'Starbucks Rewards' Revamped from the 17th

Kiosk Implementation, Expansion of Delivery Services, and Other Changes

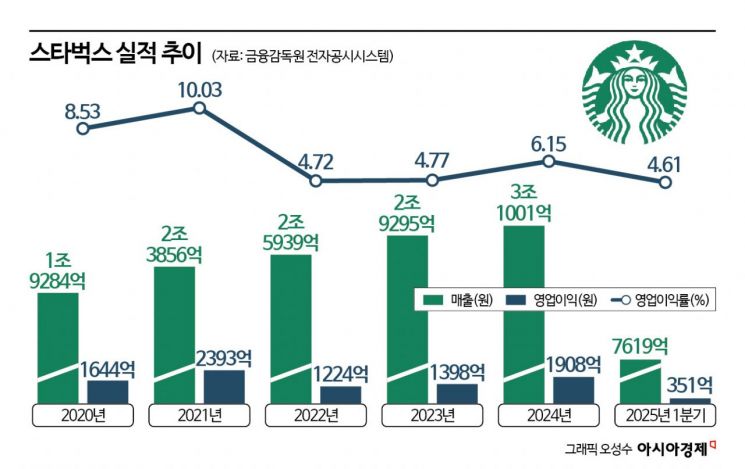

Growth Stagnates with Single-Digit Operating Profit Margin

Starbucks, the leading coffee chain in South Korea, has been making bold moves in recent days. The company has repeatedly introduced unprecedented initiatives, such as implementing kiosks, expanding delivery services, and holding large-scale discount events. These actions are seen as a strong determination not to lose its leadership in the increasingly competitive coffee market. Since 2021, Starbucks has recorded single-digit operating profit margins, and attention is focused on whether the company can find a breakthrough to boost its stagnant profitability.

According to industry sources on June 17, Starbucks is launching a newly revamped membership program called 'Starbucks Rewards' starting today. This is the first major overhaul in 14 years. The options for Gold members' coupons have been greatly expanded to include handcrafted beverages, food, and merchandise (MD), and the function to exchange accumulated star coupons, which was previously limited to Gold members, has been extended to Green members as well. In addition to free beverage coupons for collecting stars, the program will also include benefits such as free size upgrades for handcrafted beverages, food discounts, and MD discounts.

However, the criteria for earning stars will be raised. Previously, stars could be earned with purchases of 1,000 won or more, but after the revision, the threshold will be increased to 3,000 won. The validity period for some stars is also expected to be less than one year.

Since the end of last year, Starbucks has been experimenting with various transformations. In December 2024, the company introduced its first paid subscription service, 'Buddy Pass.' For a monthly fee of 7,900 won, customers can receive coupons available after 2 p.m. each day, enjoy 30% discounts on handcrafted beverages and food, and get free delivery and online store shipping coupons.

In addition to 'Hello Student,' a benefit program exclusively for university students, Starbucks has also launched a series of unprecedented large-scale discount events. A representative example is 'One More Coffee,' which offers a 60% discount on certain menu items when repurchased on the same day. For example, the second cup of Today's Coffee in tall size (4,500 won) can be purchased for 1,800 won.

The company has also made changes to its ordering system. Starbucks, which has traditionally emphasized direct communication with customers and maintained an order and pick-up system, began introducing pagers at some large stores with heavy foot traffic starting last year. The company also plans to introduce kiosks at select locations within the year.

The delivery system has also changed. Even during the pandemic, when strict social distancing measures were in place, Starbucks maintained a 'No Delivery Application' policy. However, in April 2025, Starbucks joined Baemin, the number one delivery app, and began collaborating with Coupang Eats for delivery services. Since the end of March, Starbucks has also started a pilot morning delivery service in partnership with the delivery platform Vroong, operating from 9 a.m. at select stores.

Starbucks has extended its operating hours to 10 p.m. at 80% of its stores, excluding some mall locations, and has expanded the sale of alcoholic beverages such as cocktails to 12 locations nationwide.

These efforts by Starbucks Korea are a response to the intensified competition in the coffee market due to the aggressive expansion of low-cost coffee brands. Last year, Starbucks surpassed 3 trillion won in annual sales for the first time, achieving its highest-ever performance. In the first quarter of this year, sales and operating profit reached 761.9 billion won and 35.1 billion won, respectively, up 3.7% and 7.3% from the same period last year. However, the operating profit margin remains sluggish. The operating margin, which was 10.0% in 2021, dropped to 4.7% in 2022, 4.8% in 2023, and 6.2% in 2024, remaining in the single digits. After incurring massive costs during the recall of the 'Summer Carry Bag Carcinogen' in 2022, the company has not managed to recover.

Meanwhile, low-cost coffee brands are rapidly growing and threatening Starbucks. Last year, Nhouse, the operator of MegaMGC Coffee, recorded sales of 466 billion won, up 36.4% from the previous year, and operating profit soared by 55.1% to 107.6 billion won. During the same period, Compose Coffee posted sales of 89.7 billion won and operating profit of 40 billion won, up 0.8% and 8.9%, respectively, from the prior year. Last year, Nhouse's operating margin was 21.7%, while Compose Coffee's reached 44.5%.

Low-cost coffee brands have already surpassed Starbucks in the number of stores. As of the end of last year, MegaMGC Coffee had 3,420 stores, Compose Coffee had 2,772 stores, both exceeding Starbucks' 2,009 locations.

An industry insider said, "Since Emart became the largest shareholder of Starbucks, the company's profitability has struggled to improve. With rising prices, increased raw material costs, and a saturated market, domestic coffee chains continue to face a crisis. Even as the industry leader, Starbucks is likely grappling with how to strengthen its competitiveness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.