Report Published by Korea Insurance Research Institute on "Directions for Improving Asset Management Ratio Regulations for Insurance Companies"

"It Is Difficult to Overcome Market Saturation with Traditional Business Models Alone"

Improvements Needed, Following Examples of Major Foreign Countries Such as the United Kingdom, Germany, and Japan

There have been criticisms that asset management ratio regulations for insurance companies are excessively strict. Considering the current economic situation and examples from major foreign countries, experts suggest that the regulatory paradigm should shift from a preemptive and quantitative control approach to a post-monitoring and risk management-centered model.

According to the report "Directions for Improving Asset Management Ratio Regulations for Insurance Companies," published by the Korea Insurance Research Institute on June 22, the Korean insurance market has entered a mature phase, making it difficult to overcome market saturation with traditional business models alone. Since the introduction of the International Financial Reporting Standard (IFRS17) in 2023, there has been an increased concentration on protection-type insurance, while annuity and savings-type insurance have shrunk, thereby weakening the insurance industry's function of providing retirement income security.

Unlike the insurance industry, the broader financial sector is actively seeking to strengthen competitiveness related to retirement income security. Banks and financial investment firms are leveraging digital technology to offer diverse investment opportunities and improve investment returns, thereby enhancing their competitiveness in the pension market.

The Korea Insurance Research Institute believes that, in this environment, it is necessary to improve asset management ratio regulations that do not reflect current realities in order to enhance the efficiency and flexibility of insurance companies' investment activities and secure new growth engines.

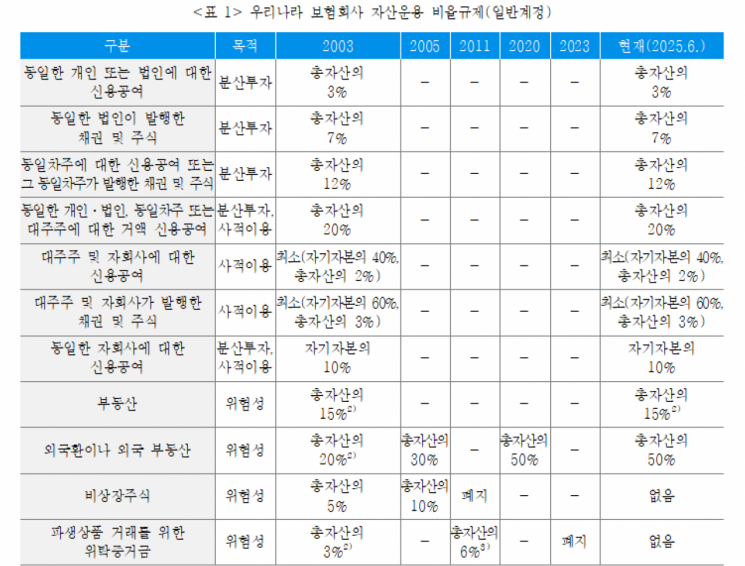

In Korea, asset management ratio limits are set to ensure that insurance companies' asset management methods do not exceed certain thresholds. The main ratio regulations include: restrictions on credit exposure to the same individual or corporation (3% of total assets); restrictions on credit exposure to major shareholders and subsidiaries (4% of equity capital, 2% of total assets); restrictions on real estate investment (15% of total assets); and restrictions on foreign currency or foreign real estate (5% of total assets).

Current Status of Asset Management Ratio Regulations for Insurance Companies in Korea. Korea Insurance Research Institute

Current Status of Asset Management Ratio Regulations for Insurance Companies in Korea. Korea Insurance Research Institute

Major foreign countries such as the United Kingdom, Germany, and Japan also previously operated preemptive asset management ratio regulations based on principles of stability and risk diversification to protect policyholders. However, they later abolished or relaxed these preemptive ratio regulations to enhance the competitiveness of insurance companies by securing their autonomy. Instead, they have strengthened quantitative capital regulations and emphasized internal controls and disclosure requirements. Hwang Inchang, a research fellow at the Korea Insurance Research Institute, stated, "Korea should also refer to foreign cases and shift its regulations on insurance company asset management to a post-monitoring and risk management-centered approach." He added, "To enable insurance companies to respond proactively to consumer demand and secure industry competitiveness in a rapidly changing market environment, we need to transfer the current asset management ratio regulations stipulated in the law to subordinate regulations, thereby increasing regulatory flexibility."

It has been pointed out that, given the introduction of the risk-based capital ratio (K-ICS), which has significantly increased the required capital for risk assets and already reflects asset concentration risk, Korea should consider significantly relaxing ratio regulations on risk assets and concentration in specific assets. Hwang emphasized, "Such regulatory easing could also apply to ratio regulations related to major shareholders. However, this should be approached cautiously, based on the premise of ensuring the effectiveness of regulations related to large business groups under the Fair Trade Act, regulations on financial conglomerates, and the effectiveness of insurance companies' internal control systems." He further stated, "To strengthen market surveillance functions corresponding to regulatory flexibility, insurance companies' investment disclosure systems should shift from an accounting-based to a risk-based approach. It is necessary to expand information disclosure on individual investment cases with high loss potential and strengthen disclosure regarding risk awareness and management of conflicts of interest."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)