Cost of Living Up 19.1% Since Onset of High Inflation in 2021

Processed Foods Drove Price Hikes in First Half of This Year... 53 Out of 73 Items (73%) Increased

Delayed Impact of Accumulated Import Raw Material Prices and Exchange Rate Rises Reflected Over Time

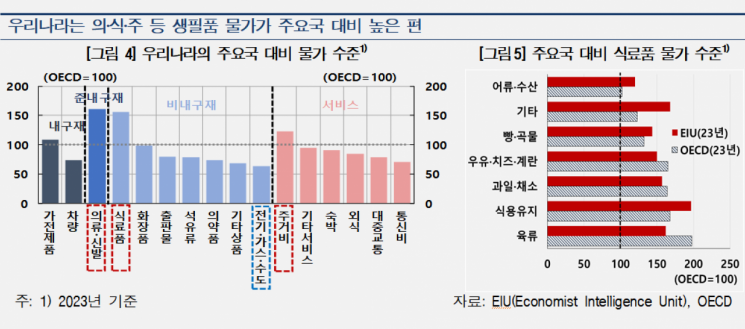

Korea's Food, Clothing, and Housing Prices 1.2 to 1.6 Times Higher Than OECD Average

Essential Goods Price Increases Intensify Cost Burden for Vulnerable Groups

"Need to Diversify Raw Material Import Sources and Ease Market Entry Barriers"

This year, processed foods such as ramen have been identified as the main drivers behind the renewed increase in the cost of living for daily necessities and other essential goods. The delayed reflection of accumulated increases in import raw material prices and exchange rates since last year is a key factor. However, the fact that there were successive price hikes in the first half of this year, when both domestic and global economic uncertainties were high, has further delayed the recovery of consumer sentiment among households. As households already perceive a high cost of living after the period of high inflation following COVID-19, there are growing calls for structural solutions such as deregulation and diversification of import sources for raw materials.

Cost of Living Up 19.1% Since 2021... Processed Foods Saw Successive Price Hikes in First Half of This Year

The Bank of Korea announced these findings on the 18th in its report titled "Assessment of Recent Trends and Levels in the Cost of Living, Including Processed Foods." According to the Bank of Korea's Price Trends Team (Lee Seungho, Jang Taeyoon, Kim Sanghyo, Wi Seunghyun), "From the beginning of this year through last month, prices rose for 53 out of 73 processed food items, accounting for 73% of the total," and "The increase in processed food prices has significantly contributed to widening the gap between the growth rates of the cost of living and consumer prices, a gap that had narrowed considerably last year due to stabilized agricultural product prices and international oil prices."

Recently, the inflation rate has remained stable near the Bank of Korea's target level of 2.0%. However, the overall price level remains high as a result of prolonged high inflation since COVID-19. In particular, the cost of living for essential goods, which account for a large share of low-income households' spending, continues to rise more rapidly, increasing the economic burden on vulnerable groups. This is due to overlapping domestic and international supply shocks during the COVID-19 period, including supply chain disruptions, the Russia-Ukraine war, and worsening weather conditions, which drove up food and energy prices?items that make up 32.4% of the cost of living. On top of this, the successive increases in processed food prices this year have pushed the cumulative increase in the cost of living since the onset of high inflation in 2021 to 19.1% as of last month. This is 3.2 percentage points higher than the cumulative increase in consumer prices (15.9%). The contribution of processed foods to the cost of living inflation rate more than doubled, from 0.15 percentage points in the second half of last year to 0.34 percentage points from January to May this year.

However, it has been analyzed that the recent price increases for processed foods and other essential consumer goods are largely due to the delayed reflection of accumulated increases in import raw material prices and exchange rates since last year. According to the Bank of Korea's Price Research Team (Lee Sumin, Moon Taedong), since 2020, companies' input costs have risen sharply due to increases in import prices for raw materials and intermediate goods, as well as the won-dollar exchange rate, and the resulting rise in domestic intermediate goods prices. For processed foods and personal services, the prices of domestically produced intermediate inputs used in production have continued to rise, and recently, the prices of major imported intermediate inputs such as agricultural, forestry, fishery, and food products have also increased, leading to a sustained upward trend in input prices. The portion of consumer price increases attributable to input prices was 13.4 percentage points for processed foods, 13.0 percentage points for dining out, and 5.0 percentage points for personal services excluding dining out. Notably, for processed foods and personal services, the degree of cost pass-through has increased over time. Much of the recent upward trend in prices is the result of higher input costs being reflected with a time lag. However, the fact that many processed food prices were raised in the first half of this year, when both domestic and global economic uncertainties were high, is seen as a factor delaying the recovery of consumer sentiment among households.

