Runaway Seoul Apartment Prices Continue

Potential Buyers' Loan Capacity Expected to Drop Significantly

Uncertain Impact on Housing Prices... Calls for Parallel Supply Measures

The government's decision to tighten control over household debt is largely due to the recent sharp surge in Seoul apartment prices. As household debt, including mortgage loans, has increased rapidly and is holding back domestic demand and the overall national economy, President Lee Jaemyung has pledged to manage it in a stable manner. Real estate experts have predicted that this measure will reduce transactions and lead to price adjustments, but some have also argued that its impact on the market will be limited.

Runaway Seoul Apartment Prices

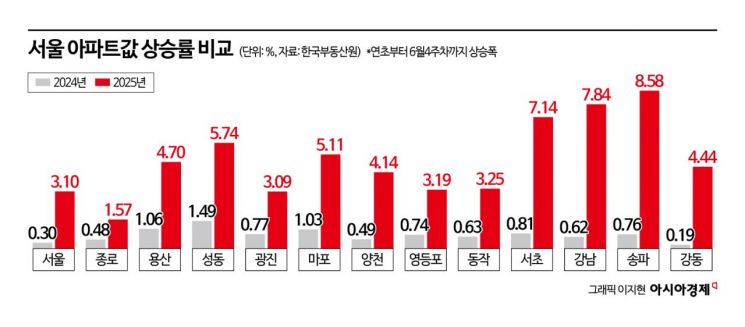

The upward trend in Seoul apartment prices has become even steeper. In March, the government broadly re-designated areas such as the three Gangnam districts as land transaction permit zones, which seemed to slow the rise temporarily, but the upward trend soon spread to surrounding areas. According to the 'Weekly Apartment Price Trends for the Fourth Week of June' announced by the Korea Real Estate Board on the 26th, Seoul apartment sales prices rose by 0.43% compared to the previous week, marking 21 consecutive weeks of increases. This figure surpasses the previous week's increase of 0.36% and is the highest weekly increase since the second week of September 2018 (0.45%).

As financial authorities are expected to strengthen household debt management for the time being, there is a steady movement among buyers to purchase homes before it becomes even more difficult. In addition, the so-called 'balloon effect' has also played a role, with buying demand spreading to highly preferred areas along the Han River, such as Mapo and Seongdong districts. Hopes that the new government will boost liquidity to stimulate the economy, as well as vague expectations and concerns that housing prices will rise under a Democratic Party administration, are further fueling the trend.

In Seoul, Seongdong District saw the largest increase among all districts, rising by a remarkable 0.99%. This is higher than the previous week's increase of 0.76%. Demand was concentrated in small and medium-sized preferred complexes in areas such as Geumho, Hawangsimni, and Haengdang-dong. Mapo District (from 0.66% to 0.98%) also saw its increase approach 1%. Both Seongdong and Mapo districts recorded their highest increases since statistics began to be compiled in May 2012.

The situation is similar in land transaction permit zones where actual residence is required. Gangnam District (from 0.75% to 0.84%), Songpa District (from 0.70% to 0.88%), Seocho District (from 0.65% to 0.77%), and Yongsan District (from 0.61% to 0.74%) all saw their increases grow compared to the previous week. The preference for a 'smart single property' has become more pronounced due to heavier taxes on multiple homeowners, making it difficult to distinguish between end-user and investment demand. The Korea Real Estate Board analyzed, "There is active buyer inquiry, especially in complexes undergoing redevelopment and large complexes, with sellers setting high asking prices, leading to continued upward transactions."

Possibility That Even 'Smart Single Property' Upgrading Demand Will Be Blocked

As a result of this measure, the loan capacity of potential buyers is expected to decrease significantly. In the entire Seoul metropolitan area, including the three Gangnam districts, those who own two or more homes will not be able to get loans at all. Previously, loans were possible up to a loan-to-value (LTV) ratio of 30%. Since the measures are set to take effect immediately from the 28th, the market expects transactions to drop sharply.

