The two leading companies in the global obesity treatment market, Novo Nordisk and Eli Lilly, have both unveiled their next-generation pipelines, solidifying their competitive landscape. At the same time, latecomers such as Hanmi Pharmaceutical, Peptron, and Dong-A ST are pursuing the frontrunners by introducing advanced mechanisms of action and combination strategies, intensifying the competition for new drugs.

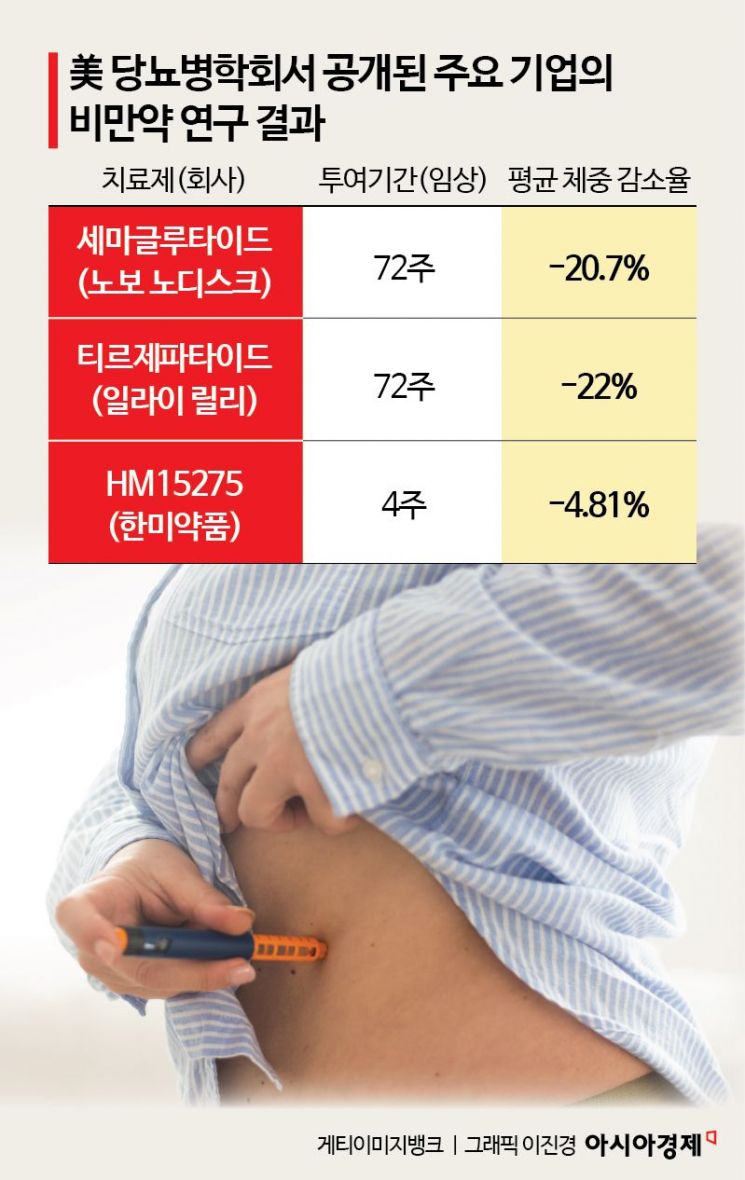

According to industry sources on June 27, at the recently concluded American Diabetes Association (ADA) 2025 Annual Scientific Sessions, Novo Nordisk highlighted its high-dose administration strategy for its flagship drug, semaglutide (the active ingredient in Wegovy). While the existing Wegovy showed an average weight loss rate of 17.5% over 72 weeks at a 2.4 mg dose, the newly presented 7.2 mg high-dose group achieved up to a 20.7% reduction. Novo Nordisk also announced that initial clinical data for its dual-acting amylin and GLP-1 (glucagon-like peptide-1 receptor agonist) agent, Amycretin, demonstrated a weight loss effect of over 24% with a 60 mg injection.

Another major player in the obesity drug market, Eli Lilly, also showcased new combination mechanism candidates, reinforcing its presence. To overcome the limitations of the GLP-1 class, Lilly introduced amylin analogs and antibody-based drugs that preserve or increase muscle mass. Notably, clinical results for the muscle-increasing antibody therapy bimagrumab, when combined with semaglutide, showed a 22% weight loss rate, an improvement over the 16% seen with monotherapy, and 93% of the lost weight was achieved with minimal muscle loss. Additionally, the amylin analog eloralintide demonstrated an 11.5% weight loss effect after 12 weeks of administration.

Both companies are advancing existing GLP-1 therapies and are actively pursuing strategies that combine or develop multi-acting agents with GIP (gastric inhibitory peptide), glucagon, and amylin. This approach aims to expand indications beyond simple weight loss to include complex metabolic diseases such as liver and cardiovascular disorders.

Latecomers are also intensifying their pursuit. In particular, Hanmi Pharmaceutical unveiled data for the first time at this ADA on its triple-acting agent HM15275 and muscle-increasing candidate HM17321. HM15275 is a triple agonist targeting GLP-1, GIP, and glucagon receptors simultaneously. It is characterized by superior weight loss effects and relatively low lean mass loss compared to existing GLP-1 monotherapies. The company aims to begin Phase 2 trials within the year and is considering a global development strategy targeting patients with severe obesity. HM17321 selectively reduces fat while increasing muscle mass, and preclinical data showed weight loss comparable to Wegovy, along with improved muscle function.

Dong-A ST revealed its combination strategy focused on the potential treatment of metabolic dysfunction-associated steatohepatitis (MASH). The company presented animal study results combining the GPR119 agonist DA-1241 and the FGF21 analog efruxifermin, which not only demonstrated weight loss effects but also significant improvement in liver fibrosis markers, suggesting the potential for integrated metabolic disease treatment.

Global research firms Morningstar and PitchBook estimate that the global obesity drug market will grow to $200 billion (271 trillion KRW) by 2031. An industry official stated, "After semaglutide and tirzepatide, new candidates are emerging to vie for blockbuster status. The competitive landscape will be redefined based on detailed data such as weight loss rates, muscle loss, and dosing convenience compared to existing drugs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)