Mainly Focuses on Litigation Defense for Insured Executives

Companies and Executives Must Understand Exclusion Clauses

Tailored Riders Needed for Duty Mapping and Serious Accidents Act

As the introduction of the amended Commercial Act draws near, Korean insurance companies are preparing to revise their Directors and Officers Liability Insurance (D&O) offerings. This is because demand is expected to rise if lawsuits against executives increase after the amendment. However, there are concerns that, without specific government-level guidelines to promote D&O, there are limits to how much products can be improved.

Mainly Covers Litigation Costs... Intentional Crimes Excluded

Currently, the 'big five' insurers?Samsung, DB, Meritz, Hyundai, and KB?as well as some small and medium-sized non-life insurers, offer D&O insurance. At one major insurer, there were about 230 D&O contracts last year, with gross written premiums totaling around 10 billion won. The average loss ratio (the ratio of claims paid to premiums received) was 55 to 60 percent. For small and medium-sized insurers, the number of contracts last year was about 20, with gross written premiums in the range of 500 million to 1 billion won.

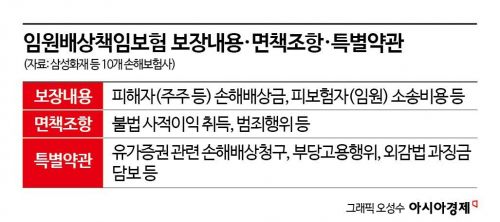

According to the policy terms of major insurers, coverage mainly includes attorney fees and damages. Hyundai Marine & Fire Insurance covers issues such as omissions in disclosure, errors in reporting to regulatory agencies, and inappropriate instructions by management pointed out in employee wrongful dismissal lawsuits. Hanwha General Insurance covers not only breaches of duty by executives but also damages arising from negligence, errors, false statements, and mistakes. Meritz Fire & Marine Insurance even covers expenses incurred by executives to prevent or mitigate losses. Hana Insurance provides direct compensation to executives for trial-related costs if the company does not reimburse them, and also covers actual litigation-related expenses such as investigation and mediation costs.

Most special riders are services supporting executive liability compensation, which are expected to see a surge in demand after the Commercial Act is amended. Representative examples include corporate securities liability riders and employment practices liability riders. KB Insurance expanded its coverage by adding an external auditor penalty rider as a special option. NH Nonghyup Property & Casualty Insurance included a shareholder derivative action rider.

Understanding Exclusion Clauses Such as Circumstantial Notice Is Essential

The most important aspect that companies and executives considering D&O insurance should pay attention to is the exclusion clauses. If these clauses are not properly understood, policyholders may not receive adequate coverage for litigation costs and other expenses from the insurer.

In the past, outside directors of Daewoo Shipbuilding & Marine Engineering (now Hanwha Ocean), KB Insurance, and Meritz Fire & Marine Insurance were involved in legal disputes over D&O insurance payouts related to compliance with exclusion clauses. Daewoo Shipbuilding signed a D&O policy with KB Insurance in 2014. After a 2 trillion won accounting fraud scandal broke out the following year, Daewoo Shipbuilding switched to a D&O policy with Meritz Fire & Marine Insurance. When signing the new contract, Meritz required Daewoo Shipbuilding to provide a 'circumstantial notice' to KB Insurance, stating that there could be future insurance claims related to the accounting fraud. Daewoo Shipbuilding fulfilled this requirement before entering into the contract with Meritz.

Subsequently, Daewoo Shipbuilding executives filed insurance claims with both KB Insurance and Meritz, but both claims were denied. KB Insurance argued that the CEO of Daewoo Shipbuilding had failed to disclose knowledge of the accounting fraud, constituting a breach of the duty of disclosure, and therefore terminated the contract and refused to pay the outside directors. However, the court ruled differently. The court recognized the validity of Daewoo Shipbuilding's circumstantial notice and ordered KB Insurance to pay the insurance proceeds. In the case of Meritz, the exclusion clause applied. Although the lawsuit related to the accounting fraud occurred during the Meritz policy period, the court determined that the obligation to pay insurance benefits was based on the time when the company became aware of the possibility of litigation and notified the insurer (circumstantial notice).

As coverage under the policy can lead to legal disputes, experts advise that companies should always purchase D&O insurance with the most up-to-date policy terms. Recent risks such as ESG (environmental, social, and governance) lawsuits, data breaches, and the Serious Accidents Punishment Act may not be specified in older policies. Updated policies often broaden coverage, reduce exclusion clauses, and are designed for greater premium efficiency.

"Tailored Riders Needed for Duty Mapping, Serious Accidents Act, and Other Laws"

Korean insurers still face many challenges in improving D&O insurance. Although the Serious Accidents Punishment Act and the duty mapping system have been introduced, there are still few products with coverage and riders tailored to these regulations. Kim Heonsu, professor of IT Finance at Soonchunhyang University, said, "As the duty mapping system becomes more widespread in the financial sector, the responsibilities of registered executives and the content of shareholder lawsuits will become clearer. Insurers should actively develop products with the growth potential of the D&O market in mind." Kim Myunggyu, professor of Real Estate Finance and Insurance at Mokwon University, advised, "Insurance compensation is fundamentally based on claims, not accidents. Insurers can expand coverage by specifying damages resulting from violations of the duty mapping system or stock price declines as insured losses."

The insurance industry has a positive outlook on the growth potential of the D&O market. However, since current profitability is not high and there are many regulatory changes to consider, insurers are taking a cautious approach to expanding coverage and special riders for individual regulations. A representative of a major non-life insurer said, "If financial authorities pursue improvements or changes to laws, systems, or guidelines, the relevant policy terms or coverage will be revised accordingly. Associations, the industry, and reinsurers will work closely together to respond." Another representative of a major non-life insurer stated, "We plan to strengthen D&O-related product sales through our sales organization soon." A representative of a small and medium-sized non-life insurer said, "If there are specific improvements to the Commercial Act or D&O guidelines, we will respond accordingly with premium increases or policy revisions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.