Housing Price Emergency Check

Rising Trend Spreads Beyond Gangnam and Yongsan

Last-Minute Buying Sentiment Grows Ahead of Third-Phase DSR Next Month

"There are no listings available, yet asking prices are rising by 50 million won every week. It has also become common for deals to fall through at the last minute because homeowners raise the price just before closing. On the ground, people are even using the expression 'the contract has been broken.'" (Real estate agent in an apartment complex in Mapo-gu)

"Even when I ask sellers if they can provide their bank account information now, they often say they'll wait a bit longer, delaying the transaction. Since agencies have no properties to show, many are now focusing more on rental listings than sales." (Real estate agent in Seongdong-gu)

This tug-of-war between sellers pulling listings and buyers trying to purchase is happening all across Seoul. There is no clear way to resolve the supply shortage, especially in preferred areas, and the likelihood that the new administration will not implement demand suppression measures is also fueling this phenomenon.

A real estate agency in Oksu-dong, Seongdong-gu, Seoul, with property listings posted. Photo by Oh Yukyo

A real estate agency in Oksu-dong, Seongdong-gu, Seoul, with property listings posted. Photo by Oh Yukyo

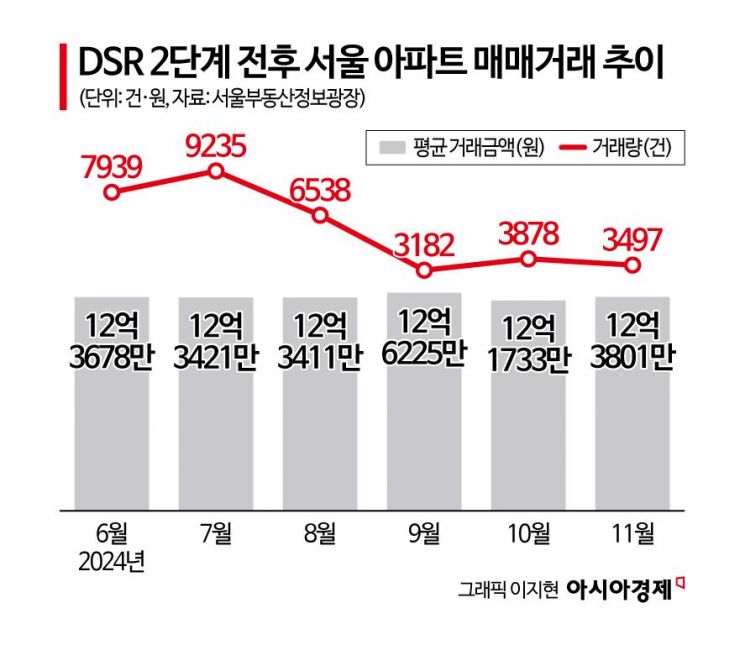

For now, when the third phase of the Stress Debt Service Ratio (DSR) is implemented next month, loan limits will be reduced, which is expected to slow transactions in the short term. However, some observers believe the effect will be limited, noting that after the second phase was implemented last year, transactions increased and abnormal price surges occurred just a few months later.

Housing Market Swayed by "Prices Will Rise Further" and "Buy Now" Sentiment

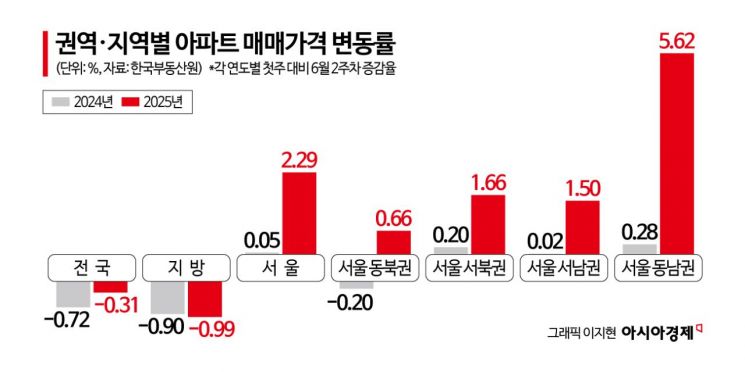

According to the Korea Real Estate Board's monthly housing price trend survey released on June 17, the apartment sales price index change for Seoul was recorded at 0.54. After appearing to slow following a sharp spike in March this year (0.80), which was driven by the lifting of land transaction permit zones in Gangnam, the index has rebounded. The weekly apartment price trend, also tracked by the board, shows the highest rate of increase since August last year.

On the ground, agents report that the actual price increases feel even greater. As more sellers change their minds and withdraw from deals, one agent explained, "The number of transactions has dropped significantly, but asking prices have risen sharply." The 'balloon effect' feared during the process of lifting and re-designating land transaction permit zones is spreading to major complexes in areas such as Seongdong-gu and Mapo-gu.