On the 27th, apartment prices in Mapo and Seongdong districts of Seoul were announced to have risen the most sharply since related statistics began to be published in 2013. The expectation that Seoul apartment prices will continue to rise is projected to sustain the upward trend for the time being. The photo shows a view of apartment complexes in downtown Seoul from Namsan, Seoul. 2025.06.27 Photo by Dongju Yoon

On the 27th, apartment prices in Mapo and Seongdong districts of Seoul were announced to have risen the most sharply since related statistics began to be published in 2013. The expectation that Seoul apartment prices will continue to rise is projected to sustain the upward trend for the time being. The photo shows a view of apartment complexes in downtown Seoul from Namsan, Seoul. 2025.06.27 Photo by Dongju Yoon

Even genuine end-users are unlikely to escape the effects of these regulations. The LTV for first-time homebuyers has been lowered by 10 percentage points to 70%, and the limits for policy loans such as Didimdol (purchase) and Bogeumjari (jeonse) loans will be reduced by tens of millions of won, up to a maximum of 100 million won. By introducing a maximum mortgage loan limit of 600 million won, which did not exist before, it has become much more likely that only wealthy buyers who do not need loans will be able to purchase high-priced apartments in most areas of Seoul, including Gangnam. For end-users with fewer assets, this could mean losing out on investment opportunities.

Lee Changmu, professor of urban engineering at Hanyang University, said, "This is a strong regulation that can restrict both single-homeowners looking to upgrade and low-income households seeking to purchase a home. Considering the possibility of expanding regulated areas, the impact on the market will not be small. Currently, the market is centered on 'single-homeowners' who are looking to upgrade to a better property, but in a sluggish or stagnant market where transactions are low, it is difficult to sell existing homes, so this could effectively block even the demand for upgrading."

On the other hand, some believe that this measure will be ineffective in curbing rising home prices. Son Jaeyoung, professor emeritus of real estate studies at Konkuk University, said, "This measure will only hurt innocent people and its impact on the market will be limited. In the past, even when loans for homes priced over 1.5 billion won were completely banned, prices still rose. We have already seen that even stronger measures have no effect." He also responded to the government's suggestion of expanding regulated areas by saying, "It is difficult to change the overall direction of the market."

On the 27th, apartment prices in Mapo and Seongdong districts of Seoul rose at the largest rate since related statistics began to be published in 2013. It is expected that the upward trend in Seoul apartment prices will continue for the time being due to the expectation that prices will rise further. The photo shows a real transaction notice at a real estate agency in Mapo, Seoul. 2025.06.27 Photo by Dongju Yoon

On the 27th, apartment prices in Mapo and Seongdong districts of Seoul rose at the largest rate since related statistics began to be published in 2013. It is expected that the upward trend in Seoul apartment prices will continue for the time being due to the expectation that prices will rise further. The photo shows a real transaction notice at a real estate agency in Mapo, Seoul. 2025.06.27 Photo by Dongju Yoon

Housing Supply Measures Also Needed

Experts point out that, along with managing household debt, appropriate housing supply and demand management measures are also needed at this time. President Lee Jaemyung and the new administration have yet to present a concrete direction regarding real estate policy.

During the tenure of former President Yoon Sukyeol, the first real estate measures were announced about a month after Minister of Land, Infrastructure, and Transport Won Heeryong took office. At that time, the measures focused on increasing housing supply in the Seoul metropolitan area and easing regulations such as regulated areas and price caps. In the case of former President Moon Jaein, he appointed Kim Hyunmi, a former lawmaker and politician, as the first Minister of Land, Infrastructure, and Transport and declared a war on real estate speculation. There are indications that the various demand suppression measures implemented at that time actually contributed to driving up housing prices, so it is widely expected that the Lee Jaemyung administration will take a more cautious approach.

Lee Choonseok, head of the Second Economic Subcommittee of the National Policy Planning Committee, which serves as the transition committee for the new government, recently stated at a meeting, "From a mid- to long-term perspective, we will focus on establishing national policy tasks related to housing supply and residential welfare for the next five years of the administration. I do not believe that it is right to come up with short-term measures just because apartment prices have risen."

Park Wongap, senior expert at KB Kookmin Bank, explained, "With concerns about a supply cliff and the prospect of falling interest rates, the market situation is challenging. In Seoul and the metropolitan area, it is necessary to pursue a two-track strategy of expanding supply and controlling demand simultaneously."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.