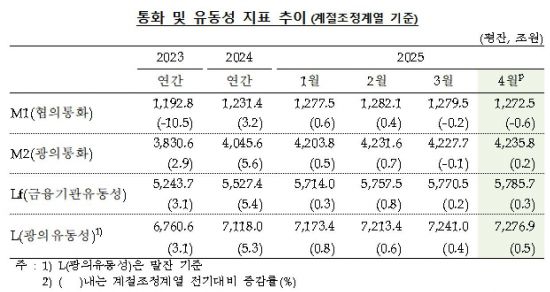

Money Supply (M2) Averaged 4,235.8 Trillion Won in April

Up 0.2% from Previous Month... Rebounds After One-Month Decline

In April of this year, the amount of money circulating in the market increased by more than 8 trillion won, with the money supply rising again after just one month. This was driven by increased demand for time deposits and installment savings, due to expectations of falling interest rates.

According to the Bank of Korea on June 16, the seasonally adjusted average balance of broad money (M2) in April stood at 4,235.8 trillion won, up by 8.1 trillion won (0.2%) from the previous month. After declining in March 2024 for the first time in 23 months, M2 rebounded and increased again within a month.

M2 is a broad measure of the money supply that includes cash, demand deposits, and transferable savings deposits (M1), as well as money market funds (MMFs), time deposits and installment savings with maturities of less than two years, beneficiary certificates, and repurchase agreements (RPs).

By financial product, time deposits and installment savings increased by 9.4 trillion won, and beneficiary certificates rose by 5.1 trillion won compared to the previous month. A Bank of Korea official explained, "Time deposits and installment savings increased as more people sought to deposit funds before further declines in deposit rates," and added, "Beneficiary certificates, particularly short-term bond types that offer relatively higher returns than deposits, also saw an increase."

On the other hand, transferable savings deposits decreased by 5.3 trillion won. The Bank of Korea explained that this was due to local governments withdrawing funds for fiscal spending, as well as decreases caused by corporate dividend payments and value-added tax payments. Other liquid monetary products decreased by 3.9 trillion won, mainly in foreign currency deposits, due to payments for import settlements and net repayments of foreign currency borrowings.

By economic entity, the money supply held by households and non-profit organizations increased by 300 billion won, mainly in time deposits and installment savings. Corporations saw an increase of 6.4 trillion won, mainly in MMFs and beneficiary certificates. In contrast, other financial institutions saw a decrease of 1.3 trillion won, mainly in other liquid monetary products. The other sector also saw a decrease of 6.7 trillion won, mainly in demand deposits and transferable savings deposits.

The average balance of M1 was 1,272.5 trillion won, down by 7 trillion won (0.6%) from the previous month, as both transferable savings deposits and demand deposits decreased.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)