Publication of "Innovation and Change Seen Through the Top 10 Trends in the Game Industry"

Game Company M&A Recovery Since Last Year: "Securing Technology and Investing Based on Popular IPs"

"Business Opportunities Must Be Secured by Re-entering the Chinese Market Amid the Easing of the 'Hallyu Ban'"

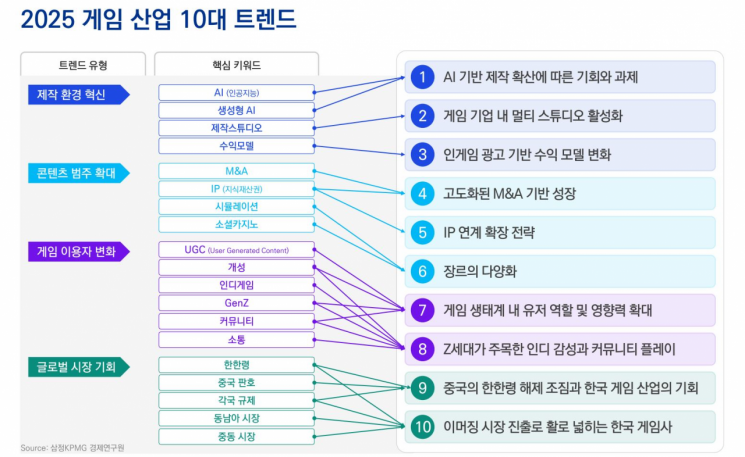

There is an analysis suggesting that the Korean game industry can find new growth engines through the spread of artificial intelligence (AI) technology and innovation in game development structures. On the 19th, Samjong KPMG released a report titled "Innovation and Change Seen Through the Top 10 Trends in the Game Industry," diagnosing major changes in the game industry and forecasting the future direction of the domestic game sector.

According to the report, the widespread adoption of generative AI across the game industry is not only increasing development efficiency, but also highlighting concerns about copyright and ethical issues, as well as the potential for job displacement. In particular, with the implementation of the domestic AI Basic Act next year and the strengthening of related regulations, it is important to establish regulatory response strategies alongside technological development.

Among major game companies, a system is spreading in which individual studios under each company independently handle production and operations. The multi-studio strategy contributes to genre diversification and enhances the creativity of development personnel, while also establishing a creator-centered organizational culture and a fast decision-making structure. As regulations on probability-based items are being strengthened, there is a growing need for new revenue models. In-game advertising, which generates revenue without disrupting gameplay flow, has emerged as a key tool for revenue diversification strategies.

Mergers and acquisitions (M&A) strategies are also being strengthened. After a decline since 2021, global game industry M&A activity has been recovering since 2024. In Korea, companies such as Krafton and NCSoft have been enhancing their capabilities by acquiring and investing in development studios, pursuing both technology acquisition-type M&As and investment-type M&As based on popular IPs.

There is also active development of new titles utilizing popular non-game intellectual properties (IPs) such as webtoons and video content, as well as proven game IPs. Korean game companies are working to diversify their IP portfolios by expanding partnerships with related industries and acquiring major content companies.

The spread of gameplay and review content through video platforms is leading to the influx of new users, and the influence of user-generated content (UGC) within games is expanding. The popularity of user-participation games such as Roblox and Minecraft is also increasing, and major game companies are focusing on strengthening user-based creative ecosystems.

The growing influence of Generation Z is also noteworthy. As Generation Z emerges as a new user base, various genres such as multiplayer online battle arena (MOBA) games, simulation, and social casino games are gaining popularity. The preference for original content is also driving the rising popularity of indie games. In addition, a play culture based on sharing and participation is forming around community platforms such as Discord.

Diversifying overseas markets is also a challenge. Amid the easing of the "Hallyu ban," Korean game companies are looking to re-enter the Chinese market, the world's second largest, with expectations of increased sales, enhanced global IP value, and expanded investment and cooperation opportunities. However, as China continues to support and regulate its domestic game industry to strengthen its competitiveness, Korean companies are required to respond strategically.

In emerging markets such as Brazil, India, and Saudi Arabia, the usage and consumption of Korean games are increasing. In particular, the Middle East is attracting attention for its high purchasing power and large-scale investments centered on Saudi Arabia, highlighting the market's potential. Major companies such as Wemade, Nexon, NCSoft, and Krafton are achieving results in emerging markets and finding new growth opportunities.

An Changbeom, Executive Director at Samjong KPMG, said, "Technological and strategic shifts in the game development environment, such as AI and multi-studio systems, can become new growth engines for the Korean game industry. In particular, expanding content categories, IP-based collaboration, and strategies to address various genres are key tasks for building content competitiveness that suits the changing user base."

He added, "In response to changes in game usage patterns centered on Generation Z, game companies need to strengthen user creative ecosystems and concretize experience-centered UX (user experience) design strategies. From a global perspective, they should focus on refining localization and distribution strategies to target China, India, and other emerging markets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)