On June 20, the KOSPI successfully settled above the 3,000 mark, buoyed by strong buying from foreign investors. The KOSDAQ also soared more than 1%, prompting a celebratory mood.

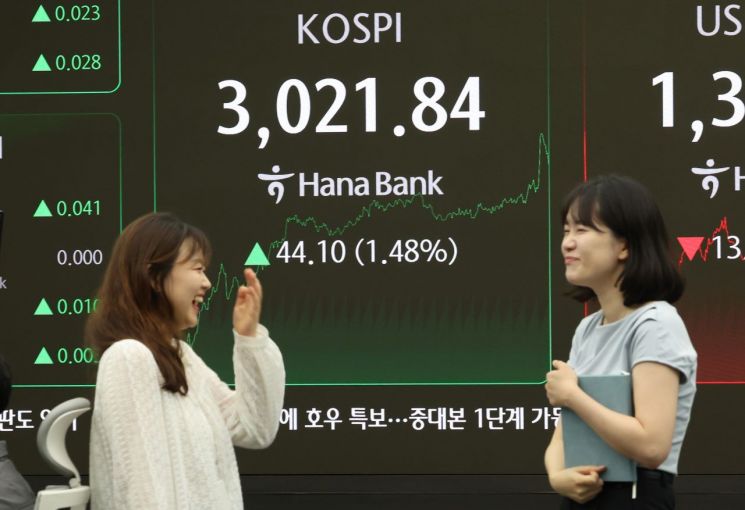

On this day, the KOSPI closed at 3,021.84, up 44.10 points (1.48%). This is the first time the KOSPI has surpassed the 3,000 level since January 3, 2022 (3,010.77), marking a return after approximately three years and five months. The index initially opened at 2,986.52, up 8.78 points (0.29%), and fluctuated within a narrow range before turning upward and extending its gains. While individual investors sold a net 602.1 billion won, foreign investors and institutions bought a net 561.9 billion won and 38.0 billion won, respectively, driving the index higher.

Most of the top market capitalization stocks also closed higher. Kakao and Naver, considered the biggest beneficiaries of the new government's AI (artificial intelligence) policies, surged 10% and 7%, respectively, leading the rally. In addition, LG Energy Solution (4.81%), SK Hynix (4.47%), HD Hyundai Heavy Industries (2.90%), Samsung Biologics (1.70%), Hyundai Motor (1.45%), and Celltrion (1.25%) all saw their share prices rise. In contrast, Doosan Enerbility (-1.31%) and KB Financial Group (-0.19%) ended lower.

Kim Jiwon, a researcher at KB Securities, commented, "With the 30.5 trillion won second supplementary budget bill approved at the Cabinet meeting, expectations for a recovery in consumption and economic growth have driven up shares in the film, food and beverage, and retail sectors." She added, "Policy-themed stocks such as AI and stablecoins also continued their strong momentum." Additionally, secondary battery stocks gained strength on news of Tesla's robotaxi launch scheduled for June 22, and cosmetics stocks surged on expectations of sales growth in the Chinese market.

On the same day, the KOSDAQ finished at 791.53, up 9.02 points (1.15%). The index had opened at 783.63, up 1.12 points (0.14%). Individual investors recorded a net sale of 79.6 billion won, while foreign investors and institutions bought a net 47.0 billion won and 38.5 billion won, respectively.

Among the top market capitalization stocks, Ecopro BM and Ecopro stood out with gains of over 12% and 7%, respectively. Rainbow Robotics (7.14%), Samchundang Pharm (4.59%), Silicontwo (2.70%), and Leeno Industrial (1.98%) also closed higher. In contrast, Kolon TissueGene (-2.39%), Classys (-1.62%), and Hugel (-0.94%) ended the day lower.

On the Seoul foreign exchange market, the weekly closing exchange rate of the Korean won against the US dollar (as of 3:30 p.m.) was 1,365.6 won, down 14.6 won from the previous day. This is interpreted as a sign that risk aversion, which favors the safe-haven dollar, has eased due to factors such as the US holding off on intervention in the Middle East.

After first breaking through the 3,000 mark in January 2021 and experiencing various ups and downs, the KOSPI has once again entered the "Samcheonpi" (3,000-point era) after three and a half years. Noh Donggil, a researcher at Shinhan Investment Corp., said, "If the current earnings trend of the KOSPI continues, it could reach the 3,100 level by the end of the year." He added, "If expanded excess liquidity and a higher price-to-earnings ratio (PER) are also factored in, the index could climb as high as 3,400."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.