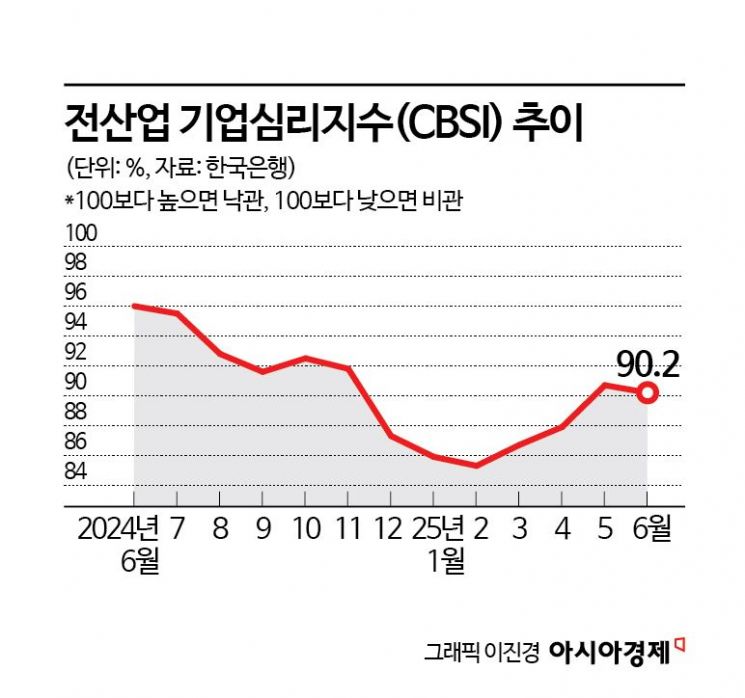

June Composite Business Sentiment Index at 90.2, Down 0.5 Points

Non-Manufacturing Sector, Including Construction and Real Estate, Remains Sluggish...

Weakness Expected to Continue Next Month

The business sentiment index for all industries in June barely held above the 90 mark. While product inventories generally declined as the United States postponed reciprocal tariffs, the index turned downward after just one month, due to factors such as a slowdown in exports to the U.S. for certain items, ongoing geopolitical uncertainty in the Middle East, and continued sluggishness in the construction sector.

According to the "June Business Survey Results and Economic Sentiment Index (ESI)" released by the Bank of Korea on the 26th, the composite business sentiment index (CBSI) for all industries in June stood at 90.2, down 0.5 points from the previous month. The CBSI is a business sentiment indicator calculated using key indices from the Business Survey Index (BSI). A reading above 100 indicates that companies are more optimistic about the economic situation compared to the past, while a reading below 100 suggests pessimism.

Lee Hyeyoung, head of the Economic Sentiment Survey Team at the Bank of Korea's Economic Statistics Department 1, stated, "Although the index fell only slightly compared to the previous month, it still remains below the long-term average, so it is difficult to say the situation is favorable." Lee added, "Future trends will depend on changes in tariff policies, the new government's economic policies, and the timing of domestic demand recovery, so we need to continue monitoring the situation." With the reciprocal tariff suspension period coming to an end, it is also important to keep an eye on the progress of trade negotiations, as well as the passage and execution of the second supplementary budget proposal in the National Assembly.

This month, the manufacturing CBSI fell by 0.3 points from the previous month to 94.4. In manufacturing, business conditions (-0.7 points) and financial conditions (-0.4 points) were the main factors behind the decline, while new orders (+0.4 points) and product inventories (+0.6 points) acted as factors limiting the drop. Manufacturing performance worsened this month, especially in chemicals and chemical products, fabricated metal products, and non-metallic minerals. Chemicals and chemical products were affected by a decline in ethylene spreads due to rising oil prices. Fabricated metal products suffered from decreased demand in downstream industries such as automobiles and auto parts. Non-metallic minerals saw production and new orders deteriorate, particularly among cement, concrete, and ceramics companies, due to the ongoing slump in the construction sector.

The non-manufacturing CBSI also fell by 0.7 points to 87.4. In non-manufacturing, sales (-0.6 points) and profitability (-0.5 points) were the main factors behind the decline, but business conditions (+0.4 points) helped prevent a further drop. Non-manufacturing performance worsened, particularly in construction, real estate, and arts, sports, and leisure-related service industries. In construction, not only did the housing construction market remain sluggish, but civil engineering orders also declined. In real estate, business conditions deteriorated mainly among commercial real estate sales and leasing companies in regional areas. Arts, sports, and leisure-related service industries were affected by a decrease in visitors to golf courses, performance venues, and similar facilities.

The outlook for next month was mixed. The CBSI forecast for July was 89.4, down 0.1 points from the previous month. Manufacturing is expected to rise by 0.3 points to 93.4 compared to the previous month, while non-manufacturing is projected to fall by 0.4 points to 86.7. The July manufacturing outlook is expected to improve, particularly in electrical equipment, petroleum refining and coke, and rubber and plastics. The July non-manufacturing outlook is expected to deteriorate, especially in construction, professional and scientific and technical services, and real estate.

The Economic Sentiment Index (ESI), which combines the Business Survey Index (BSI) and the Consumer Sentiment Index (CSI), rose by 0.6 points from the previous month to 92.8. The cyclical component, which removes seasonal factors, stood at 89.3, up 0.2 points from the previous month.

This survey was conducted from June 11 to 18, targeting 3,524 corporate entities nationwide. Of the respondents, 1,839 were manufacturing companies and 1,455 were non-manufacturing companies, totaling 3,294 companies (93.5%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)