The Won Shows the Highest Synchronization Coefficient with the Yuan Among 33 Countries

"Economic Interconnection Between Korea and China Is the Cause"

Synchronization Has Weakened Since 2020... US-China Trade Conflict and Supply Chain Restructuring

The Korean won has shown increased synchronization with the Chinese yuan during depreciation phases. While it is generally known that the currencies of Korea and China tend to move in tandem due to the high level of economic interconnection between the two countries, the Bank of Korea has diagnosed that this synchronization displays asymmetry depending on the market phase, weakening during appreciation phases.

On June 16, the Bank of Korea's International Department announced these findings in its report, "BOK Issue Note - Background and Characteristics of the Recent Synchronization Between the Korean Won and the Chinese Yuan." Choi Moonjung, Deputy Head of the International Finance Research Team at the Bank of Korea, explained, "An analysis of changes in the synchronization between the won and the yuan from August 2015 to April 2025 showed that the estimated synchronization coefficient was 0.663 and statistically significant during depreciation phases of the won, but only 0.143 and not significant during appreciation phases." This asymmetric feature is attributed to several factors: the trend of both currencies weakening together against the US dollar, the competitive relationship between Korea and China in the global export market, and Korea's free-floating exchange rate system. The phase of synchronization between the won and the yuan has lasted longer than the phase of desynchronization. The period from December 2023 to April 2025 has been identified as a synchronization phase.

The won and the yuan have maintained a high correlation and continued to move in sync, but the degree of synchronization has varied over time. In particular, the correlation coefficient was high during the following periods: from April 2018 to September 2019, which coincided with the first Trump administration's US-China trade conflict; from February 2022 to April 2023, during the US Federal Reserve's interest rate hikes; and after October 2024, around the time of the second Trump administration's presidential election victory. Choi explained, "The background for this high level of synchronization includes structural factors such as the common influence of the US dollar, the high degree of economic interconnection between the two countries, and the practice in the foreign exchange market of trading currencies from closely linked economic regions as a bundle."

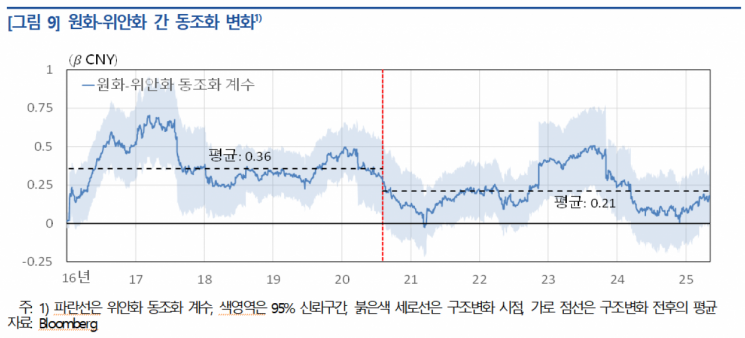

Breaking down the periods in more detail, synchronization has structurally weakened since 2020. This was influenced by factors such as the US-China trade conflict in 2018-2019 and the restructuring of global supply chains during the COVID-19 pandemic in 2020, which led to a decrease in the proportion of Korea-China trade. However, although the synchronization coefficient has remained below the long-term average since 2024, it has recently risen back to the long-term average level. This is analyzed as a result of both China and Korea, which have a high proportion of exports to the US, being exposed to significant trade shocks as protectionism has intensified under the second Trump administration.

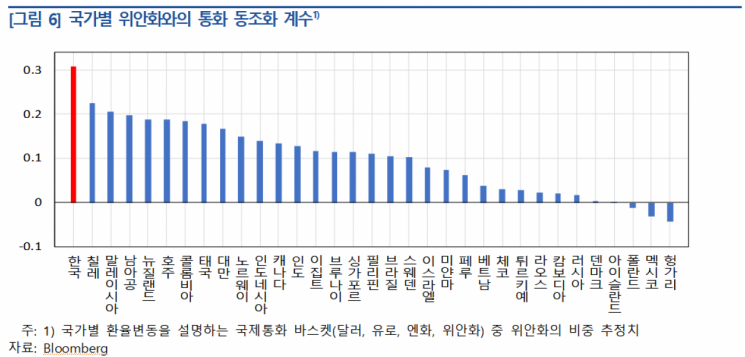

Looking at currency synchronization with the yuan by country, the won showed the highest synchronization coefficient (0.31) with the yuan among 33 countries. Choi stated, "This coefficient reflects the proportional relationship with trade and financial linkages with China," adding, "The strong synchronization between the won and the yuan demonstrates the high level of economic interconnection between Korea and China."

Choi concluded, "Given these findings, the won is likely to continue to be influenced by the movements of the yuan in the future," and emphasized, "It will be important to closely monitor the development of the US-China trade conflict and to continuously track the trend of the yuan going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)