Securities Stocks Continue Record-Breaking Rally

Mirae Asset Securities Surges Over 9%, Touches 25,000 Won Intraday

Kiwoom Securities and Korea Financial Group Reach All-Time Highs

Possibility of a Correction Due to Rapid Short-Term Surge

As the KOSPI has recovered the 3,000-point level for the first time in three and a half years, securities stocks continue to hit record highs and maintain an upward trend, despite adverse developments from the Middle East. There is a prevailing sense of policy optimism, and trading volumes are increasing, leading to expectations that the strong performance of securities stocks will persist.

According to the Korea Exchange on June 24, while the KOSPI fell slightly the previous day due to geopolitical risks stemming from the Middle East, securities stocks continued their record-breaking rally and showed strong performance. On the previous day, the KOSPI closed down by 0.24%, but the KRX Securities Index rose by 4.13%. Mirae Asset Securities surged 10.34% to close at 21,550 won. During the session, it climbed to 25,350 won, setting a new 52-week high. Samsung Securities closed up 5.61% at 71,500 won, surpassing the 70,000-won mark. It also reached a new 52-week high of 71,700 won during the session. Kiwoom Securities exceeded 220,000 won, marking an all-time high, and Korea Financial Group also hit a record high.

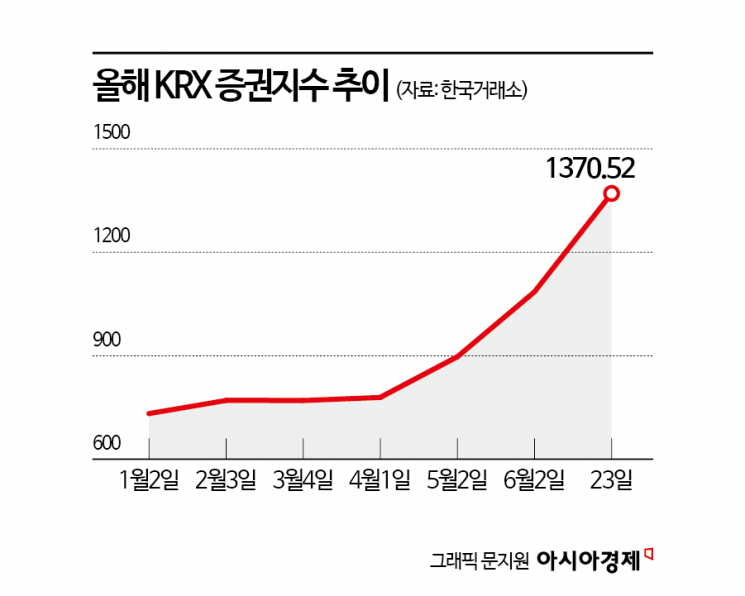

The strong performance of securities stocks is being supported by policy optimism and other factors. The KRX Securities Index has risen 85.93% so far this year, significantly outpacing the KOSPI, which rose 25.63% during the same period. Park Hyejin, a researcher at Daishin Securities, explained, "The factors driving the rise in securities stocks can be summarized as President Lee Jaemyung's pledge to achieve a 5,000-point KOSPI, increased liquidity due to a supplementary budget in the second half of the year, the Korean interest rate cut cycle, and regulatory easing." She added, "Among these, expectations for the pledge to achieve a 5,000-point KOSPI are having an explosive impact on securities stocks. In fact, this is an extension of the value-up policy along with amendments to the Commercial Act, and it has become even more aggressive under the new administration." She further noted, "The surge in trading volume and increased operating profit due to higher liquidity and the interest rate cut cycle are also supporting the performance of securities firms."

As the stock market remains strong, trading volumes are also increasing. The average daily trading volume in June (as of the 23rd) was 22.022 trillion won, the highest level so far this year. This is the first time since March last year that the average daily trading volume in the domestic stock market has exceeded 22 trillion won. Securities firms are raising their estimates for average daily trading volume. Korea Investment & Securities raised its second-quarter estimate from 19.1 trillion won to 21.3 trillion won, and its third-quarter estimate from 17.3 trillion won to 23.2 trillion won. Baek Doosan, a researcher at Korea Investment & Securities, stated, "Depending on the development and duration of the bull market, there is room for further upward revisions of trading volume estimates," and explained, "With policy tailwinds and a strong capital market, the momentum for profits related to brokerage, trading, and investment banking (IB) continues."

Shinhan Investment & Securities also raised its estimate for average daily trading volume in the second half of the year by 17% to 21.3 trillion won, and simultaneously raised its earnings estimates for all covered securities firms. Lim Heeyeon, a researcher at Shinhan Investment & Securities, said, "As market optimism grows, trading volume is surging, especially among individual investors," and added, "The moves to revise the Commercial Act and restructure corporate governance are seen as drivers that could open up new business opportunities across the securities industry. If the amendments to the Commercial Act are passed, there is room for upward adjustments to trading volume and earnings estimates."

However, it is important to keep in mind the possibility of a correction due to the recent rapid surge. Jang Youngim, a researcher at Hyundai Motor Securities, pointed out, "Given the sharp rise in stock prices over a short period, it is necessary to prepare for a correction," and added, "While there may be additional upside, policy implementation will be the key factor for the re-rating of securities stocks' valuations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.