Apartment complexes in Apgujeongdong and Cheongdamdong, Gangnam-gu, viewed from Eungbongsan, Seoul. Photo by Yonhap News

Apartment complexes in Apgujeongdong and Cheongdamdong, Gangnam-gu, viewed from Eungbongsan, Seoul. Photo by Yonhap News

In particular, news that the new administration may designate additional speculative zones or land transaction permit areas is causing anxiety among potential buyers. A real estate agency representative at Seoul Forest Prugio in Geumho-dong, Seongdong-gu, said, "After the land permit zone was re-designated, funds that were pushed out of Gangnam have flowed into Oksu and Geumho, making listings scarce and pushing prices upward in these areas as well. For example, a deal initially negotiated at 1.6 billion won was put on hold when a 1.7 billion won offer came in."

A real estate agent in Ahyeon-dong, Mapo-gu, said, "With Gangnam and Yongsan restricted, gap investment demand has shifted to Mapo, where prices are relatively lower. This has created a situation where people are chasing after purchases, thinking 'I have to buy now.'" Another agent in nearby Yeomni-dong added, "Rumors of new land permit zones have actually increased buying pressure, as those wanting to buy before restrictions take effect are clashing with sellers hoping to get higher prices."

Focus on Direction of New Administration's First Real Estate Measures

Experts point out that the recent surge is "not a normal situation." While the government needs to introduce measures, they caution that hasty regulations could act as a catalyst and should be approached carefully. Ko Jongwan, head of the Korea Asset Management Research Institute, said, "Listings in key parts of Seoul have dried up, creating a dangerous market where prices rise without transactions. This is a complex situation driven by rising expectations, lack of listings, policy uncertainty, falling interest rates, and delayed supply, so effective countermeasures are needed."

Yoon Jihae, head of Proptech Research Lab at Real Estate R114, said, "Demand with strong purchasing power is concentrating on certain areas and types of properties, driving up Seoul apartment prices. This cannot be solved by supply alone. With global capital also flowing in, unless the concentration of demand is addressed, it will be difficult to resolve the issue."

Since President Lee Jaemyung has expressed a negative stance on real estate regulations since his candidacy, there is keen interest in the direction of upcoming policies. Yang Jiyeong, head of Asset Management Consulting at Shinhan Investment & Securities, said, "The administration's policy of restraint from regulation, differentiating itself from the Moon Jaein government, is now being put to the test. Premature regulations could increase image risk and conflict with the early policy stance emphasizing market autonomy, so the authorities are likely to deliberate carefully." There are concerns that if the first real estate measures are perceived as regulatory, the new administration could lose momentum for its overall policy agenda.

A real estate agency in Yeomni-dong, Mapo-gu, Seoul, with property listings posted. Photo by Choi Seoyoon

A real estate agency in Yeomni-dong, Mapo-gu, Seoul, with property listings posted. Photo by Choi Seoyoon

Park Wongap, chief expert at KB Real Estate, pointed out, "Seoul and the metropolitan area are overheated markets driven more by sentiment and asking prices than by actual transactions, while in the provinces, price increases are possible due to liquidity and policy expectations. Large-scale supplementary budget policies could end up stimulating asset price increases rather than boosting the real economy, potentially leading to structural problems such as declining birth rates and increased housing burdens."

"DSR's Market Impact Expected to Be Limited"

The government is likely to announce new measures after observing the market following the implementation of the third phase of the DSR next month. The third phase DSR preemptively reflects future risks by reducing loan limits. According to financial authorities' simulations, for an annual income of 100 million won, loan limits will decrease by about 18 million to 33 million won compared to the second phase, depending on the loan product. For credit loans, individual borrowers will see a reduction of about 1 million to 4 million won.

Regarding the third phase stress DSR, the market expects that housing transactions will decrease to some extent. When the second phase was implemented in September last year, transactions dropped sharply. In the three months before the second phase (June-August), the average monthly apartment sales volume was 7,904, but in the three months after the third phase (September-November), it dropped to a monthly average of 3,519, less than half.

However, there are also predictions that the effect of the third phase DSR will be weaker than before, as the sentiment that home prices will continue to rise is spreading among both sellers and buyers. A real estate agent in Mapo-gu said, "Demand has always been dominated by buyers with low reliance on loans and ample funds," predicting that there will be little impact even after next month.

Yang Jiyeong added, "The government has so far only issued verbal warnings, and real regulations are likely to come after monitoring transaction trends in July. However, the lack of signals for supply expansion and the absence of policies to address pent-up demand are also among the factors exacerbating the problem." Park Wongap said, "Although the government initially stated it would leave the market to operate autonomously, it will inevitably have to send regulatory signals to the market in response to public opinion and market pressure."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.