July BSI Outlook at 94.6

Actual Index Remains Sluggish for 41 Consecutive Months

Leisure, Accommodation, and Other Domestic Demand Sectors Expected to Improve

Amid unstable international conditions such as U.S. tariff policies and the Israel-Iran war, domestic business sentiment in South Korea has remained below the baseline for 3 years and 4 months.

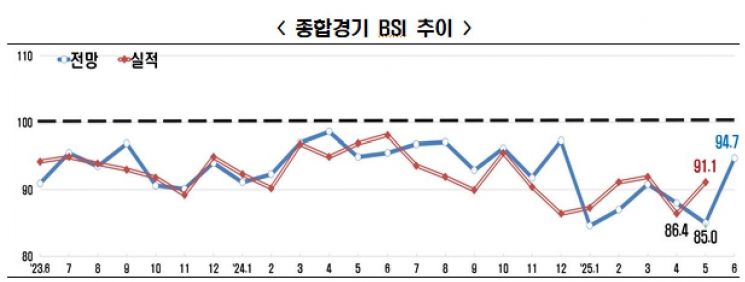

According to a survey conducted by the Korea Economic Association on the 600 largest companies by sales, the Business Survey Index (BSI) outlook for July 2025 was 94.6, below the baseline of 100. The BSI has remained below 100 for 3 years and 4 months since April 2022 (99.1). A BSI above 100 indicates a positive outlook compared to the previous month, while a BSI below 100 indicates a negative outlook.

The actual BSI for June was recorded at 93.5. Although the index has remained sluggish for 3 years and 5 months since February 2022 (91.5), it increased by 2.4 points compared to May (91.1).

The July outlook varied by industry. The manufacturing BSI (86.1) remained sluggish for 1 year and 4 months since April of last year, while the non-manufacturing BSI (103.4) rose by 9.9 points from the previous month (93.5), returning to a positive outlook for the first time in 7 months.

Among the 10 detailed manufacturing sectors, food, beverages, and tobacco (112.5) showed a positive outlook. Except for wood, furniture, and paper (100.0), which was at the baseline, the remaining 8 sectors are expected to remain sluggish.

The Korea Economic Association attributed this to the spread of negative business sentiment across manufacturing, caused by the economic slowdown in major export destinations such as the U.S. and China in the second half of the year, as well as the expansion of Middle East risks due to the Israel-Iran conflict.

Among the 7 detailed non-manufacturing sectors, leisure, accommodation, and food service (150.0), transportation and warehousing (111.5), and wholesale and retail (106.4) showed positive outlooks. The remaining 4 sectors are expected to remain sluggish.

The Korea Economic Association explained that the rise in the index was driven by leisure, accommodation, and food service (150.0) and transportation and warehousing (111.5), which are expected to benefit from seasonal demand, as well as wholesale and retail (106.4), which is directly affected by supplementary budgets and domestic demand stimulus policies.

Lee Sangho, head of the Economic and Industrial Division at the Korea Economic Association, stated, "Geopolitical instability originating from the Middle East and the slowdown in growth among major countries in the second half of the year continue to burden corporate management." He emphasized, "We must make efforts to enhance the export competitiveness of manufacturing by diversifying key export markets, establishing preemptive response systems for trade conflicts with major countries, and checking the stability of supply chains in core industries."

He also commented, "With the government's supplementary budget, domestic demand stimulus policies, and expectations for the summer vacation season coinciding, signs of improvement in business sentiment are emerging, particularly in the service sector."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)