Estimated Net Profit of Eight Listed Insurers at 2.4916 Trillion Won, Down 7.9% Year-on-Year

Auto Insurance Loss Ratio Worsens, Large-Scale Fires Take a Toll

Second Half Outlook Remains Gloomy Amid Rate Cuts and Trump Tariffs

The outlook for the second-quarter earnings of major domestic insurance companies is bleak. Due to worsening auto insurance loss ratios and the aftermath of large-scale fires, non-life insurers are expected to underperform life insurers in the second quarter, continuing the trend from the first quarter.

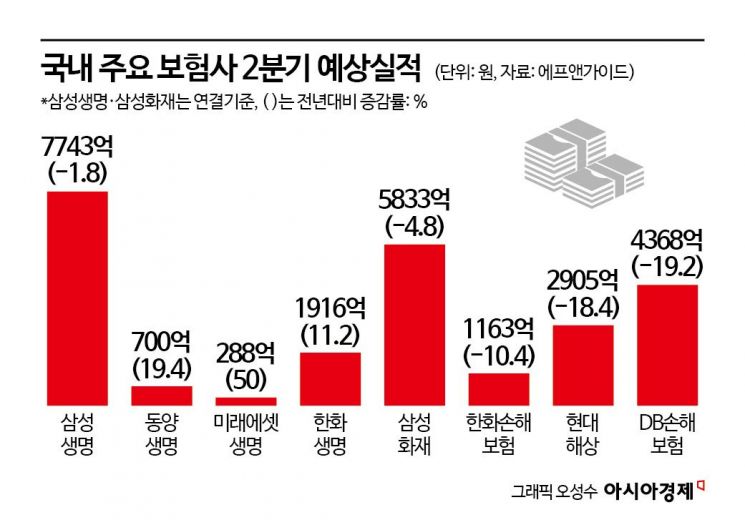

According to financial information provider FnGuide on June 24, the consensus (market average forecast) for the second-quarter net profit of eight listed domestic insurers (Samsung Life, Hanwha Life, Tongyang Life, Mirae Asset Life, Samsung Fire & Marine, Hyundai Marine & Fire, DB Insurance, Hanwha General Insurance) is estimated at 2.4916 trillion won. This represents a 7.9% decrease compared to the net profit of 2.7059 trillion won in the second quarter of last year. For Samsung Life and Samsung Fire & Marine, consolidated figures are used, while for the others, separate figures are summed.

Performance is expected to diverge by sector. Life insurers are projected to see a 0.2% decrease compared to the same period last year, while non-life insurers are expected to decline by 12.9%. This is similar to the situation in the first quarter. In the first quarter, the total net profit of all life insurers, including major listed companies, fell by 10.9% year-on-year, while non-life insurers saw a sharp drop of 19%.

Even when looking at individual insurers, the difference in performance by sector is clear. Only two companies?Mirae Asset Life and Hanwha Life?are expected to see an increase in second-quarter earnings compared to the same period last year, with projected growth of 50% and 11.2%, respectively. In contrast, all four non-life insurers are expected to post lower results. DB Insurance is expected to decline by 19.2%, Hyundai Marine & Fire by 18.4%, and Hanwha General Insurance by 10.4%. For the two leading companies in the life and non-life sectors, Samsung Life's second-quarter net profit is projected at 774.3 billion won, down 1.8% year-on-year, while Samsung Fire & Marine's net profit for the same period is expected to be 583.3 billion won, a decrease of 4.8%.

One of the main reasons for the poor performance of non-life insurers is the worsening auto insurance loss ratio. In April, the auto insurance loss ratio for the five major non-life insurers?Samsung, Hyundai, DB, KB, and Meritz?stood at 85.1%, up 4.9 percentage points from a year earlier. DB Insurance had the highest loss ratio at 87.9%, followed by Hyundai Marine & Fire (86.5%), KB Insurance (84.7%), Meritz Fire & Marine (83.2%), and Samsung Fire & Marine (83%). In the insurance industry, a loss ratio of 82% is generally considered the break-even point. If the loss ratio rises above this, the business is considered to be operating at a loss when accounting for business expenses. An industry official stated, "Auto insurance premiums have declined for four consecutive years, and the increase in springtime outings has further worsened the loss ratio in the second quarter," adding, "Based on preliminary second-quarter results, some major companies' auto insurance businesses have turned to losses."

The series of fires that have occurred this year are also expected to negatively impact the performance of non-life insurers. In addition to fires in the Gyeongsang region in the first quarter, a major fire broke out at the Kumho Tire Gwangju plant on May 17. The insurance coverage for the Gwangju plant held by Kumho Tire amounts to 1.2947 trillion won. Six non-life insurers, including DB Insurance, Hyundai Marine & Fire, and Samsung Fire & Marine, underwrote the comprehensive property insurance. DB Insurance, which has the largest share at 47%, estimates its related losses at about 30 billion won, taking into account reinsurance arrangements.

The financial soundness of insurers continues to deteriorate. After the application of transitional measures in the first quarter, the insurers' risk-based capital ratio (K-ICS) fell to 197.9%, dropping below 200% for the first time in about 23 years. The ratio was 190.7% for life insurers and 207.6% for non-life insurers.

The outlook for the second half of the year is also not bright. The burden has increased due to the comprehensive tariff imposition by the US Trump administration and the resulting changes in economic conditions. For non-life insurers, various costs are expected to rise, while for life insurers, investment risks are likely to increase. Moon Je-Young, a research fellow at the Korea Insurance Research Institute, explained, "For auto insurance, the rise in imported parts prices will increase repair costs, leading to a higher loss ratio. For construction and fire insurance, the increase in import prices of key building materials such as steel and timber will raise construction and reconstruction costs, resulting in larger insurance payouts when accidents occur." He added, "For long-term investment products such as variable and annuity insurance, a decline in returns could lead to higher policyholder surrender rates. If the trend of interest rate cuts continues, declining bond yields and the widening negative spread in fixed-rate products will further lower the K-ICS of life insurers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)