Agreement Reached with G7... May Also Be Requested of Korea

Wall Street Relieved... "Provides Investment Certainty"

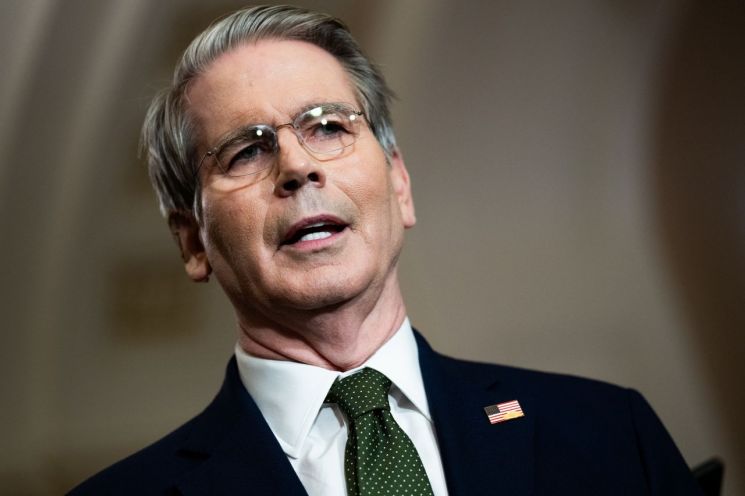

Scott Besant, U.S. Secretary of the Treasury, announced that, based on an agreement among the Group of Seven (G7) countries, the global minimum tax will not be applied to U.S. companies. Following Secretary Besant's request to Congress to remove the so-called "retaliatory tax" provision, Wall Street welcomed the move.

On this day, Secretary Besant stated via the social networking service X (formerly Twitter), "After months of productive discussions with other countries regarding the Organization for Economic Cooperation and Development (OECD) global tax agreement, we plan to announce a joint agreement among G7 countries that protects U.S. interests."

He said, "The OECD Pillar 2 tax will not be applied to U.S. companies, and we will work together in the coming weeks and months to implement this agreement across the entire OECD-G20 Inclusive Framework." He added, "Based on this progress and understanding, I have requested the Senate and House to exclude Section 899 protective measures from the 'one big, beautiful bill (the tax cut bill).' "

On the same day, House Ways and Means Committee Chairman Jason Smith and Senate Finance Committee Chairman Mike Crapo issued a statement announcing that they would withdraw Section 899 as requested by Secretary Besant.

The global minimum tax provision (Pillar 2) of the OECD global tax agreement allows for an additional tax to be levied if a multinational company with global consolidated revenue of at least 750 million euros (approximately 1.1914 trillion won) pays less than 15% in taxes abroad, making up the shortfall to 15%. This system was introduced to prevent multinational companies from avoiding taxes and to stop countries from competitively lowering their corporate tax rates. A total of 137 countries, including South Korea, agreed to adopt it, and the United States also agreed during the previous Joe Biden administration, but it did not pass Congress at that time.

President Trump argued that this would hand over U.S. tax sovereignty to other countries and instructed an investigation into unfair tax systems such as other countries' digital taxes, responding with tariffs and other measures. Under this new agreement, there is a possibility that South Korea will be asked not to apply the global minimum tax to U.S. companies in future negotiations with the United States, including tariff talks.

In addition, the tax cut bill currently being discussed in the U.S. Congress, which contains President Trump's key policies, includes Section 899. This section would impose additional taxes on earnings from investments in U.S. securities and other assets by investors from countries that apply a digital tax or global minimum tax to U.S. companies. Wall Street has referred to Section 899 as a "retaliatory tax" and has expressed concerns that its introduction would hinder foreign direct investment. However, with Secretary Besant's announcement, these concerns have been alleviated.

Gennadiy Goldberg, Head of U.S. Rates Strategy at TD Securities, said, "If Section 899 is excluded from the budget negotiations, investors can breathe a sigh of relief," but added, "It is difficult to know whether the market had considered the likelihood of this provision passing into the final bill to be high."

Scott Semer, partner at the law firm Torys, stated, "This is clearly a positive development for non-U.S. investors who invest frequently in the United States," and added, "It will definitely help by providing investment certainty."

Secretary Besant said, "This agreement with our G7 partners provides greater certainty and stability to the global economy and will promote growth and investment in the United States and around the world."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.