Bank of Korea: "Recent Price Trends in Major Countries and the Future Price Spillover Effects of US Tariff Policy"

Reserved Responses to US Tariffs and High US-China Export Shares...

Weak Demand Creates Predominant Downward Pressure

Further Price Declines Possible if Chinese Exports Are Redirected

There is an analysis suggesting that the United States' tariff policy could lower domestic inflation (the rate of price increases). The outlook is that, because the proportion of exports to the US and China is high and countries are responding to US tariffs not with retaliatory tariffs but in a more reserved manner, downward pressure such as weak demand could become dominant. There is also a possibility that if China shifts its export volume from the US to other countries, including South Korea, prices could fall further.

On June 18, the Bank of Korea presented this outlook in its report titled "Recent Price Trends in Major Countries and the Future Price Spillover Effects of US Tariff Policy."

The US tariff policy affects not only the growth outlook of major economies but also their price levels. The contraction in trade caused by tariffs slows global economic growth and lowers demand for raw materials, which are factors exerting downward pressure on prices. On the other hand, rising production costs resulting from reduced production activity and the restructuring of global supply chains can put upward pressure on prices.

The Bank of Korea expects that the price spillover effects will differ depending on how countries respond to US tariffs.

First, in the case of the US, which is imposing the tariffs, there is greater upward pressure on prices because consumer prices rise through imported finished goods and business production costs increase through imported intermediate goods. In fact, when tariff rates on major imported goods such as passenger cars and IT devices rose sharply, the PMI output price index, which leads consumer prices by about four months, increased from 54 in April to 59 last month. As the number of tariffed items and tariff rates increase, not only consumer goods but also capital goods?which have a higher import dependency rate (38% according to the Federal Reserve Bank of San Francisco)?are likely to be affected in terms of price.

Countries that respond to US tariffs with their own retaliatory tariffs are also expected to see greater upward pressure on prices. In Canada, for instance, concerns over economic contraction have grown, and the consumer price index (CPI) growth rate fell to 1.7% in April. However, import prices for certain goods, such as automobiles, have risen, increasing the possibility of higher inflation.

For other trading partners that are more reserved in their response to US tariffs, the US tariff policy is likely to act as a demand shock and lower inflation. In fact, the Bank of England estimated in its forecast last month that the downward impact of US tariffs on inflation would be 0.2 percentage points within the next two years. The Bank of Japan also revised its CPI growth rate for next year downward from 2.0% to 1.7%.

The Bank of Korea believes that, like Japan, South Korea?which has a high proportion of exports to both the US and China?could also experience dominant downward pressure on prices due to weak demand and falling raw material prices. In particular, if Chinese exports to the US decrease and low-priced Chinese manufactured goods are redirected to countries like South Korea, this could exert additional downward pressure on prices. In fact, during the first Trump administration, items subject to tariffs were redirected from the US to India, South Korea, the European Union (EU), ASEAN, and other regions, leading to a decline in export prices for those countries.

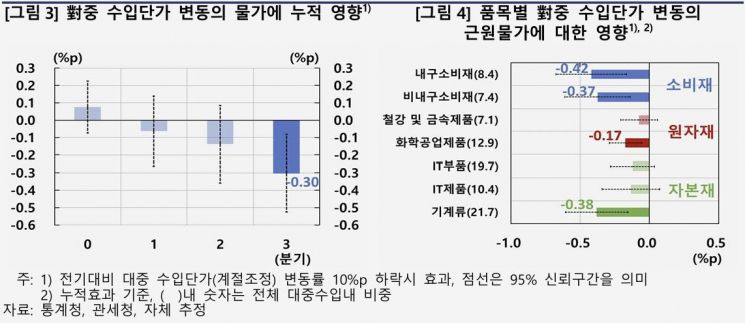

The Bank of Korea used the methodology employed by US economist Gita Gopinath to estimate the domestic price pass-through effect of import price changes from China. The results suggest that if import prices fall by 10 percentage points, the domestic core inflation rate (excluding food and energy) would decrease by 0.3 percentage points over the course of a year. The decline in import prices for consumer goods, which are directly related to core inflation items, was relatively large.

The Bank of Korea stated, "In a situation where weak domestic demand in China is prolonged, US tariffs on Chinese goods will further lower Chinese export prices, acting as a factor in reducing the domestic inflation rate," and added, "Depending on the progress of tariff negotiations, upward pressure on prices could increase due to factors such as a depreciation of the Korean won or supply chain disruptions, so it is important to pay close attention to the interactions among various price drivers."

Meanwhile, the Bank of Korea also forecast that recent geopolitical instability, such as the conflict between Israel and Iran, will have a significant impact on South Korea's prices, comparable to that of US tariffs.

International oil prices have recently risen from the $60 per barrel range to the $70 range due to geopolitical tensions in the Middle East. The Bank of Korea projected that if international oil prices remain at $75 until next year, the inflation rate for this year will rise by 0.1 percentage points compared to the forecast in May, and by 0.3 percentage points for next year. Previously, in its "May Economic Outlook," the Bank of Korea assumed that the average international oil price would fall to $69 this year and $65 next year, forecasting inflation rates of 1.9% for this year and 1.8% for next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)