The ACE US Dividend Quality ETF series consists of three monthly distribution products that were newly listed on May 13. These products are designed based on the WisdomTree DGRW (WisdomTree US Quality Dividend Growth ETF), managed by the US asset management firm WisdomTree. The series includes the ACE US Dividend Quality ETF, the ACE US Dividend Quality + Covered Call Active ETF, and the ACE US Dividend Quality Bond Mix 50 ETF.

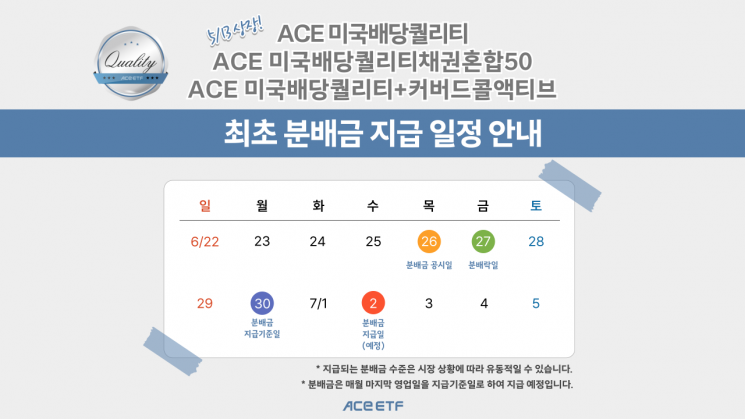

The first distribution for these three ETFs will be paid to investors who purchase the ETFs by June 26. The distribution amount covers approximately 1.5 months, from the listing date on May 13 through the end of June. The specific distribution amount will be announced after the market closes on June 26 via the ACE ETF website and other channels.

The ACE US Dividend Quality ETF invests in US-listed stocks that have paid dividends in the past year and are characterized by strong earnings growth, a high three-year average return on equity (ROE), and a high return on assets (ROA). Its underlying index is the same as DGRW, namely the "WisdomTree U.S. Quality Dividend Growth Index (Price Return)," which the ETF tracks after converting to Korean won.

As of the previous day, the top holdings in the portfolio included Microsoft (9.05%), Exxon Mobil (4.78%), Apple (4.12%), Nvidia (3.79%), and Philip Morris International (3.04%). Unlike the Schwab US Dividend Equity ETF (SCHD), which is familiar to domestic investors as a representative US dividend stock ETF, the ACE US Dividend Quality ETF series has a higher proportion of technology stocks in its portfolio.

The ACE US Dividend Quality + Covered Call Active ETF and the ACE US Dividend Quality Bond Mix 50 ETF are covered call and bond mix versions, respectively, of the ACE US Dividend Quality ETF. Korea Investment Management simultaneously listed all three products in May to broaden the range of US dividend investment options for domestic investors. Investors who seek higher distribution rates with a focus on technology dividend stocks may choose the ACE US Dividend Quality + Covered Call Active ETF, while those who want to reduce volatility may prefer the ACE US Dividend Quality Bond Mix 50 ETF. Notably, the ACE US Dividend Quality Bond Mix 50 ETF can be invested in up to 100% within defined contribution (DC) retirement pensions and individual retirement pensions (IRP).

Nam Yongsoo, head of ETF Management at Korea Investment Management, stated, "Along with the ACE US Dividend Dow Jones ETF, which is considered the Korean version of SCHD, many investors are paying attention to the ACE US Dividend Quality ETF series. Investors who are approaching or have entered retirement can pursue higher distribution income with the ACE US Dividend Dow Jones ETF."

He added, "Younger and middle-aged investors who have more time until retirement can pursue higher long-term performance through dividend investing with the ACE US Dividend Quality ETF series."

All ACE ETFs are performance-based distribution products, so investors should be aware that principal loss may occur depending on investment results.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)