Over 20 Trillion Won Has Left Banks Since Late March

Investor Deposits in the Stock Market Surpass 60 Trillion Won This Month

Personal Credit Loans Increase by Over 1 Trillion Won in June

As the interest rate cycle has shifted to a downward trend, deposit rates have dropped rapidly, resulting in approximately 20 trillion won flowing out of banks since March. It is analyzed that these funds have been redirected toward the stock and real estate markets. During the same period, personal credit loans increased by more than 3 trillion won. As deposit rates have fallen to the 1% range, it appears that funds have been seeking alternative investment destinations such as real estate and the stock market.

According to the financial sector on June 19, the balance of demand deposits (as of the 17th, including MMDA) at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) stood at 629.7916 trillion won. Demand deposits are classified as funds waiting to be invested, as they can be withdrawn or deposited freely. At the end of March, the balance of demand deposits at the five major banks was 650.1241 trillion won, meaning that 20.3325 trillion won has flowed out in less than three months.

Credit loans have also increased rapidly. As of the 17th, the volume of household credit loans at the five major commercial banks was 104.3835 trillion won, an increase of 2.7772 trillion won compared to the end of March (101.6063 trillion won). Of this, more than 1 trillion won?about half of the increase?was added in June alone. Compared to the end of last month (103.3145 trillion won), this represents an increase of 1.069 trillion won in just about two weeks. A banking industry official said, "There has been a surge in demand to take out credit loans ahead of the implementation of the third phase of the Debt Service Ratio (DSR) regulation in July. In addition, the stock market has been booming this month, which seems to have led to increased borrowing for leveraged investment."

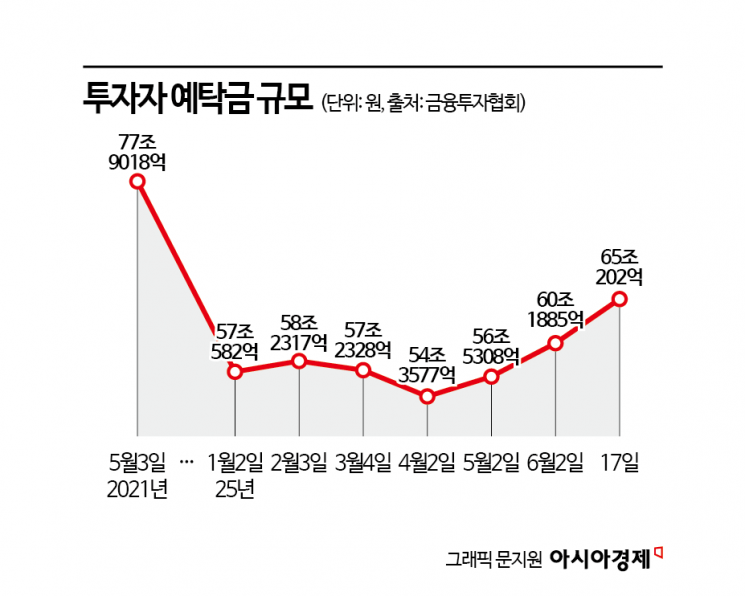

In fact, it is analyzed that the funds withdrawn from banks have flowed into the stock market. According to the Korea Financial Investment Association, as of the 17th, investor deposits stood at 65.0202 trillion won. This is the first time this year that investor deposits have exceeded 60 trillion won. Previously, investor deposits first surpassed 60 trillion won in November 2020, when the domestic stock market experienced a major bull run, and reached an all-time high of 77.9018 trillion won on May 3, 2021, as the KOSPI approached its highest level ever. Afterward, investor deposits fell below 60 trillion won again in May 2022 and have remained in the 40 to 50 trillion won range for more than three years.

The real estate market is also heating up. According to the Korea Real Estate Board, apartment sale prices in Seoul during the second week of June rose by 0.26% compared to the previous week, marking 19 consecutive weeks of increases. As of the 17th, the balance of mortgage loans at the five major commercial banks stood at 596.4178 trillion won, an increase of about 2.7562 trillion won in just two weeks.

The rapid outflow of funds from banks is attributed to the booming stock and real estate markets, as well as deposit rates falling to the 1% range, which has accelerated capital flight. In contrast, deposit rates have been dropping quickly in response to the Bank of Korea's base rate cuts. Since June 9, KB Kookmin Bank has lowered the base rates on three time deposit products by 0.10 to 0.25 percentage points, depending on the product. IBK Industrial Bank of Korea (up to 0.25 percentage points), SC First Bank (up to 0.20 percentage points), and NH Nonghyup Bank (up to 0.30 percentage points) have also sequentially lowered their deposit product rates. According to the Korea Federation of Banks, the average one-year deposit rate at 19 commercial banks is in the 2% range, with some banks even offering deposit rates in the 1% range. As the Bank of Korea is expected to cut rates one or two more times in the future, deposit rates are also expected to continue declining.

An official from a major commercial bank said, "There is no longer any merit to deposit or savings rates, and with the stock and real estate markets performing strongly, funds are flowing out of deposits and savings at a rapid pace. We are considering expanding partnerships and other measures to secure low-cost deposits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)