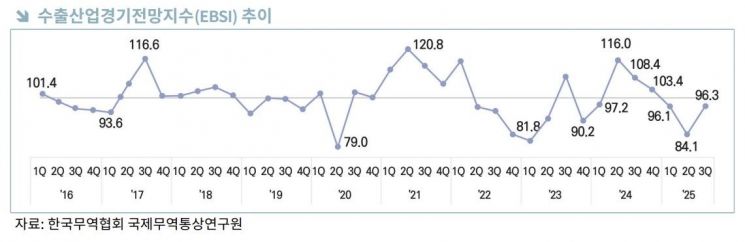

The Korea International Trade Association (KITA) Institute for International Trade and Commerce announced on the 30th that the Export Business Survey Index (EBSI) for the third quarter of 2025 stood at 96.3, according to its newly released report. This marks the third consecutive quarter that the EBSI has remained below the baseline of 100, indicating that export conditions are expected to weaken somewhat compared to the previous quarter. The EBSI is an index that surveys and analyzes the outlook of domestic export companies regarding export conditions for the following quarter. A value above 100 indicates an expected improvement over the previous quarter, while a value below 100 signals a deterioration.

By product category, export conditions for 10 out of the 15 major items are projected to worsen compared to the previous quarter. In particular, home appliances (52.7) remained in the 50-point range for the third consecutive quarter. This is interpreted as a result of the United States adding home appliances to the list of steel derivative products subject to product-specific tariffs on June 23, applying a '50% ad valorem tariff.' The economic slowdown in major export markets for home appliances, such as North America and the European Union (EU), also appears to be a contributing factor. The outlook for automobiles and auto parts (56.0), which were already subject to tariffs, also worsened due to the impact of these tariffs.

On the other hand, semiconductors (147.1) showed an improved outlook, driven by rising demand for high-performance artificial intelligence (AI) chips and an expected increase in DRAM prices in the third quarter. In addition, shipbuilding (135.5) is projected to remain strong, supported by expanded exports of high-value-added vessels such as LNG carriers and higher export prices.

By category, 8 out of 10 items recorded values below 100, including ▲import regulations and trade friction (67.1), ▲international logistics (86.8), and ▲economic conditions in export destinations (87.3). In the case of import regulations and trade friction, the index rose slightly to 67.1 in the third quarter from 45.4 in the second quarter, reflecting expectations for progress in tariff negotiations.

In particular, sectors already subject to 'targeted tariffs' such as ▲home appliances (6.4) and ▲automobiles and auto parts (50.0) showed significant concern, and a similar trend was observed in semiconductors (51.6), where the possibility of additional tariffs has been raised.

As for export obstacles (based on multiple responses), the most frequently cited factor was 'economic downturn in export destinations (15.0%)', as global economic growth rates are slowing more than previously forecast. This was followed by ▲increased exchange rate volatility (14.7%), ▲rising raw material prices (14.2%), and ▲import regulations in export destinations (12.7%).

Yang Ji-won, a senior researcher at KITA, stated, "Following the launch of Trump's second term, global uncertainty has increased and the economic slowdown in major countries has coincided, causing business sentiment among our export companies to freeze." He emphasized, "Not only items directly affected by tariffs, such as home appliances and automobiles, but also strategic items like semiconductors are facing growing uncertainty, making proactive measures and efforts to diversify markets more urgent than ever."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)