Second Supplementary Budget to Be Announced Soon

Revenue Adjustment Becomes Increasingly Likely

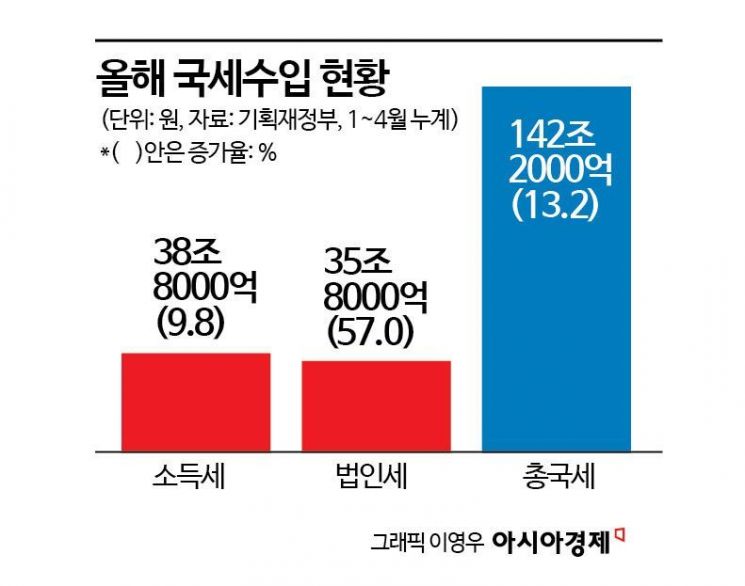

As the national tax revenue for this year is increasingly likely to fall short of expectations due to the sluggish economy, the government is considering adjusting this year's revenue budget. After experiencing large-scale tax revenue shortfalls for two consecutive years, there have been projections that another deficit amounting to tens of trillions of won will be inevitable this year as well. However, the government currently believes it is premature to forecast a significant tax revenue shortfall exceeding 10 trillion won this year. Unless there is a significant change in economic conditions, the tax revenue shortfall for this year is estimated to be in the range of 5 trillion to 10 trillion won.

According to relevant ministries on June 16, the Ministry of Economy and Finance is reviewing whether a revenue adjustment is necessary for the second supplementary budget, which will be announced soon, based on the tax revenue performance as of May. A revenue adjustment is a measure to reflect actual budget figures when tax revenue is higher or lower than expected. If the government decides to officially acknowledge that tax collection is falling short of expectations and to maintain its expenditure, it will also prepare measures to cover the shortfall, such as issuing government bonds.

The prevailing outlook is that the scale of the revenue adjustment will be around 10 trillion won. Ryu Deokhyun, the presidential secretary for fiscal planning, consistently emphasized the need for a revenue adjustment during his academic career and suggested a scale of 10 trillion won. In a report released in March, the Hyundai Research Institute projected that a revenue adjustment of 8.3 trillion won would be needed. Within the Democratic Party, there were also forecasts of a large-scale tax revenue shortfall exceeding 10 trillion won.

The Ministry of Economy and Finance believes that, as of now, the possibility of a large-scale shortfall exceeding 10 trillion won is not high. The key factor is corporate tax revenue, which is most sensitive to economic volatility and tends to have the largest margin of error. As corporate performance improved through the third quarter of last year, 13 trillion won more was collected compared to the same period of the previous year. In terms of progress rate, it stands at 40.6%, which is lower than the five-year average of 42%. However, at the current pace, it is expected that corporate tax revenue will fall short of the budget by 1.2 trillion won.

Focus on Q2 Results of Samsung Electronics and SK Hynix

The crucial period is August this year. Starting this year, large corporations are required to make interim prepayments of corporate tax, meaning these companies must make provisional settlements and prepay their corporate tax in August and September. Based on first-quarter results, Samsung Electronics and SK Hynix, which have a significant impact on corporate tax revenue, recorded strong performances. However, second-quarter results have not yet been announced. The target for corporate tax revenue in this year's budget is 88.3 trillion won, but as of April, 62.5 trillion won had been collected, meaning an additional 25.7 trillion won is needed to meet the target. A Ministry of Economy and Finance official explained, "If second-quarter results slow due to the impact of tariffs, there could be changes in national tax revenue."

In terms of progress rate, value-added tax revenue stands at 45.2%, which is significantly below the five-year average of 48.5%. At this pace, it is predicted that value-added tax revenue will fall short by 2.8908 trillion won this year. However, a Ministry of Economy and Finance official explained, "According to forecasts by the Bank of Korea and others, there is a possibility that value-added tax revenue will improve in the second half as domestic demand recovers." In its economic outlook report released in February, the Bank of Korea stated, "As political uncertainty gradually dissipates and the effects of eased financial conditions become apparent, domestic demand is expected to recover moderately."

The possibility that more income tax could be collected is also a variable. May is the period for filing and paying comprehensive income tax and capital gains tax. Recently, with the increase in 'Seohakgaemi' (Korean retail investors investing in overseas stocks), there are projections that capital gains tax revenue from overseas stock sales will exceed expectations. According to the National Tax Service, the number of people required to file final returns on overseas stocks for last year was 116,000, an increase of 30,000 from 86,000 in 2023. The Ministry of Economy and Finance stated, "Unlike last year's expectations, this year's economic outlook has worsened and various indicators have deteriorated, so we are closely monitoring the downside risks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.