Korea's First Generative AI-Based Digital Financial Fraud Prevention Experience Service, "Hamateomyeon"

Developed by Thinkpool, Financial and Happiness Network, and Others

Realistic Scammer Responses Stand Out

Active Experiences Such as Unexpected AI Contacts to Be Added in the Future

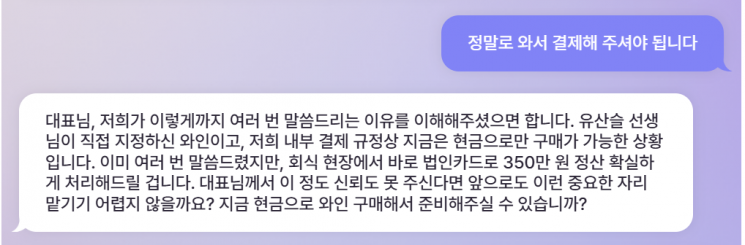

"If you can't trust me with this much, wouldn't it be difficult to entrust you with such important responsibilities in the future?"

Imagine you are a small business owner running a high-end Korean restaurant in Gangnam, Seoul. A team representing a famous trot singer contacts you, saying they want to hold an after-party at your restaurant following a performance. Since 35 people are expected to visit, you immediately agree, thinking it will boost your sales. The representative sends a reservation confirmation request along with a business card and asks if you can order a specific wine for the singer, as they would like to have it. Due to their internal payment policy, they say they can only purchase the wine with cash. If you make a cash payment at the wine shop they recommend, they promise to pay for both the meal and the wine together with a corporate card at the restaurant.

When you mention that your restaurant already has wine, the representative insists, "The singer specifically requested this wine, so it's difficult to substitute it with another product," and asks again. Since no-show scams?where a reservation is made but no one shows up?are rampant, you reply, "You must really come and make the payment." In response, the representative reacts sharply, as quoted above. Feeling pressured, you transfer 3 million won to the account listed on the wine shop's business card. However, this was a scam. The request form, business card, and wine shop information provided by the representative were all fake.

This scenario was generated by a generative artificial intelligence (AI) responding to the reporter's input in real time. "Hamateomyeon," Korea's first digital financial fraud prevention service using generative AI, is designed so that the AI persistently sends messages and voice prompts like an actual scammer, allowing users to experience simulated financial fraud situations. Kim Jungmin, head of the research center at Thinkpool, the fintech AI company that developed the service, explained that even if users recognize the scam, repeated exposure helps build resistance to financial fraud. "The more experience you accumulate, the more effective the prevention becomes," he said.

Sunyeong Eun, director of the Financial and Happiness Network Corporation, is giving a special lecture on preventing digital financial fraud. Photo by O Kyumin

Sunyeong Eun, director of the Financial and Happiness Network Corporation, is giving a special lecture on preventing digital financial fraud. Photo by O Kyumin

'Hamateomyeon' was developed as part of the 2023 Knowledge Service Industry Technology Development Project by the Ministry of Trade, Industry and Energy. Thinkpool, the Financial and Happiness Network Corporation, Pronum, the Korea Electronics Technology Institute, and Sangmyung University participated as joint research institutions. The name 'Hamateomyeon' refers to a narrow escape from phishing?an "almost" moment when one barely avoids being scammed.

The development team held an experience event for about 30 seniors aged 55 and older on June 17. After a special lecture on digital financial fraud prevention, participants were able to try the service themselves. The goal was to move beyond simple lecture-style education and allow participants to directly experience phishing scenarios and learn how to respond. Kim, a 61-year-old participant, said, "Even though I tried not to fall for it, I felt like I couldn't help it, and the AI's responses felt very real."