In Korea, the price levels of essential goods such as food, clothing, and housing are 1.2 to 1.6 times higher than the OECD average. As of 2023, Korea's price levels for clothing (161), food (156), and housing (123) far exceed the OECD average (100). In particular, food prices are high not only for agricultural, livestock, and fishery products but also for processed foods compared to major countries. According to combined data from the Economist Intelligence Unit (EIU) and the OECD, Korea's prices for fruits, vegetables, and meat are more than 1.5 times the OECD average. Prices for processed foods such as bread and oils are also relatively high. The report pointed out, "Low productivity and openness, as well as high distribution costs, are also contributing factors," and evaluated, "The high price levels of essential goods are a major factor raising the perceived cost of living, especially among vulnerable groups, even as inflation slows."

Essential Goods Price Increases... Negative Impact on Household Consumer Sentiment and Spending

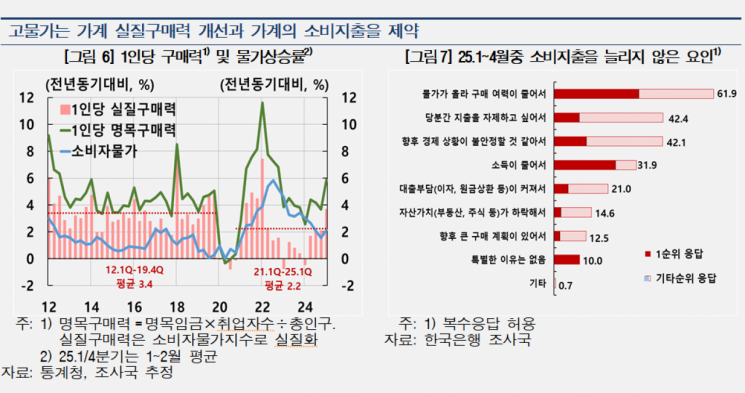

Prolonged high inflation since COVID-19 has reduced real purchasing power, increasing the burden on households. The report noted, "Since 2021, nominal purchasing power (labor income) of households has not increased enough to offset the high inflation rate, so the average real purchasing power growth rate from 2021 through the first quarter of this year (2.2%) has dropped significantly compared to the pre-COVID-19 period of 2012-2019 (3.4%)."

With prices rising mainly for essential goods such as those in the cost of living index, household consumer sentiment is weakening and the negative impact on consumer spending is growing. According to a survey conducted by the Bank of Korea's Research Bureau last month, 62% of respondents who did not increase their consumer spending from January to April this year cited reduced purchasing power due to rising prices as the main reason.

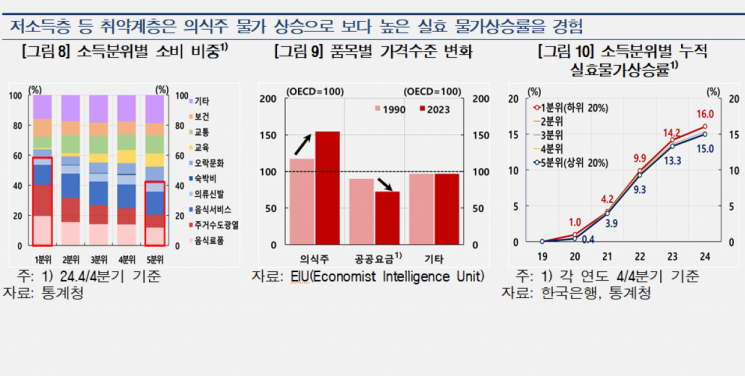

If the rise in the cost of living continues to accumulate, inflation inequality between income groups may worsen, increasing the living cost burden for vulnerable groups such as low-income households. Low-income households spend a larger proportion of their consumption on essential goods such as food, clothing, and housing. The phenomenon of "cheapflation," where prices of lower-priced products rise more sharply within the same category, is further intensifying perceived inflation inequality. The report noted, "Since COVID-19, Korea has experienced cheapflation, where the price increase rate for lower-priced products is higher than for higher-priced ones," and "Low-income households, who already spend a greater proportion on lower-priced goods, are especially affected because it is difficult for them to substitute consumption when these prices rise." Considering cheapflation, the gap in effective inflation rates between low- and high-income households becomes even greater.

The report emphasized the need to promote competition among companies through deregulation and easing entry barriers, while also diversifying import sources for raw materials to mitigate the extent to which shocks to specific items spread to other goods. Given that the rising cost of living, including processed foods, has significantly increased the burden on vulnerable households, the report explained that, in the short term, measures such as quota tariffs should be used to stabilize the prices of imported raw materials such as agricultural products.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)