Hyundai Motor and Kia Post Double-Digit Gains This Month

Foreign Investors Net Buyers for Eight Consecutive Days Amid Enhanced Shareholder Return Policies

Tariff Concerns Appear to Have Peaked

Automotive stocks, which had been left out of the bull market due to U.S.-driven tariff concerns, have shown a different trend this month. With foreign investors returning as buyers, these stocks have begun a full-fledged recovery.

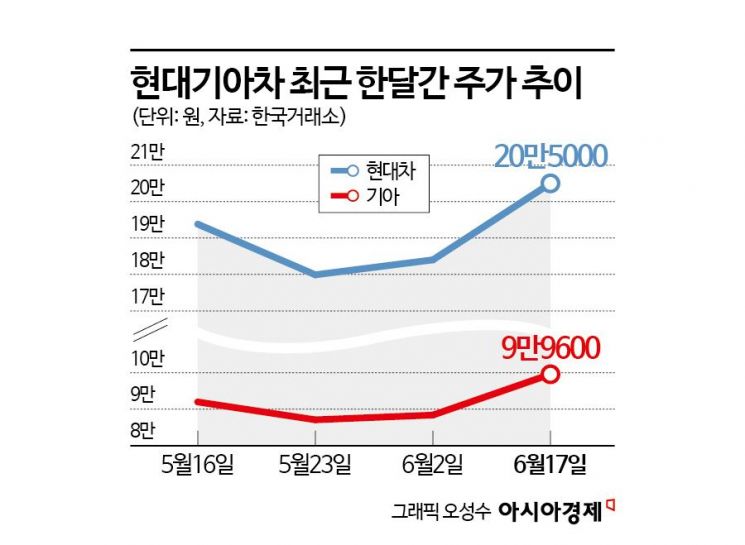

According to the Korea Exchange on June 18, Hyundai Motor shares have risen by 10.63% so far this month. Kia has climbed 11.41%, and Hyundai Mobis has increased by 13.04%. These gains outpace the KOSPI's return of 9.36% over the same period. On the previous trading day, Hyundai Motor closed at 205,000 won, up 1.74%, marking two consecutive days of gains above 1%. Kia finished at 99,600 won, up 2.15%, putting it on the verge of reclaiming the 100,000-won mark. Their market capitalization rankings have also recovered. At the beginning of the month, Hyundai Motor had slipped to 8th place and Kia to 10th, but recently, Hyundai Motor overtook KB Financial Group to reclaim 6th place, and Kia moved back up to 8th.

Since the beginning of the year, automotive stocks have underperformed despite the bull market, due to concerns over U.S. tariffs. Although all three stocks have posted double-digit gains this month, compared to the end of last year, Hyundai Motor is still down 3.30% and Kia is down 1.09%. Over the same period, the KOSPI has risen by 22.96%. Lee Byungkeun, an analyst at LS Securities, explained, "After the Donald Trump administration imposed a 25% tariff on imported cars, investor sentiment in the automotive sector deteriorated and stock prices stagnated." He added, "Concerns about a stronger won and reduced sales due to the tariffs also negatively affected share prices."

The shift in sentiment toward automotive stocks appears to have been driven by foreign buying. Foreign investors have been net buyers of Hyundai Motor and Kia for eight consecutive trading days recently. During this period, they net purchased 276.9 billion won of Hyundai Motor shares, making it the third most purchased stock after SK Hynix and Samsung Electronics. They also net purchased 209.9 billion won of Kia shares.

Lim Eunyoung, an analyst at Samsung Securities, stated, "There is strong foreign buying centered on the three Hyundai Motor Group companies," and explained, "Foreign investors are interested because of Hyundai Motor Group's enhanced shareholder return policies and more stable earnings compared to competitors."

Due to the impact of U.S. tariff policy, most automakers have withdrawn their guidance, and GM has suspended its share buyback program. However, the three Hyundai Motor Group companies are the only ones maintaining share buyback and cancellation policies, which they plan to continue through 2027. Lim analyzed, "The three Hyundai Motor Group companies hold cash equivalent to 30-45% of their market capitalization, and capital expenditures (CAPEX) are set to peak this year and then decline. With high annual free cash flow (FCF), they have ample capacity to pay dividends even in the face of tariff shocks." The shareholder return yield for Hyundai Motor and Kia is around 9%, among the highest globally, while Hyundai Mobis's shareholder return rate is also as high as 5%.

Another notable factor is their strong profitability compared to competitors. In the first quarter of this year, Hyundai Motor and Kia posted operating margins of 8.2% and 10.7%, respectively, which are high compared to global peers. Lim said, "Even if tariffs persist for a long time, their high profitability provides a foundation to withstand the pressure better than competitors."

There are also views that tariff concerns have peaked. Lim stated, "I believe the peak of the tariff risk that has weighed on the automotive sector is now behind us." He continued, "Tariff relief is expected through refunds of 3.75% of the Manufacturer's Suggested Retail Price (MSRP) for vehicles produced in the U.S. between April 3, 2025, and April 30, 2026, and 2.5% between May 1, 2026, and April 30, 2027. This will reduce Hyundai Motor Group's tariff burden by about 1.5 trillion won in 2025 and about 1.2 trillion won in 2026." He added, "Considering the increase in utilization at Hyundai Motor Group Metaplant America (HMGMA), the negative impact of tariffs will be further reduced."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.