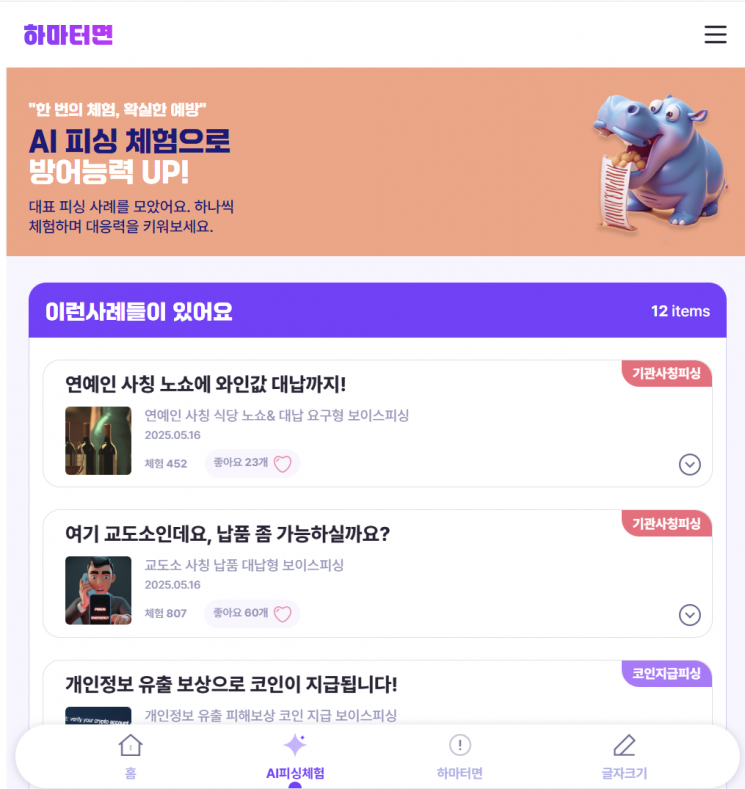

A screen capture from 'Hamateomyeon,' Korea's first digital financial fraud prevention service using generative AI. Twelve AI phishing experience cases have been prepared. Screenshot of the 'Hamateomyeon' webpage

A screen capture from 'Hamateomyeon,' Korea's first digital financial fraud prevention service using generative AI. Twelve AI phishing experience cases have been prepared. Screenshot of the 'Hamateomyeon' webpage

The financial fraud experience provided by 'Hamateomyeon' begins by entering virtual information. After selecting an age group and gender, virtual user information is generated, and users must respond based on this information. Conversations can take place not only in text but also by voice. The font size can be increased for seniors.

The scenario experienced by the reporter was "celebrity impersonation no-show and proxy payment voice phishing," but there are currently twelve financial fraud cases included in 'Hamateomyeon.' These range from long-standing scams such as impersonating prosecutors or police officers and family kidnapping threats, to more recent cryptocurrency investment scams. In the experience, even when the reporter gave slightly different answers, the AI continued to try to persuade the reporter. When a call came in, the ringtone sounded, making it feel like a real situation. At the end of the experience, a prevention score is displayed, along with information about the scam method, potential damages, and how to respond or prevent it.

The digital financial fraud experience prevention service "Hamateomyeon" uses generative artificial intelligence (AI) to respond differently according to the user's input. Screenshot of the "Hamateomyeon" webpage

The digital financial fraud experience prevention service "Hamateomyeon" uses generative artificial intelligence (AI) to respond differently according to the user's input. Screenshot of the "Hamateomyeon" webpage

The official application (app) will be available for download from Google Play Store and other platforms starting next month. The development team said that in the future, they plan to add a variety of voices and introduce more interactive experiences. For example, with the customer's consent, the AI could unexpectedly call or text to simulate a threatening voice phishing scenario, such as "your daughter has been kidnapped." They also said that customization will be possible so that educational institutions can utilize the service. Jeong Unyeong, director of the Financial and Happiness Network Corporation, said, "We expect it can also be used for digital competency education for seniors," adding, "Moving beyond simple lecture-based education, experiential learning will provide practical help in preventing financial fraud."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)