Korea Federation of Banks Proposes Trust Business Innovation Measures to National Planning Committee

Expansion of Eligible Trust Assets and More

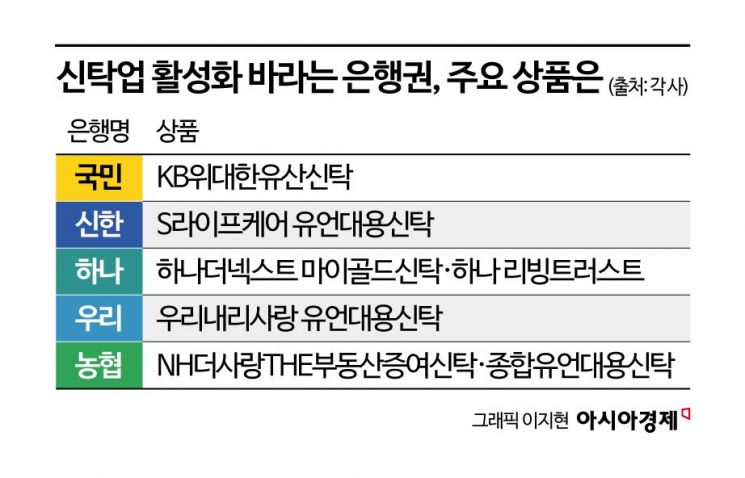

Banks Expanding Their Own Product Offerings

"Tax Benefits Needed to Promote Small-Amount Trusts"

Banks are actively working to revitalize the trust business. They are either making policy recommendations to the government, such as strengthening the comprehensive asset management function of trusts and promoting non-face-to-face trust contracts, or enhancing their own product offerings. As the elderly population in South Korea increases, social demands for stable retirement and inheritance asset management are also rising, prompting banks to view the trust business as a future growth engine.

According to the financial sector on June 26, the Korea Federation of Banks recently proposed the revitalization of the trust business as a measure for innovation in the financial industry in its "Recommendations from the Banking Sector for Virtuous Economic Circulation and Financial Industry Innovation" submitted to the National Planning Committee. Through the prompt implementation of the Capital Markets Act amendment, led by Kim Sanghoon of the People Power Party, the Federation requested the strengthening of the comprehensive asset management function of trusts and improvements to the explanation process for non-face-to-face specific monetary trust contracts.

First, they proposed expanding the scope of assets eligible for trust. Currently, only seven types (cash, securities, monetary claims, movables, real estate, real estate-related rights, and intangible property rights) are allowed. The proposal is to add collateral rights and assets designated by Presidential Decree to this list. They also emphasized the need for special provisions allowing trust-related tasks to be delegated to specialized institutions in various fields that are not trust operators. In addition, they suggested permitting the issuance of beneficiary certificates for non-cash asset trusts and relaxing restrictions on the exercise of voting rights for trust-held shares (currently, voting rights are prohibited if the shareholding exceeds 15%).

For specific monetary trusts, there is currently a mandatory video call with the customer for non-face-to-face contracts. The Federation proposed eliminating this requirement to further activate trust contracts through non-face-to-face channels. The Korea Federation of Banks stated, "In order to fully activate the original function of trusts, which is the comprehensive and proactive management of various assets, the Capital Markets Act amendment should be implemented as soon as possible, and the scope of assets eligible for trust should be gradually expanded."

Banks are also strengthening their trust business on their own, actively reorganizing existing products or launching new ones. NH Nonghyup Bank, for example, introduced two new trust products this year: the Real Estate Gift Trust and the Comprehensive Testamentary Substitute Trust. The Real Estate Gift Trust is a new product that allows for pre-gifting before the value of real estate increases, thereby reducing the gift tax burden. It also allows for conditional gifting, where certain obligations are imposed on the recipient.

The Comprehensive Testamentary Substitute Trust is designed so that assets such as cash, real estate, and securities are managed under a trust contract, with the customer as the beneficiary during their lifetime and designated beneficiaries after their death. Emergency withdrawals are possible if urgent funds are needed. With this relaunch, the minimum subscription amount has been lowered from the previous 300 million won to a combined 100 million won for non-cash trust assets or 50 million won for cash, making the product more accessible to customers.

Some institutions are introducing services for the first time in the financial sector. Hana Bank, for instance, signed a business agreement with Korea Gold Exchange Digital Asset to promote physical gold transactions and launched the "Physical Gold Trust" service. The "Hana The Next My Gold Trust" allows customers to deposit physical gold under a trust contract and dispose of it at a reasonable price. In the second half of this year, Hana Bank also plans to launch the "Hana The Next My Gold Management Trust," which will allow customers to deposit gold with the bank, operate it for a certain period, and receive both the physical gold and investment returns at maturity.

A trust is a product in which a financial institution manages various assets such as cash, securities, and real estate on behalf of customers. In countries like the United States and Japan, trusts are already widely used as a means of household asset management. As the elderly population increases, trusts are expected to attract attention as a way to secure stable income and manage assets after retirement, as well as to ensure smooth distribution and management of inheritance assets after death. For example, as forecasts predict that "dementia money" will reach 488 trillion won by 2050, testamentary substitute trusts are emerging as an alternative. "Dementia money" refers to funds that remain locked in accounts after an individual loses mental capacity due to dementia and until inheritance is processed after death. By entering into a trust contract in advance, individuals can prevent their assets from becoming "dementia money" and ensure that, even if they lose mental capacity, their assets can be used for hospital or nursing care expenses.

Despite being a useful tool, experts point out that the market itself is still not very active, and government efforts are needed to popularize trusts. Seo Jungho, Senior Research Fellow at the Korea Institute of Finance, said, "The trust business innovation plan proposed by the government in 2022 needs to be legislated quickly, and tax benefits should be provided to promote small-amount trusts for the middle class. In addition, allowing online trust service providers and encouraging financial institutions to offer differentiated services can help popularize trust services."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.